Michael Saylor's MicroStrategy made its largest Bitcoin buy to this point, with a mean buy worth of $88,627 per coin, based on a Nov. 18 submitting with the U.S. Securities and Alternate Fee (SEC). Acquired 1,780 BTC for $4.6 billion.

The transfer comes only a week after the corporate bought 27,200 BTC for $2.03 billion. Mixed with these transactions, the corporate's whole Bitcoin purchases in November have been roughly 80,000 BTC, valued at greater than $6.6 billion.

These lively BTC purchases elevated whole Bitcoin holdings to three,331,200 BTC, acquired for $16.5 billion at a mean worth of $49,875 per coin. At present costs, these property are value about $30 billion.

The corporate stated the most recent purchases elevated the BTC yield on a year-to-date foundation to 41.8%. Bitcoin yield is a crucial key efficiency indicator that the corporate makes use of to measure how its BTC funding technique impacts shareholders.

Nonetheless, regardless of the dimensions of this acquisition, MicroStrategy's inventory worth motion was minimal. Pre-market buying and selling knowledge from Google Finance exhibits a slight enhance of 0.23%.

Evaluating MicroStrategy and Bitcoin ETFs

In the meantime, the most recent Bitcoin purchases imply MicroStrategy has purchased extra of the highest cryptocurrency this month than your complete U.S. Spot Bitcoin exchange-traded fund.

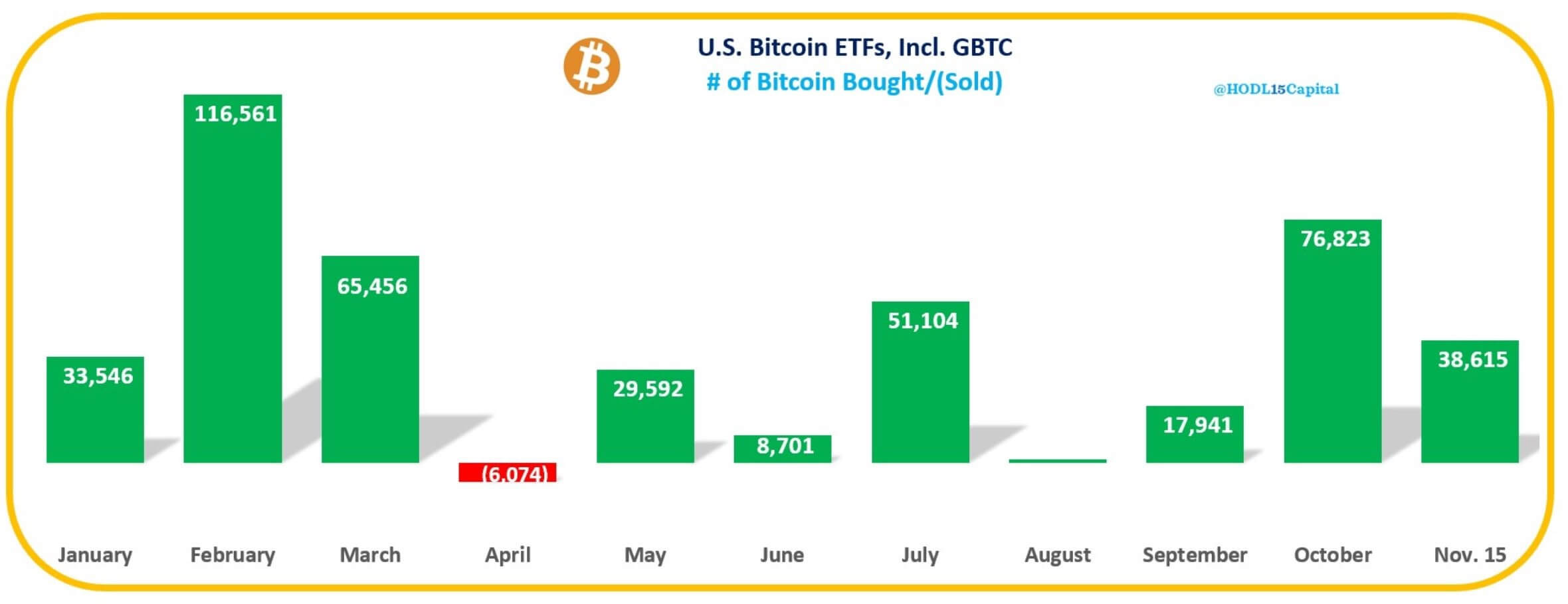

In response to knowledge compiled by HODL15Capital, these hovering BTC-related monetary devices have acquired 38,615 BTC as of November fifteenth. BlackRock’s IBIT led the acquisitions throughout this era, buying over 37,000 BTC.

Naturally, MicroStrategy's BTC buy technique has attracted vital market consideration because it has reworked the software program firm's monetary construction and established itself as a outstanding proponent of digital asset adoption.

Market watchers say the corporate's company bond reserves exceed these of all however 14 corporations within the S&P 500, together with iPhone maker Apple and Google dad or mum Alphabet.

talked about on this article

(Tag translation) Bitcoin