Bitcoin regained the psychologically essential $40,000 stage over the weekend after struggling to climb above $39,500 final week. On the time of writing, it sits simply above $42,000, indicating strong resilience at this stage. This restoration had a optimistic impression on the broader cryptocurrency market and the efficiency of public Bitcoin mining firms.

Regardless of being listed and traded on inventory exchanges resembling Nasdaq, public Bitcoin mining firms are vulnerable to fluctuations within the spot value of Bitcoin and different developments within the crypto market. Most TradFi traders concerned in shares think about TradFi to be their agent for buying and selling and proudly owning Bitcoin, so a rise within the value of Bitcoin robotically results in a rise within the inventory costs of those firms. Conversely, a decline in BTC value will result in a lower in income, which could have a unfavourable impression on inventory efficiency.

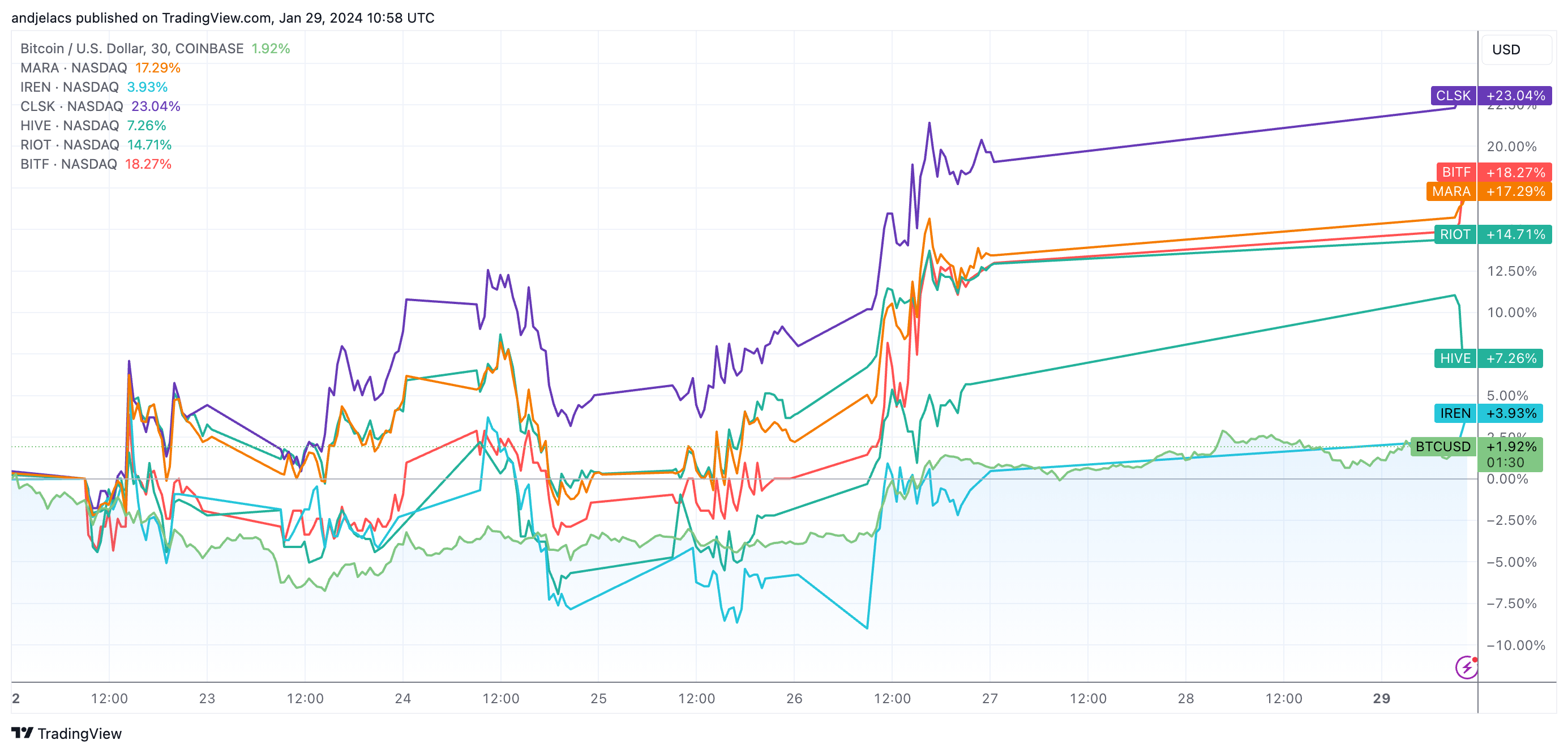

After experiencing a pointy downturn within the first two weeks of January, public miners seem to have recouped most of their losses. From January twenty second to January twenty ninth, CleanSpark (CLSK) led the pack with a rise of 23%, adopted intently by Bitfarms (BITF) with a rise of 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew 17.29%, 14.71%, and seven.26%, respectively. Throughout this era Iris Vitality (IREN) recorded a modest progress of his 3.93%.

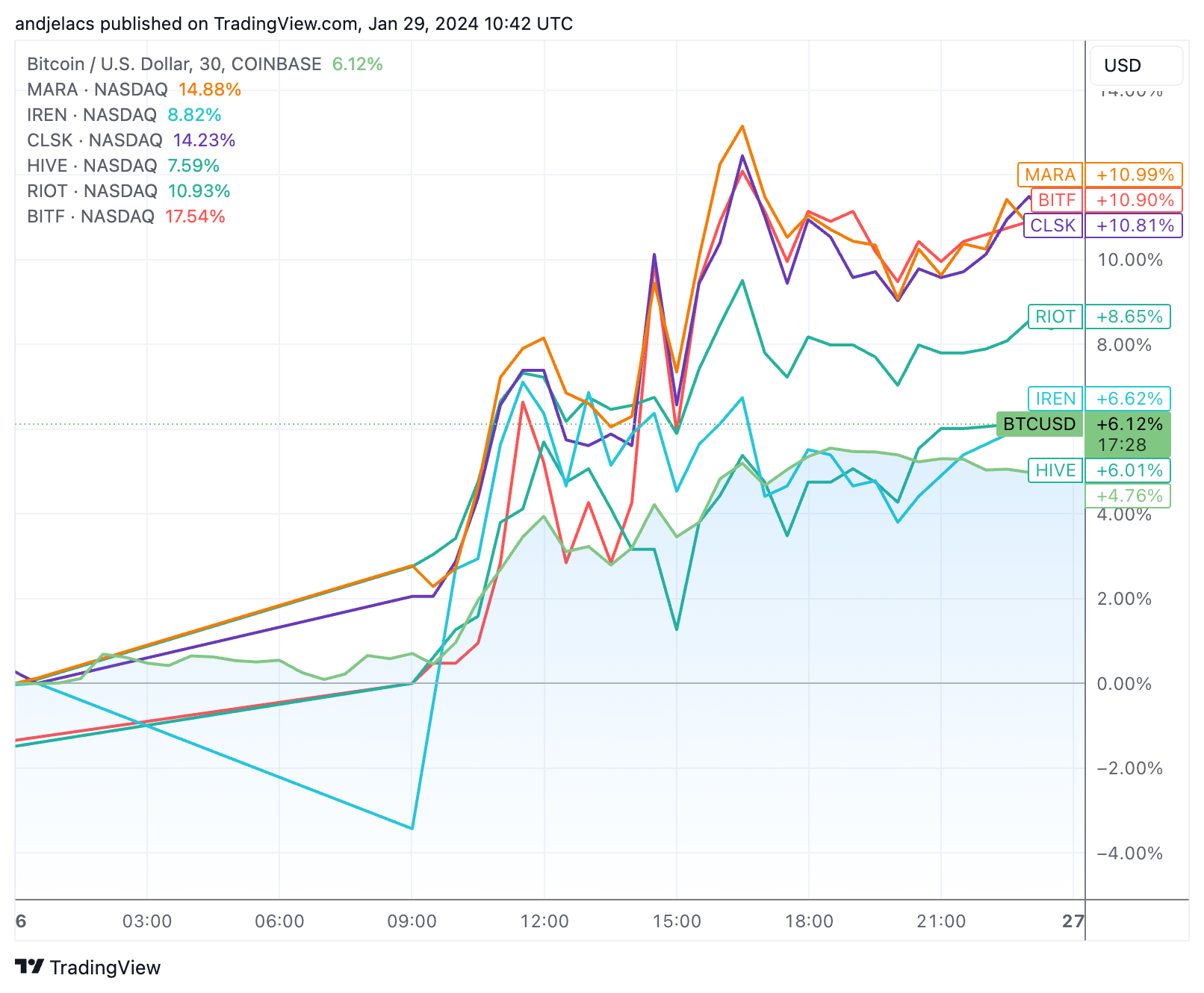

This uptrend was very noticeable on Friday, January twenty sixth, with nearly all the shares talked about outpacing Bitcoin's 6.12% progress, with MARA, BITF, and CLSK all rising over 10.80%.

As of this writing on January twenty ninth, there’s a lack of response from Bitcoin mining shares to Bitcoin value fluctuations. This delay is as a result of distinction in buying and selling hours between cryptocurrency markets, which function 24/7, and conventional inventory exchanges like Nasdaq, which function solely on weekdays and the place most mining shares are listed. Factor. This discrepancy typically delays the response of mining inventory costs to Bitcoin's weekend value actions. On condition that Bitcoin rose above $42,000 over the weekend, we may see additional progress in mining shares because the market opens on January twenty ninth and adjusts to developments subsequent week. Shares like RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, in premarket buying and selling up to now.

The efficiency of those shares additionally mirrored a slight enhance in miner income, and though final week was unstable, they confirmed an total optimistic upward development. In line with Glassnode knowledge, as Bitcoin costs fluctuated, the full each day USD income paid to miners diverse between $39 million and $47 million. Miner earnings are an essential benchmark for evaluating the well being and efficiency of mining shares, and rising earnings is without doubt one of the most essential elements driving inventory costs up.

The publish Mining Shares Get well as Bitcoin Rises Above $42,000 Regardless of ETF Rotation Issues The publish appeared first on currencyjournals.

Comments are closed.