- Crypto Tony tweets a few 150,000 ETH transaction from an unknown pockets to Coinbase.

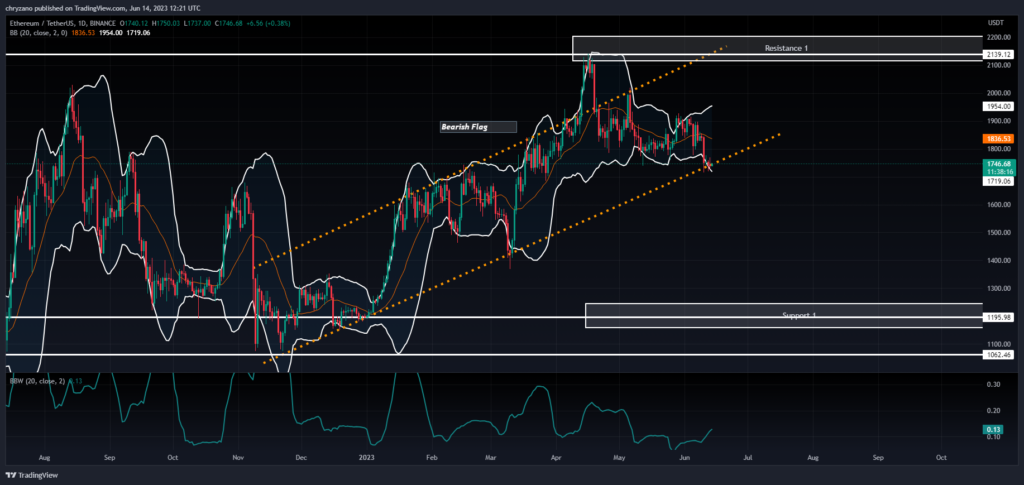

- Ethereum has been fluctuating throughout the bearish flag since late 2022 and will break at any second.

- Bollinger Bands purchase time for a breakout as ETH touched the decrease bands.

Dealer and analyst Crypto Tony retweeted Whale Alerts, a tweet by a blockchain buying and selling investigator who mentioned 149,999 ETH was transferred to Coinbase from an unknown pockets. Transferred he ETH he reaches $261,949,642.

Nevertheless, the explanation behind this huge deal has but to be recognized. Merchants ought to take precautions because the whale may very well be getting ready to alternate ETH for different cash or it may very well be one thing else the whale may very well be as much as. possibly.

Contemplating the chart above, Ethereum has been buying and selling on the bearish flag since late November 2022. ETH was touching the higher trendline more often than not whereas staying on the flag. It has been making new highs and lows for about half a 12 months. As such, we are able to anticipate Ethereum to come back out of the flag at any second.

In accordance with bearish flag buying and selling finest practices, it is suggested to set the take revenue for brief positions slightly below the help 1 stage. The speculation above is predicated on the most effective follow of shifting the wedge peak to the breakout level from the wedge within the early levels of formation.

Moreover, a cease loss might be positioned on the higher trendline of the wedge to offer ETH sufficient room to maneuver. If Ethereum crashes out of the wedge, it might attain $1,062.

Given the timing of the breakout, the Bollinger Bands look like denying the truth that ETH might get away of the wedge now. It is because ETH has touched the decrease aspect of the Bollinger Bands and should retrace and transfer greater. As such, ETH could proceed to fluctuate throughout the wedge over a fair longer time period. Furthermore, the Bollinger Bands Width indicator can be rising, which might result in additional widening of the bands and elevated volatility.

Due to this fact, it’s of utmost significance for merchants to time the breakout level from the market, particularly the wedge. It is strongly recommended to make use of an appropriate mixture of indicators to find out market actions.

Disclaimer: The views, opinions and data shared on this worth forecast are printed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly answerable for their very own actions. Coin Version and its associates usually are not answerable for any direct or oblique damages or losses.

Comments are closed.