- Michael Saylor personally holds $1 billion value of Bitcoin, proudly owning 17,732 BTC.

- MicroStrategy holds 226,500 BTC, valued at over $12 billion, with a median value of $37,000.

- Saylor sees Bitcoin as a superb, safe-haven asset and recommends continued funding.

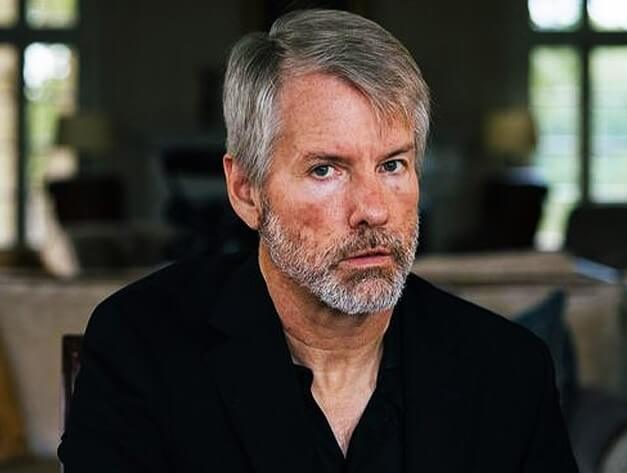

MicroStrategy Chairman Michael Saylor revealed in a current interview with Bloomberg Tv that the corporate holds roughly $1 billion value of Bitcoin.

This makes him one of the vital distinguished BTC holders on the planet, alongside figures similar to Binance founder Changpeng Zhao, the Winklevoss twins, and Satoshi Nakamoto.

Michael Saylor has not offered any of his BTC

Saylor has been an ardent supporter of Bitcoin as a capital funding asset, and in a dialog with Bloomberg's Sonali Basak on Aug. 7, Saylor confirmed that he personally holds a major quantity of Bitcoin, one thing he first revealed 4 years in the past.

On the time, he stated he had 17,732 BTC, a quantity that has solely grown since then.

Some folks ask how a lot #Bitcoin I personal it. I personally #Hoddle Purchased 17,732 BTC at a median worth of $9,882. I notified MicroStrategy of those holdings previous to their buy resolution. #Bitcoin For its personal sake.

— Michael Saylor ⚡️ (@saylor) October 28, 2020

Regardless of Bitcoin's worth rising considerably through the years, Saylor has not offered any of his Bitcoin holdings and continues to buy the cryptocurrency on an ongoing foundation.

Viewing Bitcoin as a generational asset

For Saylor, Bitcoin is greater than only a speculative funding: He describes it as a revolutionary monetary software that’s superior to each bodily capital and conventional monetary capital.

Based on Saylor, Bitcoin is a novel asset that has the potential to create generational wealth for people, households, companies and even nations. His obsession with Bitcoin stems from what he perceives as its stability, safety and talent to retain worth over the long run.

In the course of the interview, Saylor emphasised his perception that “there’s by no means a foul time to purchase Bitcoin.” He likened Bitcoin to a “cyber Manhattan,” suggesting that investing in Bitcoin is akin to purchasing prime actual property in one of the vital coveted areas.

The analogy underscores his perception that Bitcoin, being a uncommon and fascinating asset, will at all times maintain important worth no matter market fluctuations.

MicroStrategy has amassed 226,500 BTC beneath Saylor's management.

Saylor's funding philosophy extends past his private holdings to the operation of MicroStrategy: beneath his steerage, the corporate has amassed a major Bitcoin reserve totaling 226,500 BTC, valued at greater than $12 billion.

This massive funding takes up a good portion of the corporate's stability sheet. MicroStrategy's common value per Bitcoin share is roughly $37,000, and the corporate plans to implement a 10-for-1 inventory cut up, which can have additional impacts on the corporate's monetary construction and inventory worth efficiency.

Along with discussing his personal holdings, Saylor additionally addressed Bitcoin's broader affect on company funds, arguing that Bitcoin can “repair” company stability sheets by offering a protected and secure asset for long-term funding.

Saylor factors to Bitcoin's large computing and energy capabilities, claiming that they make it “nation-state succesful” and “nuclear-proof.” He proudly factors out that the Bitcoin community consumes extra electrical energy than the U.S. Navy, citing it as a testomony to Bitcoin's sturdy safety and resilience.

However Saylor's enthusiasm for Bitcoin goes past its funding potential: he sees the cryptocurrency as a groundbreaking technological development with the facility to reshape monetary techniques all over the world.