After a quick battle to regain its footing, Bitcoin lastly broke by the $52,000 barrier on February 14th. Whereas $50,000 was an vital psychological benchmark, buying and selling above $52,000 would point out rising market confidence in Bitcoin and will imply the top of the bear market.

Throughout worth fluctuations, particularly in periods of great will increase, it is very important analyze the provision of Bitcoin provide. Realizing the theoretical provide of Bitcoin out there for buying and selling tells us how a lot shopping for or promoting strain the market can take up. A rise in tradable provide could cause costs to fall if there isn’t a matching demand. Conversely, if the provision of Bitcoins which can be available for buy decreases, a scarcity might happen, resulting in a rise in worth.

Provide availability can’t be decided by a single metric. Bitcoin provides held in change wallets are often thought-about the most effective different, however this has little depth. crypto slate To higher perceive whether or not tradable provide is tight, we analyzed a number of different on-chain indicators, together with UTXO and accumulation addresses.

In fact, there are numerous different indicators that may present extra perception into the state of the market. For instance, the distinction between the provision of long-term and short-term holders signifies whether or not there is a rise in tradable (STH) and non-tradable (LTH) provide, which might trigger a requirement squeeze. Nonetheless, specializing in much less broadly used metrics like UTXO can present new views on steadily analyzed matters.

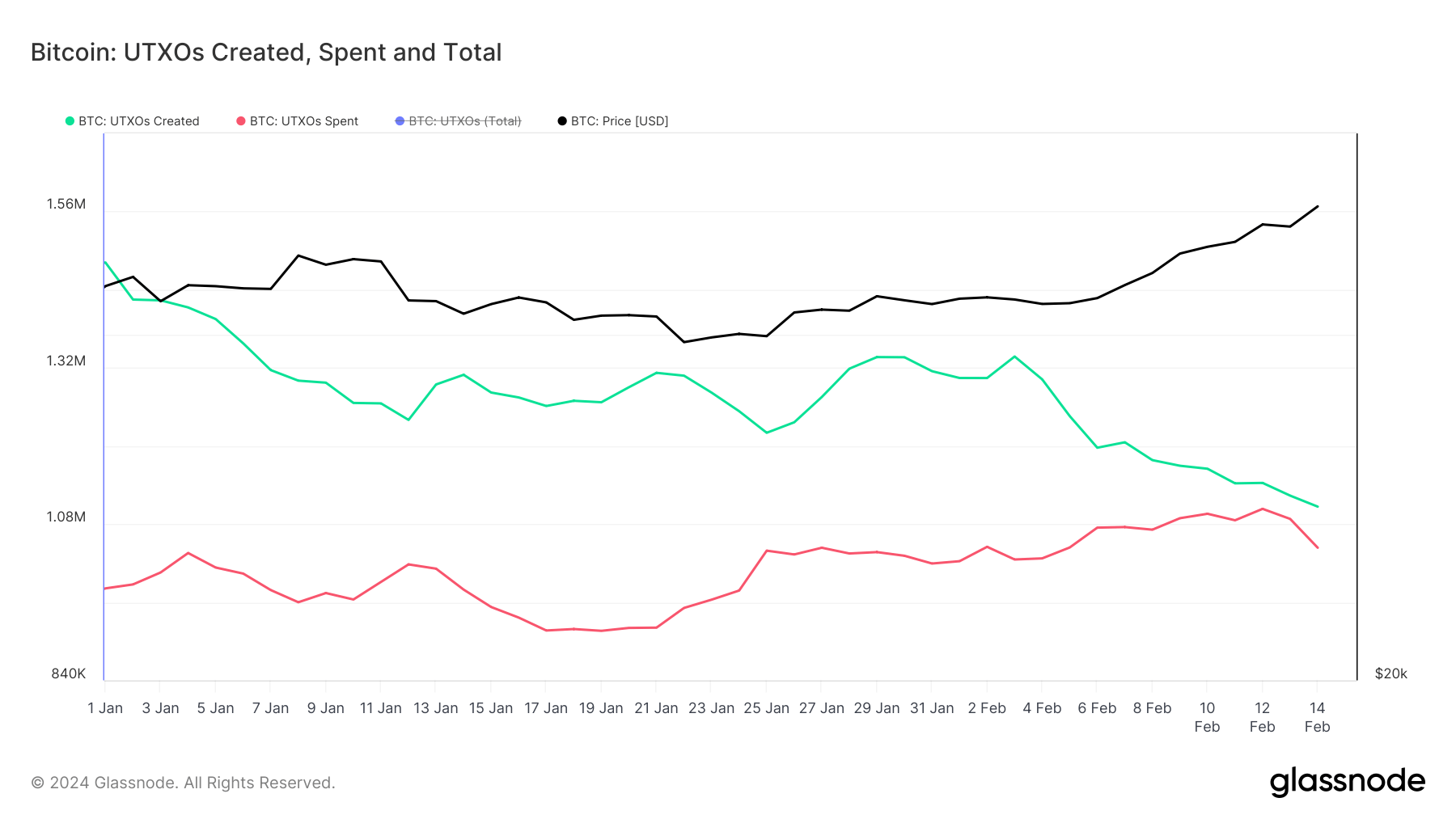

Unspent Transaction Outputs (UTXOs) are important to understanding the Bitcoin community. UTXO represents the quantity of BTC that is still unused in a pockets after a commerce and serves as a elementary indicator of Bitcoin's liquidity and motion inside the market.

On February 1st, the variety of UTXOs created was 1.304 million, which decreased to 1.106 million on February 14th. On the similar time, the variety of used UTXOs remained comparatively steady. This lower suggests that there’s much less willingness to switch his BTC between addresses.

This pattern could be seen as the primary signal of a possible liquidity scarcity and will have a big impression on Bitcoin worth within the coming weeks.

The launch of the Spot Bitcoin ETF within the US is without doubt one of the most vital milestones for Bitcoin by way of its introduction to institutional traders, introducing a regulated mainstream funding automobile for Bitcoin publicity. . These ETFs have seen over $4.1 billion in inflows since they began buying and selling only a month in the past, and are utilizing their OTC desks to amass BTC. This acquisition technique has been beforehand analyzed by currencyjournals and has a big impression on provide availability.

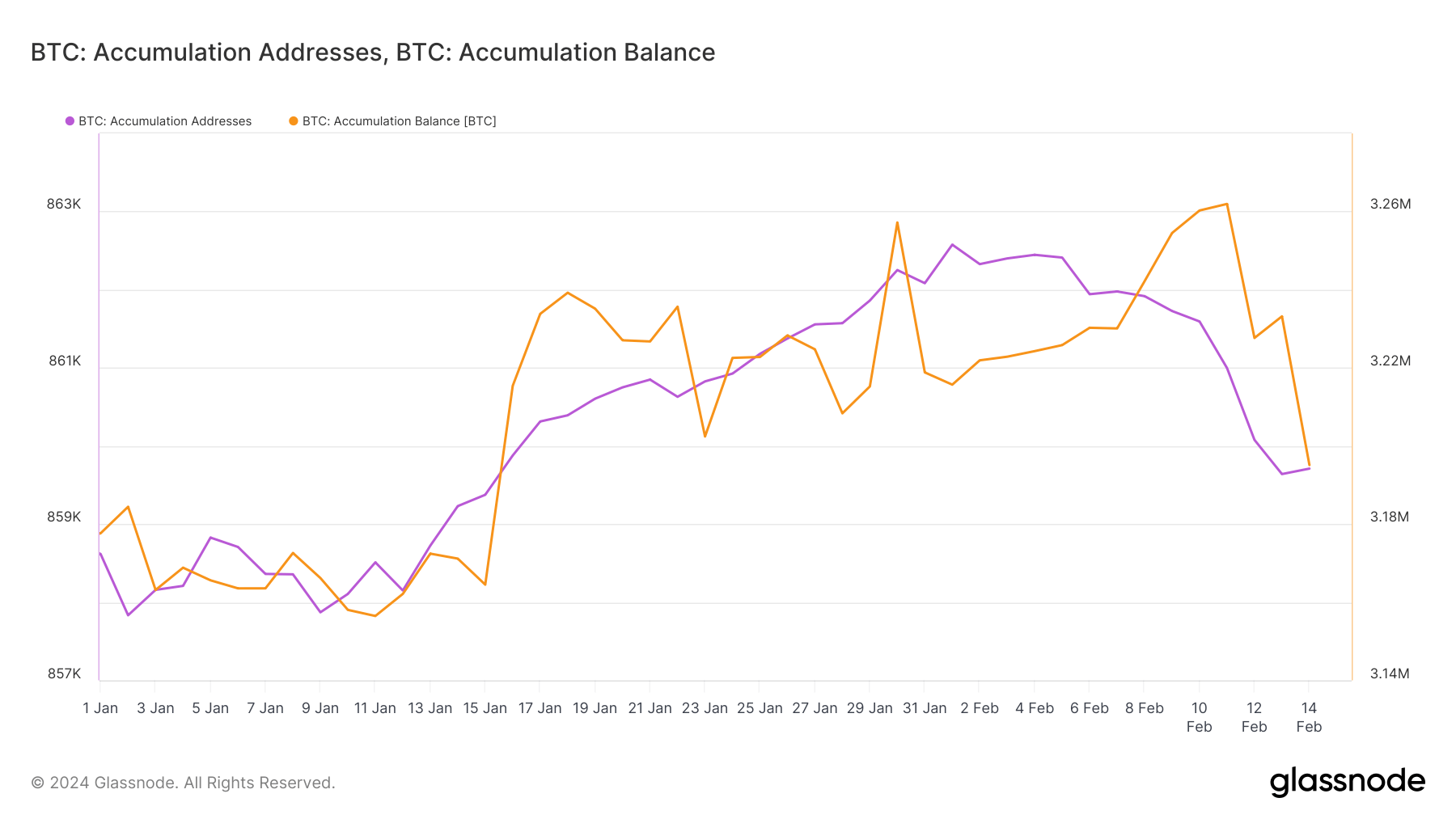

In different phrases, the quantity of Bitcoin held in storage addresses has considerably decreased from 3.215 million BTC on February 1st to three.195 million BTC by February 14th, and the variety of these addresses has decreased barely. are doing.

This decline might recommend that long-held BTC has been strategically mobilized. With the provision of long-term holders persistently rising, we imagine this is because of elevated gross sales to OTC desks in response to elevated demand from ETFs.

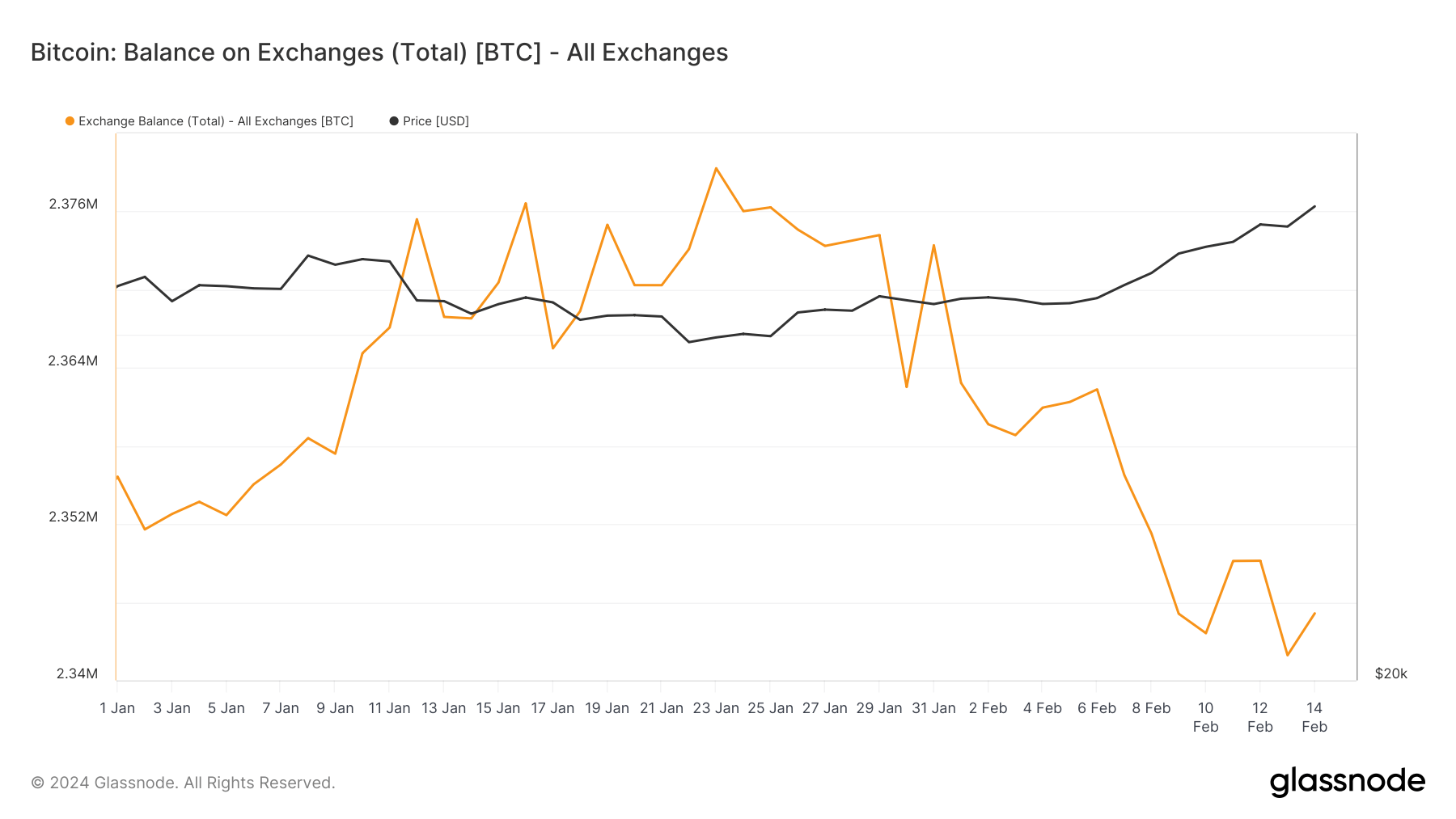

Moreover, there was a visual decline within the quantity of Bitcoin held in change wallets, from 2.363 million BTC on February 1st to 2.345 million BTC on February 14th. Whereas this can be a continuation of a year-long pattern, it exhibits a really clear tightening of provide out there for buying and selling.

A mix of things corresponding to a lower in UTXO technology, fewer Bitcoins held in storage addresses, decrease change balances, and important inflows into spot Bitcoin ETFs are indicating important adjustments out there. This variation might additional cut back the provision out there for buying and selling, particularly on the again of elevated demand from institutional traders by ETFs.

The publish On-Chain Information Reveals Bitcoin Provide Is Tight appeared first on currencyjournals.

Comments are closed.