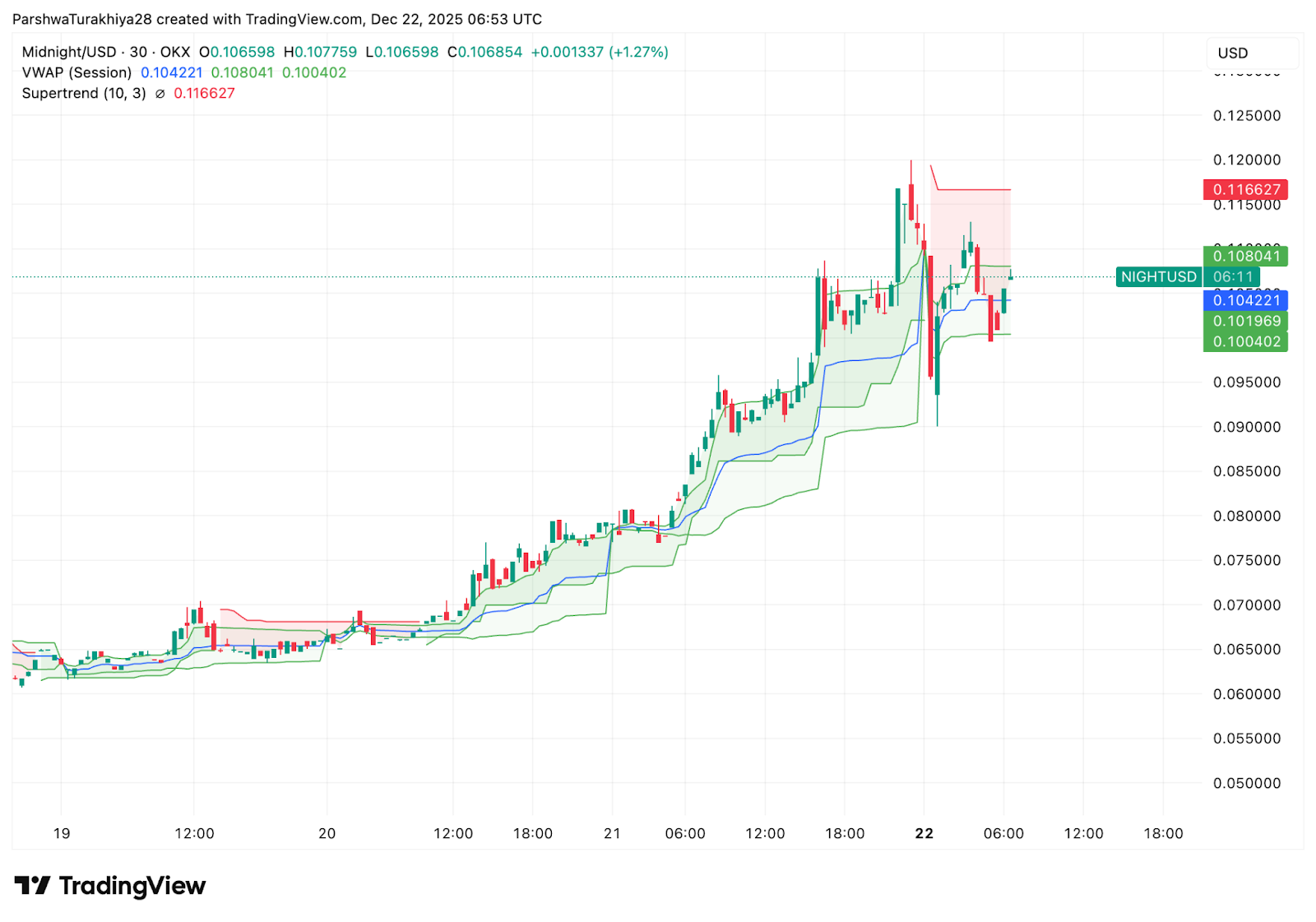

- After rejecting the $0.115 excessive, NIGHT is consolidating round $0.10, the construction is cooling, however the larger lows are nonetheless holding.

- A big spot outflow close to $28 million would sign revenue taking, limiting upside follow-through in the intervening time.

- The VWAP help between $0.100 and $0.102 stays a key stage to keep up the bullish construction.

Sellers press after vertical growth

The hourly chart reveals NIGHT rolling after breaking above the sharp impulse leg. Worth rejected the higher Bollinger Band round $0.115, triggering a pullback to the midband and uptrend help. The parabolic SAR is above worth, confirming that short-term momentum is altering to a correctional relatively than trend-driven path.

Regardless of the decline, the construction stays constructive. The upper lows are nonetheless intact and the uptrend line from the breakout round $0.075 is unbroken. Up to now, the decline displays a slowdown in momentum relatively than a failure of the development.

After the preliminary rejection, volatility subsided. This implies that the market is transferring from growth to equilibrium, a stage that always precedes a continuation or deeper retracement.

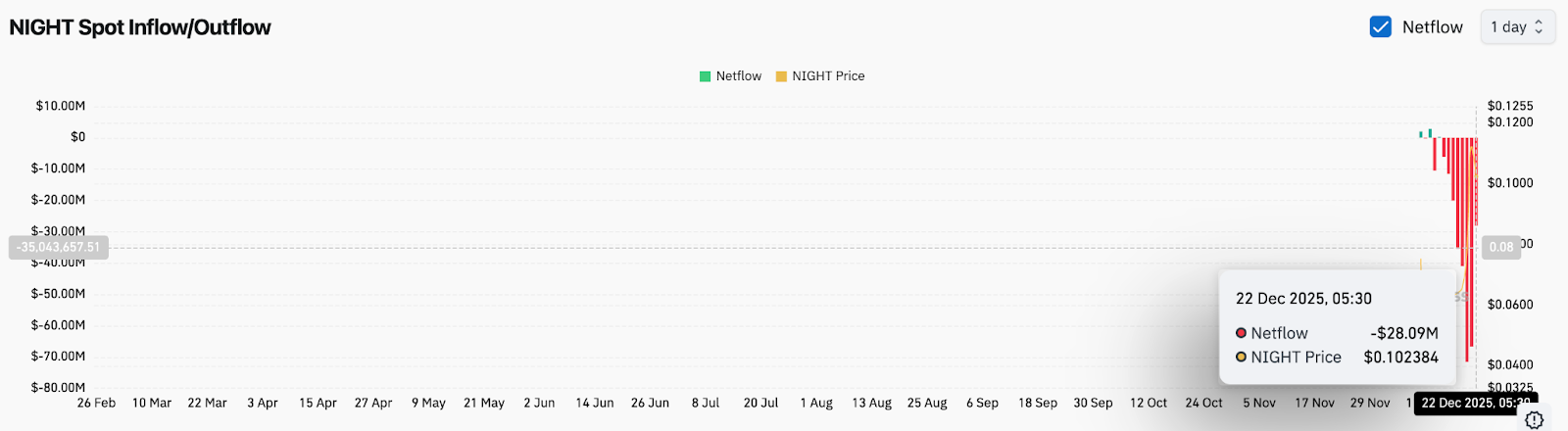

Spot out circulate sign distribution stress

Spot circulate knowledge provides stress to the near-term outlook. On December twenty second, NIGHT recorded a internet outflow of roughly $28 million, making it one of many largest distribution days because the rally started. This development coincided with the value falling in direction of $0.10, reinforcing the view that late consumers are locking in income.

Persistent runoff often limits ascent makes an attempt. Capital is returning to exchanges relatively than remaining stationary, thus limiting rebound follow-through. Till flows stabilize, bulls are prone to face overhead provide close to latest highs.

Concentrate on VWAP and short-term construction

On the 30-minute chart, NIGHT is attempting to stabilize above the session VWAP round $0.104. This stage has acted as a pivot because the rebound started. Worth regained VWAP through the day however stays beneath the supertrend resistance at $0.116.

The present construction is extra like a short-term flag or compression vary than a breakdown. Consumers proceed to defend the $0.100 to $0.102 zone, which coincides with VWAP and the decrease Bollinger Bands. So long as this space holds, draw back danger stays contained.

If VWAP fails to carry, the following help shall be uncovered close to $0.088, the decrease Bollinger Band of the upper timeframe. This stage can also be per the earlier consolidation vary earlier than the breakout.

Supporting the story from the privateness debate

Past charts and flows, Midnight continues to garner consideration from the broader Cardano ecosystem. Cardano founder Charles Hoskinson not too long ago described Midnight as a response to the EU’s evolving digital privateness framework. His feedback positioned the undertaking as a counterbalance to rising regulatory stress round digital identification and centralized surveillance.

Hoskinson’s feedback adopted warnings that mandating digital IDs might erode on-line privateness throughout the EU. In that context, Midnight’s positioning as a privacy-focused sidechain developed by Enter Output World strengthens its narrative enchantment.

Tales alone will not drive costs larger within the brief time period, however they may also help clarify why consumers aggressively defended declines through the early rally. Regardless of rising costs, the story stays a supportive backdrop.

outlook. Will Midnight Rise?

After a pointy rise, midnight continues to be in a consolidation section. The development shouldn’t be reversing, however cooling.

- Bullish case: Holding above $0.10 and regaining $0.116 on quantity will as soon as once more open the best way to an extension above $0.13.

- Bearish case: A sustained lack of $0.10 shifts focus to $0.088, invalidating the short-term bullish construction.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.