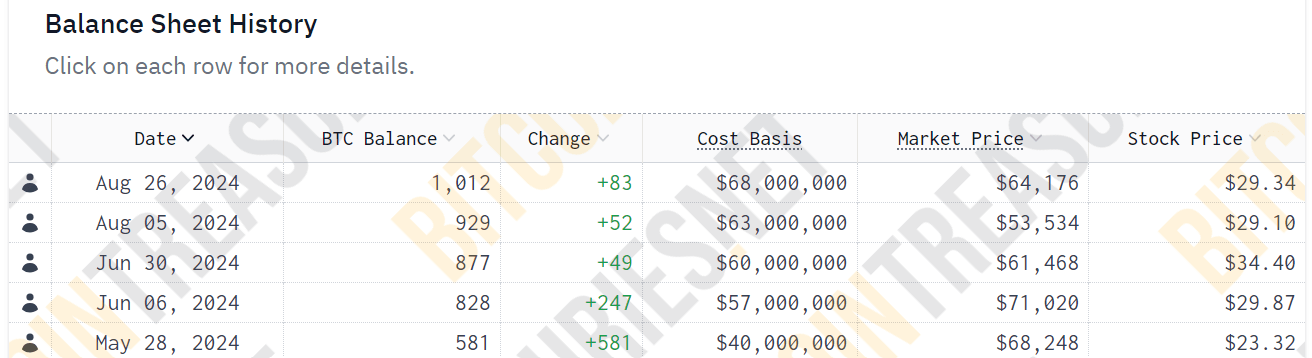

Nasdaq-listed medical expertise firm Semler Scientific introduced in an announcement on August 26 that it has elevated its Bitcoin holdings by buying an extra 83 BTC for $5 million.

The acquisition brings the corporate's whole Bitcoin holdings to 1,012 BTC, and its whole acquisition worth, together with charges and bills, is $68 million.

The corporate's Chairman Eric Semler stated the acquisition was funded primarily with money generated from its operations, supplemented by proceeds from its at-the-market fairness program.

He added:

“We’re inspired by the rising institutional adoption of Bitcoin. It was not too long ago reported that establishments now personal over 20% of the Bitcoin ETF's property below administration. We imagine this improve in institutional possession will improve worth for each Bitcoin's value and shareholders.”

Semler Bitcoin Buy

Semler Scientific started investing in Bitcoin in Might, buying 581 BTC for $40 million.

Since then, the corporate has been on a shopping for spree, buying 247 BTC for $17 million on June 6 and 49 BTC for $3 million on June 28. By August 5, the corporate had bought an extra 52 BTC for $3 million.

This newest buy places Semler Scientific within the prime 20 firms holding bitcoin, based mostly on Bitcoin Treasuries information.

Within the firm's second-quarter report, CEO Doug Murphy-Chutrian reaffirmed the corporate's dedication to Bitcoin, emphasizing the way it enhances the corporate's healthcare enterprise technique.

Institutional adoption

Semler's rising Bitcoin holdings spotlight the rising confidence of firms in using the flagship digital asset as a treasury reserve.

The pattern, which was began by MicroStrategy in 2020, has picked up vital momentum this 12 months, with different firms corresponding to Japan-based funding agency Metaplanet and publicly listed firm DeFi Applied sciences additionally making giant Bitcoin acquisitions.

Moreover, the introduction of Bitcoin exchange-traded fund (ETF) merchandise has considerably elevated institutional publicity to the rising business, a pattern that Bitwise CIO Matt Hogan predicted will solely improve within the coming years because the business continues to mature.