- MicroStrategy raised $875 million in convertible notes to purchase bitcoin and redeem older bonds.

- The notes mature in 2028 and bear curiosity of 0.625%, payable semi-annually in money.

- MicroStrategy plans to redeem $500 million of senior secured notes and purchase extra Bitcoin.

MicroStrategy introduced the issuance of $875 million in convertible senior notes. The corporate had initially deliberate to promote $700 million however elevated the providing measurement on account of elevated demand. The notes mature in 2028 and bear curiosity at 0.625%, payable semi-annually.

Donation particulars and the way funds shall be used

The convertible senior notes shall be bought to institutional consumers pursuant to Rule 144A below the Securities Act. The notes are senior unsecured obligations of MicroStrategy which are convertible into money, Class A typical inventory, or a mixture of each. Internet proceeds are anticipated to be $864.1 million, and will attain as much as $997.4 million if all choices are exercised.

A part of the funds shall be used to repay the corporate's $500 million 6.125% senior secured notes due in 2028. The remaining funds shall be used to buy Bitcoin and for different wants of the corporate.

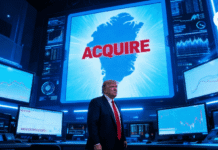

Additionally learn: MicroStrategy's Bitcoin guess continues: $700 million debt providing to accumulate extra BTC

On September 16, 2024, MicroStrategy issued a discover of redemption for the senior secured notes, setting the redemption date as September 26, 2024, as roughly 69,080 Bitcoin pledged as collateral shall be launched upon redemption.

Phrases and redemption rights of convertible notes

The brand new notes shall be exchangeable into MicroStrategy's Class A typical inventory at an preliminary conversion charge of 5.4589 shares per $1,000 principal quantity, which represents a conversion worth of roughly $183.19 per share, a 40% premium over the common worth of the Firm's shares as of September 17, 2024.

After December 20, 2027, MicroStrategy has the choice to repay the notes by way of a money redemption if the corporate's inventory worth reaches 130% of the conversion worth. Noteholders can even require MicroStrategy to redeem the notes below sure situations, particularly in September 2027.

The providing is predicted to shut by September 19, 2024, topic to the satisfaction of all closing situations. MicroStrategy plans to proceed its Bitcoin-focused method, and this new funding spherical demonstrates its dedication to buying Bitcoin as a part of the corporate's enterprise operations.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent any type of monetary recommendation or counsel. Coin Version is just not chargeable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.