Transak, a cryptocurrency and NFT funds infrastructure firm, has partnered with Visa to combine Visa debit performance into its world off-ramp service. This transfer will increase crypto-to-fiat off-ramp choices, permitting customers in over 145 nations to trade their crypto holdings for native fiat.

Transak allows the fluid conversion of digital property to fiat throughout industries with a product known as Visa Direct. This collaboration addresses a crucial hole available in the market: ease of conversion from cryptocurrencies to fiat currencies. Traditionally, the main focus has been on facilitating flows from fiat to crypto, with the reverse course of from crypto again to fiat being much less developed and sometimes remaining cumbersome. It has grow to be.

This has led to a reliance on stablecoins and various, much less regulated trade strategies, which may pose points relating to native compliance. Transak and Visa's partnership introduces an answer to this problem by providing real-time card withdrawals by way of Visa Direct. Yanilsa Gonzalez-Ore, Head of North America at Visa Direct, emphasised the significance of this integration and its position in offering customers with a extra related and environment friendly expertise.

“By enabling real-time card withdrawals by way of Visa Direct, Transak is providing customers a quicker, easier, and extra related expertise, permitting them to transform their crypto balances into fiat. It's now simple to transform and out there at greater than 130 million retailers the place Visa is accepted. ”

A key characteristic of Visa Direct is its real-time transaction processing capabilities, which may probably full transfers inside half-hour. That is in stark distinction to the prolonged procedures at conventional banks. Moreover, most off-ramps immediately are restricted to centralized exchanges, requiring traders to maneuver into central administration not less than briefly earlier than exiting.

The flexibility to transform cryptocurrencies to fiat straight from the pockets permits customers to retain the self-sovereign facet of self-control of their cryptocurrencies. Transak is built-in into “greater than 350 main Web3 wallets and video games, together with MetaMask, Belief Pockets, Coinbase Pockets, and Ledger.”

Sami Begin, CEO of Transak, considers this partnership a pivotal second for Web3, commenting:

“We consider this partnership might be a turning level for Web3 as an entire. Hundreds of thousands of individuals around the globe now have a straightforward technique to convert their digital property into native foreign money in real-time and intuitively. I’ve a way.

They not should tread the treacherous path of compliance uncertainty or face the danger of fraud. Transak and Visa cowl over 40 cryptocurrencies. ”

Testing a wallet-based fiat off-ramp.

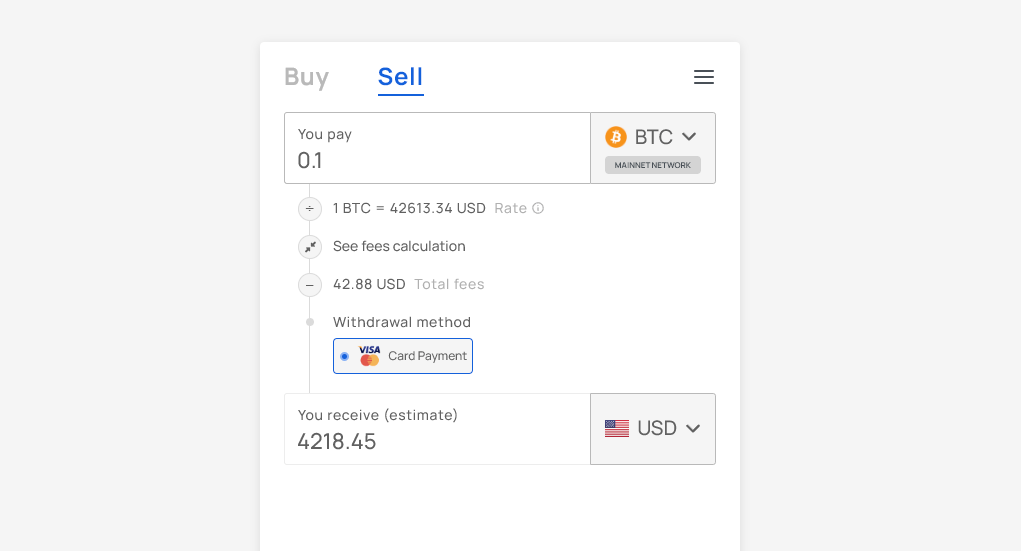

However such revelations should not with out their downsides. On the time of writing, the value of Bitcoin is $43,497. Nonetheless, should you withdraw 0.1 BTC, solely $4,218 of fiat foreign money might be deposited into the investor's checking account, corresponding to three% of his present worth. Transak receives his 1% fee and a nominal processing payment paid to the “service supplier”. Nonetheless, the data bubble on the web page signifies that the listed costs are approximate, so it’s at present unclear whether or not there might be a variety along with the fee.

The unfold between estimated costs and present market costs is roughly 2% throughout all property studied. A 2% unfold can be proven on “purchase” aspect transactions by way of Visa Card, ApplePay, GooglePay, Money App, and Financial institution Wire, which additionally incur a 0.99% transaction payment.

Transak's web site lists a flat 1% payment, however companion documentation particulars the pricing mechanism. This unfold is meant to cowl community charges and a “small proportion of slippage.” Combining charges right into a single variable might make such transactions appear simpler to non-native cryptocurrency customers. Nonetheless, on a regular basis customers might favor extra restricted management over prices. In spite of everything, comfort comes at a value.

Harshit Gangwar, Head of Advertising and marketing and Investor Relations at Transac, confirms: crypto slate “Spreads will range based mostly on components such because the complexity of liquidity sourcing and the dangers related to storing varied cryptocurrencies.” Particularly, he mentioned:

“(Spreads) are variable and decided by our methods and groups based mostly on the challenges of storing and sourcing cryptocurrencies.

For instance, if a cryptocurrency out there for off-ramping instantly drops considerably, it could alert our staff to the elevated threat of storing it for lengthy intervals of time, which might impression the unfold charge for that specific cryptocurrency. There’s a chance. ”

Moreover, for these hoping that this course of would remove the necessity for KYC steps, this doesn’t appear to be the case. Your title, tackle, date of start, ID, and selfie are all required when establishing your Transak withdrawal service account. Subsequently, if you purchase or promote by way of this non-custodial off-ramp, your private info might be linked to your pockets tackle.

These searching for a completely compliant method to purchase and promote cryptocurrencies with fiat foreign money with out utilizing a centralized trade can make the most of strategies at present out there at prices between 0.99% and three%, however this can be considerably decrease than different peer-to-peer choices.

In the end, Transak's partnership with Visa Direct is a decisive step in direction of mainstream acceptance of digital currencies. This might simplify the conversion of cryptocurrencies to fiat currencies, take away obstacles of complexity and uncertainty, and speed up the adoption of cryptocurrencies among the many normal public.

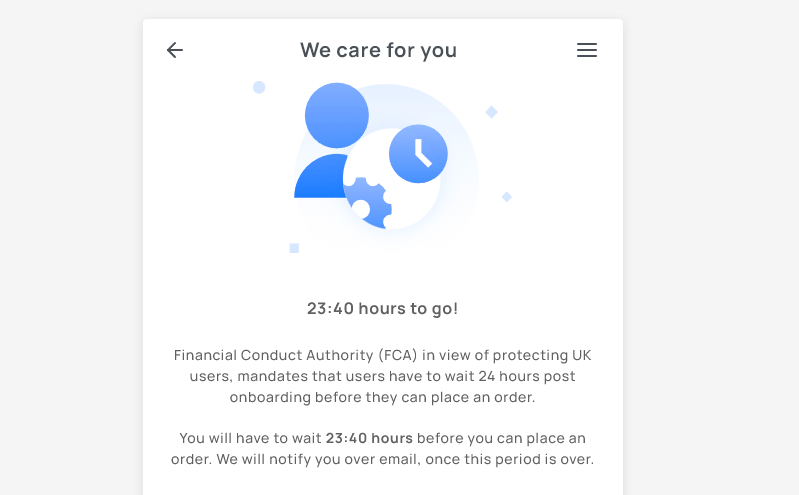

Editor's observe: I examined the method and tried to run a transaction to see if there was a 2% unfold. I supposed to off-ramp $100 price of MATIC, however resulting from new FCA promotional guidelines, I used to be introduced with this display after finishing the KYC course of.

(Tag Translation) Bitcoin

Comments are closed.