In accordance with a June 20 submitting with the U.S. Securities and Alternate Fee (SEC), MicroStrategy bought practically 12,000 BTC for $786 million.

The information despatched the corporate's shares up 3 % to $1,507 in premarket buying and selling, in line with Google Finance knowledge.

Purchase Bitcoin

The appliance acknowledged:

“MicroStrategy used the proceeds from the providing and extra money (as outlined in its Quarterly Report on Kind 10-Q for the three months ended March 31, 2024) to amass roughly 11,931 Bitcoin at a mean worth of roughly $65,883 per Bitcoin, together with charges and bills, for roughly $786 million in money.”

This newest acquisition will increase the corporate's Bitcoin holdings to 226,631 BTC. These have been acquired at a complete buy price of roughly $8.3 billion, averaging out at roughly $36,798 per BTC. Primarily based on the present worth of $65,990, the present market worth of those holdings is over $15 billion.

Notably, the corporate not too long ago accomplished an $800 million bond providing with a 2.25% coupon and a 35% conversion premium. Because the starting of the 12 months, this technique has allowed the corporate to boost greater than $2 billion for Bitcoin purchases.

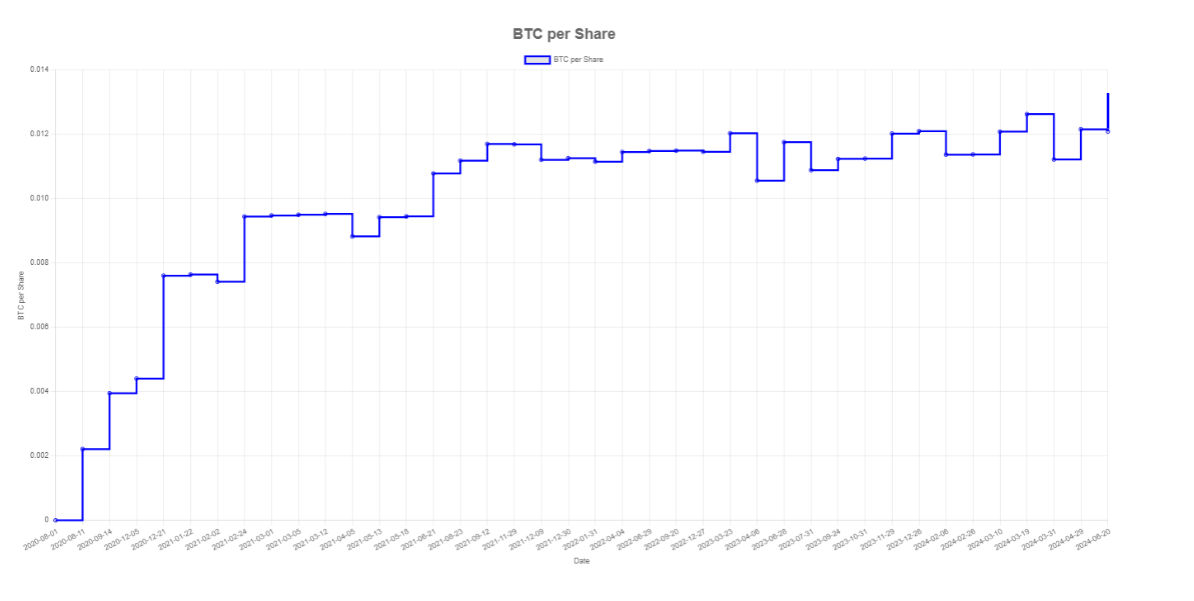

Nonetheless, that is regardless of elevated share issuance, which generally dilutes the worth of shares. currencyjournals Perception reported that the corporate’s bitcoin worth per share has elevated. This enhance implies that the worth of bitcoin per share is rising, benefiting shareholders.

MicroStrategy's bitcoin holdings per share elevated to 0.013163 BTC, with 17,194,000 shares excellent and a complete of 226,331 BTC held.

BTC hits $1 million

In the meantime, Bernstein analysts have considerably elevated their Bitcoin worth predictions, predicting the flagship digital asset to hit $1 million by 2033 and $200,000 by the top of 2025.

The optimistic outlook relies on rising demand and restricted provide for the main cryptocurrency, with analysts pointing to the newly launched Spot Bitcoin ETF and a number of other establishments starting to include BTC into their treasuries.

In addition they famous that the digital asset could also be permitted on the platforms of main brokerages and main non-public banks by the top of the 12 months, which might encourage institutional buying and selling methods and additional enhance its adoption.