- Following Pavel Durov’s arrest, TON fell 11% to $5.12, its lowest worth since Could 1.

- In keeping with Metcalfe’s evaluation, TON could also be undervalued resulting from excessive community exercise.

- Technical indicators are pointing to bearish momentum, which suggests additional worth declines are doable.

Toncoin (TON) has fallen in worth following the arrest of Telegram founder and CEO Pavel Durov in France. On August 26, TON's worth fell 11% to shut at $5.12, its lowest degree since Could 1. The drop has referred to as into query the way forward for the forex, nevertheless it may be a high-risk/high-reward state of affairs for buyers.

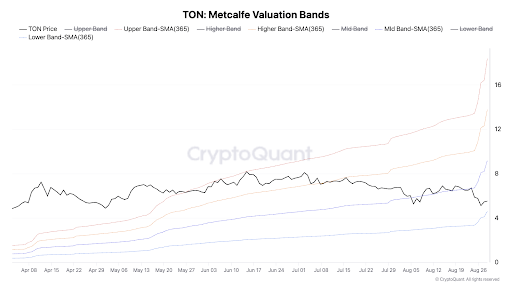

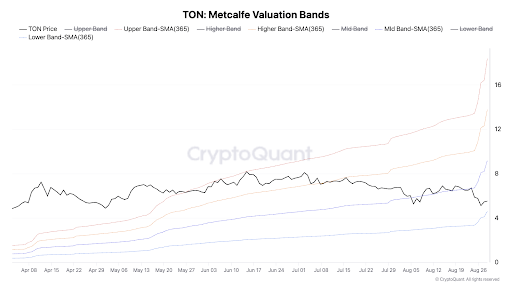

TON hit an all-time excessive of $8.17 on June 14. Nevertheless, a current drop to $5.12 signifies a weakening of the forex. Regardless of this drop, the present worth of $5.37 places TON near the decrease band of the Metcalf Valuation (presently $4.60), whereas the higher band of the Metcalf Valuation is ready at $18.40.

Calculated primarily based on the variety of lively distinctive addresses on the TON community, the Metcalfe valuation band offers a technique to assess the worth of TON in relation to its consumer base.

Curiously, the TON community hit an all-time excessive of 1.93 million lively addresses on August 28, indicating sturdy consumer engagement regardless of the current worth drop.

With TON approaching the decrease finish of the Metcalfe Valuation Band, it seems that the forex could also be undervalued relative to community exercise, which may current a profitable funding alternative.

Nevertheless, TONCOIN worth motion signifies that bearish sentiment is extra prevalent. The worth momentum indicator, the Transferring Common Convergence Divergence (MACD), is beneath its sign line and is steadily trending down.

This decline is following a downward development within the MACD histogram, and the bearish argument will get stronger as the quantity of bearish bars on the MACD histogram will increase.

Furthermore, the Relative Power Index (RSI), which measures the velocity and alter in worth actions, is presently close to 40. This place signifies that TON is neither oversold nor overbought and is leaning in the direction of a weak market place.

The mix of those indicators means that downward stress on TON worth is prone to proceed until a significant reversal sample emerges.

Disclaimer: The data introduced on this article is for informational and academic functions solely. This text doesn’t represent any type of monetary recommendation or counsel. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.