- SUI is testing key help at $1.65 because the lack of momentum weighs on worth motion.

- Regardless of the slight worth enhance to $3.50, EigenLayer’s decrease quantity may stop a breakout.

- Bitensor has consolidated under $520 as low buying and selling volumes point out a possible stagnation.

The cryptocurrency market has seen notable shifts in sentiment, particularly amongst altcoins comparable to SUI, EigenLayer (EIGEN), Bittensor (TAO), Synthetic Superintelligence (FET), and Pyth Community (PYTH). These tokens have seen important worth fluctuations over the previous 24 hours, reflecting altering market dynamics.

Analyzing key help and resistance ranges can present worthwhile perception into the potential future actions of those altcoins. Moreover, inspecting traits in buying and selling quantity and market capitalization can reveal the general sentiment inside the cryptocurrency market.

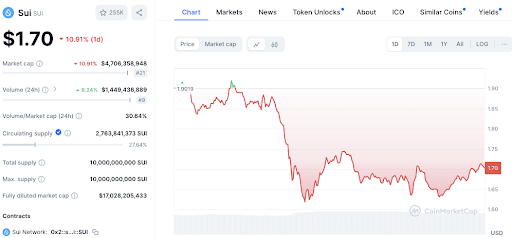

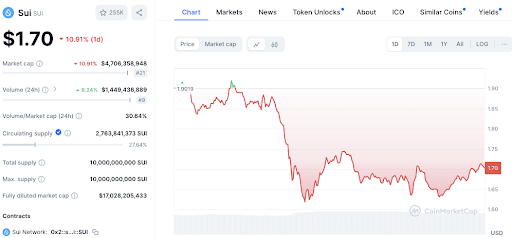

SUI: Testing key help ranges amid decline

SUI's present worth is $1.71, down 9.84% up to now 24 hours. The value lately reached $1.90 however failed to take care of its upward momentum. Importantly, the value is presently testing the important thing help at $1.65 that has held throughout previous declines.

Additionally learn: Prime 5 altcoins to observe in October: SEI, TAO, WORM, SUI, LINK

If this stage is damaged, the subsequent space to concentrate on is psychological help round $1.60. Wanting above, we see fast resistance at $1.75 and stronger resistance at $1.90. SUI buying and selling quantity stays sturdy at $1.45 billion, suggesting continued market curiosity regardless of the latest pullback.

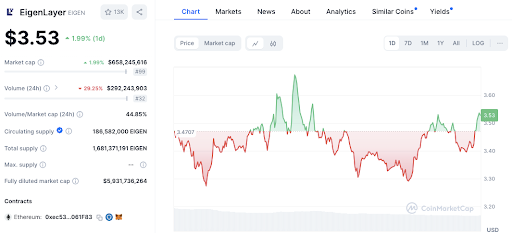

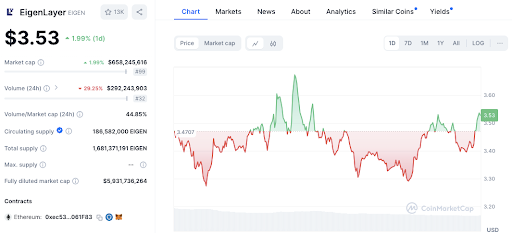

EigenLayer (EIGEN): Breakout with a small quantity of attainable delay

At its present worth of $3.50, EigenLayer is up 0.85% up to now 24 hours. Nevertheless, buying and selling quantity decreased by 31.29%, reflecting weakening market individuals.

Fast resistance lies between $3.55 and $3.60. Stronger resistance lies at $3.65, which the value is struggling to interrupt out of.

Assist is at $3.40, and the second stage is at $3.30, with earlier purchasers taking part. With a volume-to-market capitalization ratio of 44.85%, the token stays comparatively lively, however additional good points may rely upon a restoration in quantity.

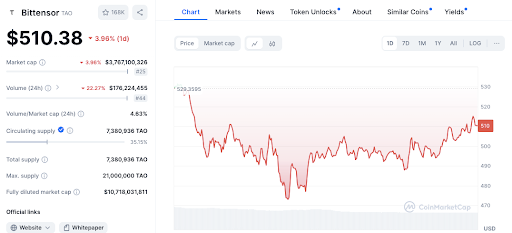

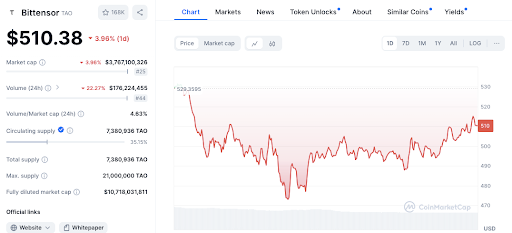

Bittensor (TAO): Consolidation part is simply across the nook

TAO is buying and selling at $515.01, down 3.02% over the previous day. The value briefly touched the $520 resistance stage however failed to interrupt out. Because of this, the subsequent strongest resistance stage is $530.

On the draw back, the fast help is at $505, and if it breaks out, $490 would be the subsequent vital defensive zone. With a market capitalization of $3.8 billion, TAO is a vital participant, however its low buying and selling quantity, as evidenced by its market capitalization ratio of 4.63%, suggests consolidation or a scarcity of curiosity from merchants. There’s a risk that it’s.

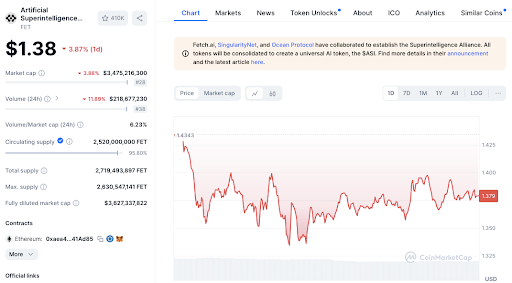

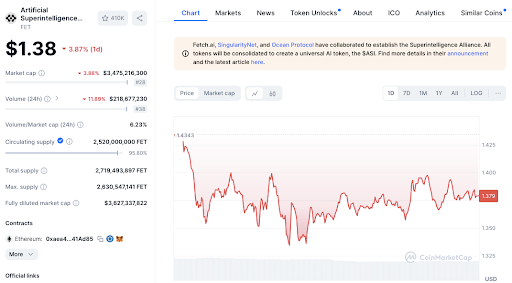

FET: Stays key help regardless of decline

FET worth is presently $1.38, down 3.72% on the day. The token has examined the $1.33 help stage a number of occasions, displaying sturdy safety from patrons at this stage.

If FET is ready to break above this, the subsequent resistance to observe can be round $1.40, and the extra vital stage can be round $1.43. Nevertheless, if the value falls under $1.33, additional declines could also be anticipated.

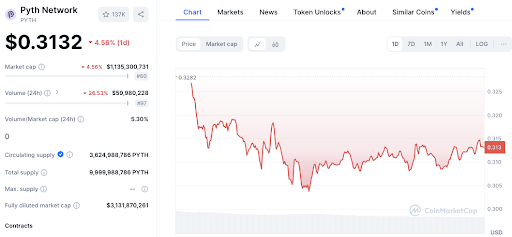

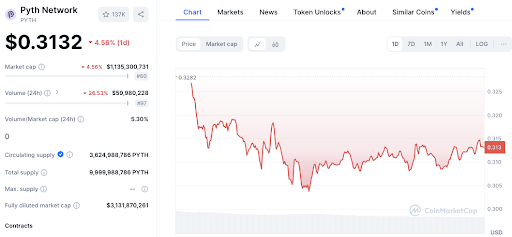

Pyth Community (PYTH): Testing the decrease bounds of help

PYTH fell by 4.54% to a worth of $0.3133. The value is approaching sturdy help at $0.305 and this help is holding all through the day.

Resistance is close to $0.320, and a break above it may sign a possible restoration. Nevertheless, because the downtrend is dominant, PYTH faces the problem of regaining bullish momentum.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.