Whereas Bitcoin buying and selling hours have exceeded these of the fashionable U.S. fiat inventory market because the Nixon Shock, it will be untimely to assert they’ve exceeded your complete historical past of U.S. inventory buying and selling or world fiat buying and selling as an entire. Nearer investigation reveals a extra nuanced image of market longevity and buying and selling exercise.

The crypto group was not too long ago abuzz with statistics launched by Corey Bates displaying that Bitcoin buying and selling instances are actually longer than the fiat inventory market.

Whereas Bates factors out that Bitcoin buying and selling is at present outperforming the fiat inventory market, it's vital to keep in mind that this doesn't imply your complete historical past of the U.S. inventory market. Nonetheless, we are able to see that Bitcoin buying and selling predates fiat buying and selling within the U.S., however not globally.

The earliest identified use of fiat forex dates again to the Music Dynasty in China (960-1279 AD), when governments issued paper cash that was not backed by any bodily commodity equivalent to gold or silver. This forex was initially backed by the credit score of the state and have become broadly accepted for commerce and taxation.

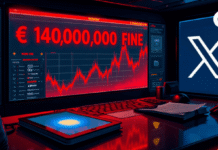

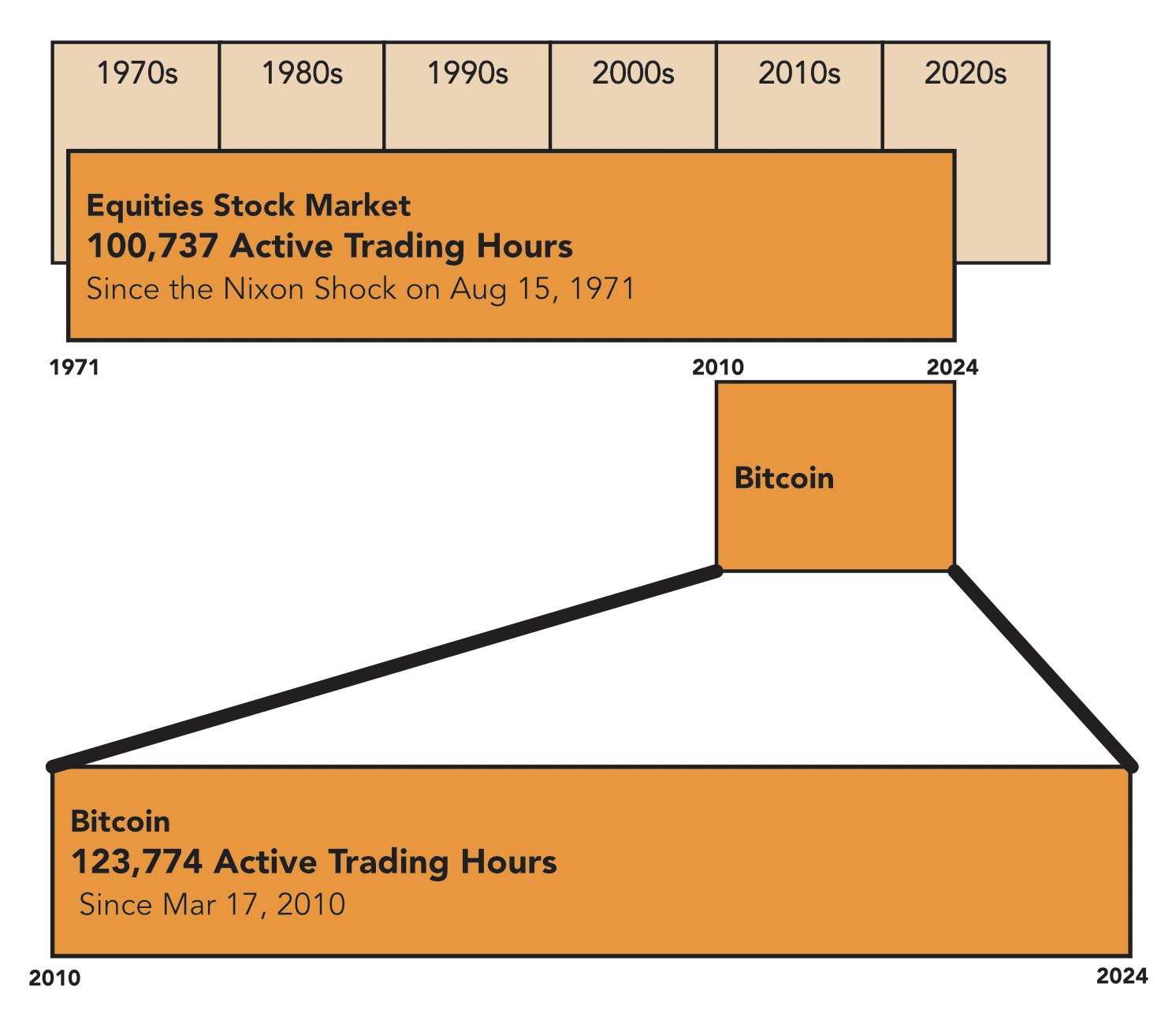

Bitcoin Buying and selling Hours vs. US Fiat Inventory Market

Launched in 2009, Bitcoin has gathered 123,774 lively buying and selling hours because the first recorded transaction on March 17, 2010. That is greater than the 100,737 hours recorded within the U.S. inventory market since August 15, 1971, when the Nixon Shock caused main modifications to the worldwide monetary system by abolishing the gold commonplace.

However the historical past of the U.S. inventory market goes again a lot additional than 1971. The New York Inventory Trade, based in 1792, has been round for over two centuries. When you think about this historical past in its entirety, the image modifications dramatically.

Primarily based on the NYSE's founding date, that works out to roughly 380,509 lively buying and selling hours by September 6, 2024. This determine far exceeds Bitcoin's present complete, regardless of the digital asset's 24/7 buying and selling schedule.

Bitcoin has a major benefit in stacking buying and selling hours as a result of it’s accessible 24 hours a day. Conventional inventory markets function on a extra restricted schedule, usually 6.5 hours a day, 5 days every week, excluding holidays.

Contemplating Bitcoin's ongoing buying and selling, it’s predicted that it’s going to take till round April 15, 2053 for the digital asset to really surpass the entire buying and selling hours of your complete historical past of the U.S. inventory market. This assumes that each markets proceed to function on their present schedules with none main disruptions.

Nevertheless, you will need to be aware that buying and selling hours alone don’t present an entire image of market depth, liquidity, and general financial impression. The US inventory market stays the linchpin of worldwide finance, with Bitcoin but to catch up when it comes to depth and breadth of listed firms and buying and selling quantity.

Bitcoin has made spectacular progress in its younger years, however the weight of centuries of U.S. inventory market historical past stays a strong benchmark.

The entire historical past of fiat forex buying and selling

Bitcoin is shifting quick, however it will likely be a long time earlier than it might critically declare to have surpassed the cumulative buying and selling hours of any main U.S. inventory market. Furthermore, to gauge Bitcoin's declare to have surpassed fiat currencies, the international change market has been accessible 24 hours a day on weekdays since 1971.

Estimating complete fiat forex transaction instances on a worldwide scale poses distinctive challenges as a result of traditionally gradual adoption of fiat financial methods. Though fiat currencies have been in use in some kind since historic China, trendy transaction instances solely turned constant within the twentieth century, particularly because the transition from the gold commonplace after the Nixon Shock in 1971.

Previous to 1971, world buying and selling hours had been localized, irregular, and diversified from area to area. At the same time as fiat forex methods turned extra widespread, there was no unified world buying and selling market and exchanges had restricted opening hours. Nevertheless, after 1971, the emergence of the international change (FX) market offered a extra dependable benchmark for calculating buying and selling hours.

Presently, trendy Foreign currency trading takes place roughly 120 hours per week (24 hours per day, 5 days per week). On this foundation, it’s estimated that fiat currencies have been traded roughly 6,240 hours per 12 months since 1971. Over the 53 years from 1971 to 2024, there can be roughly 330,720 hours of fiat forex buying and selling within the trendy world market.

In abstract, Bitcoin has outperformed the US fiat inventory market since 1971 when it comes to buying and selling hours, however the cumulative buying and selling hours of worldwide fiat forex transactions because the inception of organized world international change markets are considerably longer.

Due to this fact, Bitcoin has not surpassed the mixed complete world buying and selling hours of fiat currencies, each when it comes to trendy Foreign currency trading and when it comes to the lengthy historical past that fiat currencies have had worldwide. Nonetheless, Bitcoin may theoretically ultimately catch up, until the main Foreign exchange markets are additionally open on weekends. Nevertheless, some brokers do enable restricted weekend buying and selling on the preferred Foreign exchange pairs.