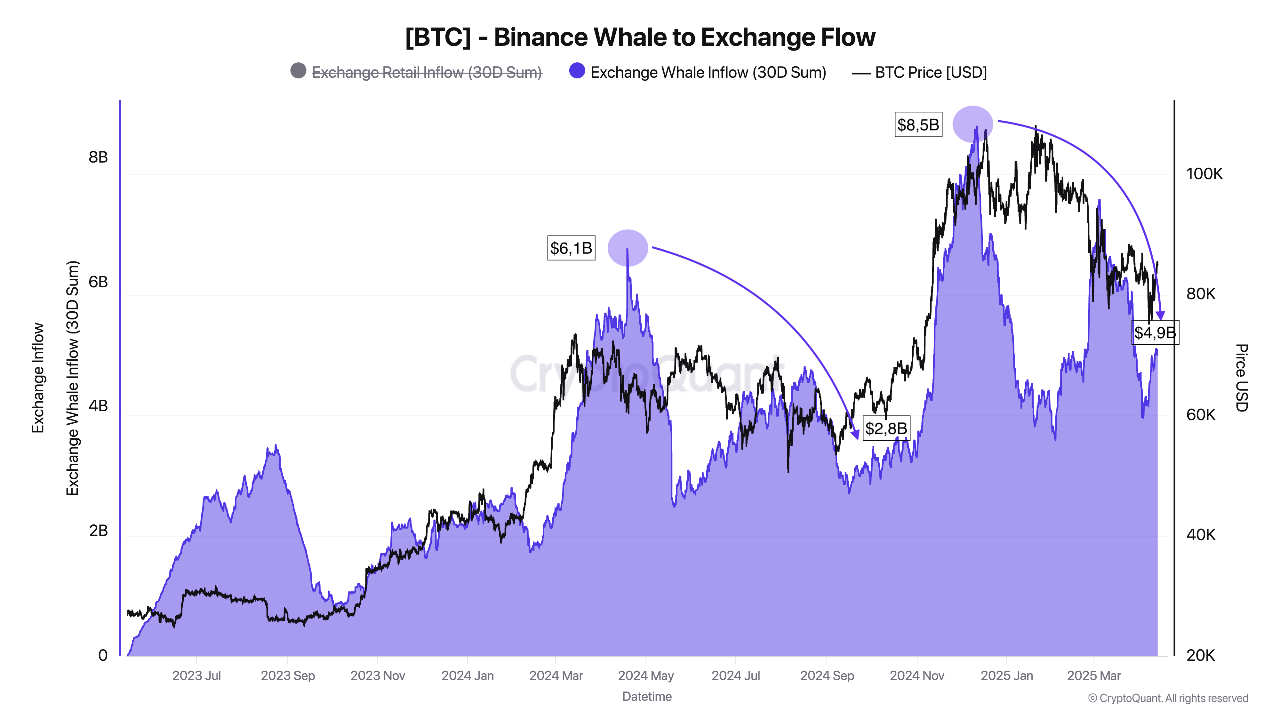

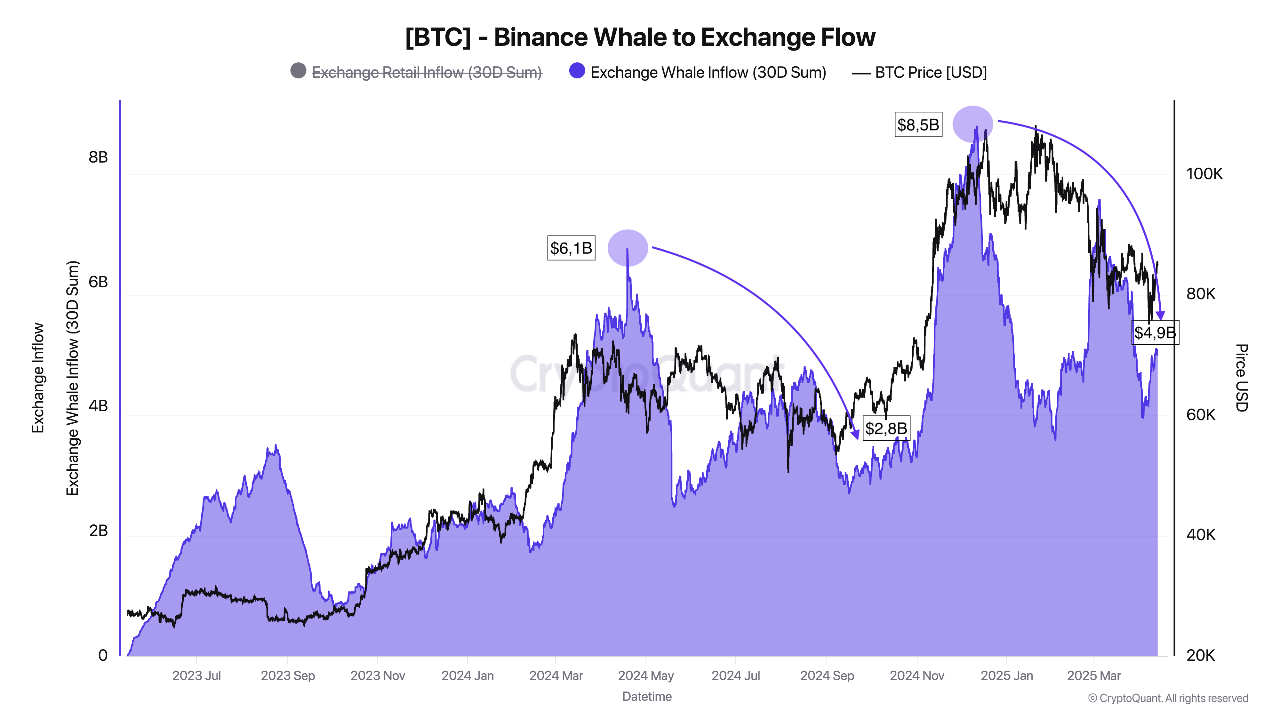

- Binan Skudhale inflows have fallen by greater than $300 million, suggesting a decline in gross sales stress.

- A possible restoration can take a number of months, in keeping with analyst Kripto Mevsimi.

- The instant assist ranges for BTC are $83,195 (0.618 FIB) and $85,704 (0.786 FIB).

Bitcoin has discovered it has marked the $84,500 mark roughly 84,500 after an extended corrective section. With whales regular conduct, lengthy bets from key establishments collide with the market, and key technical indicators bullishly shifting, it has slowly turn out to be constructive for buyers.

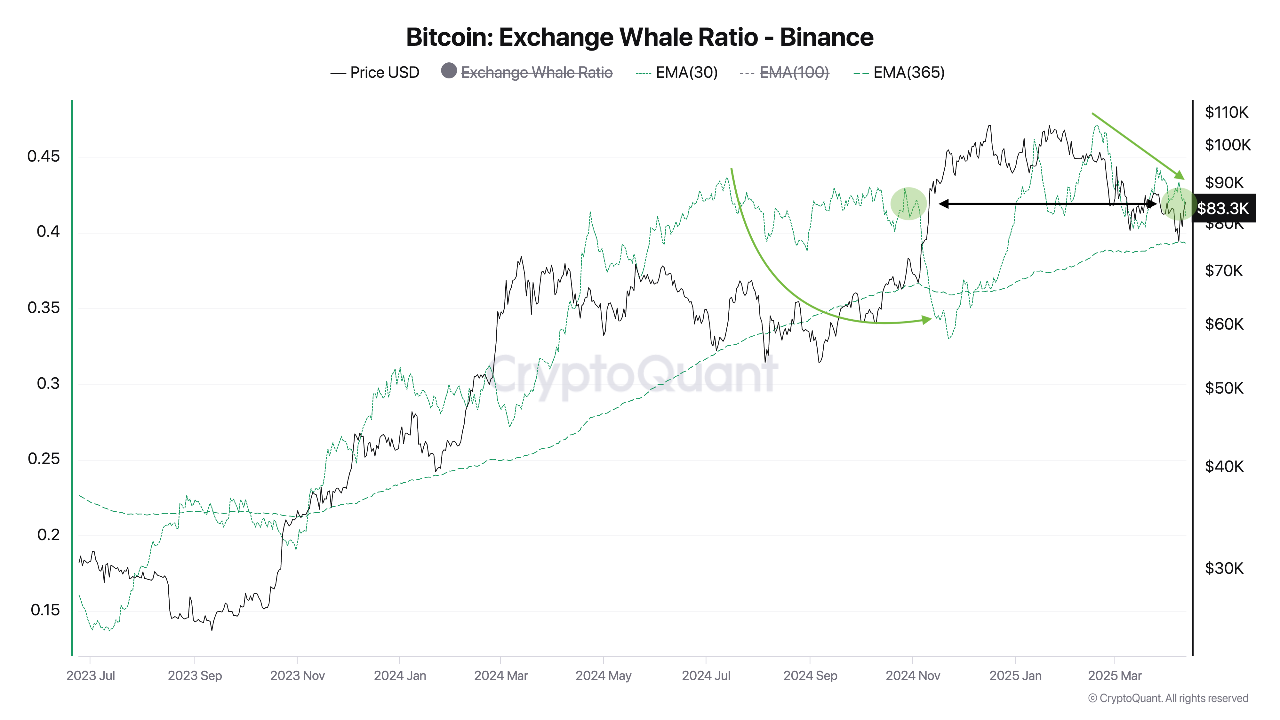

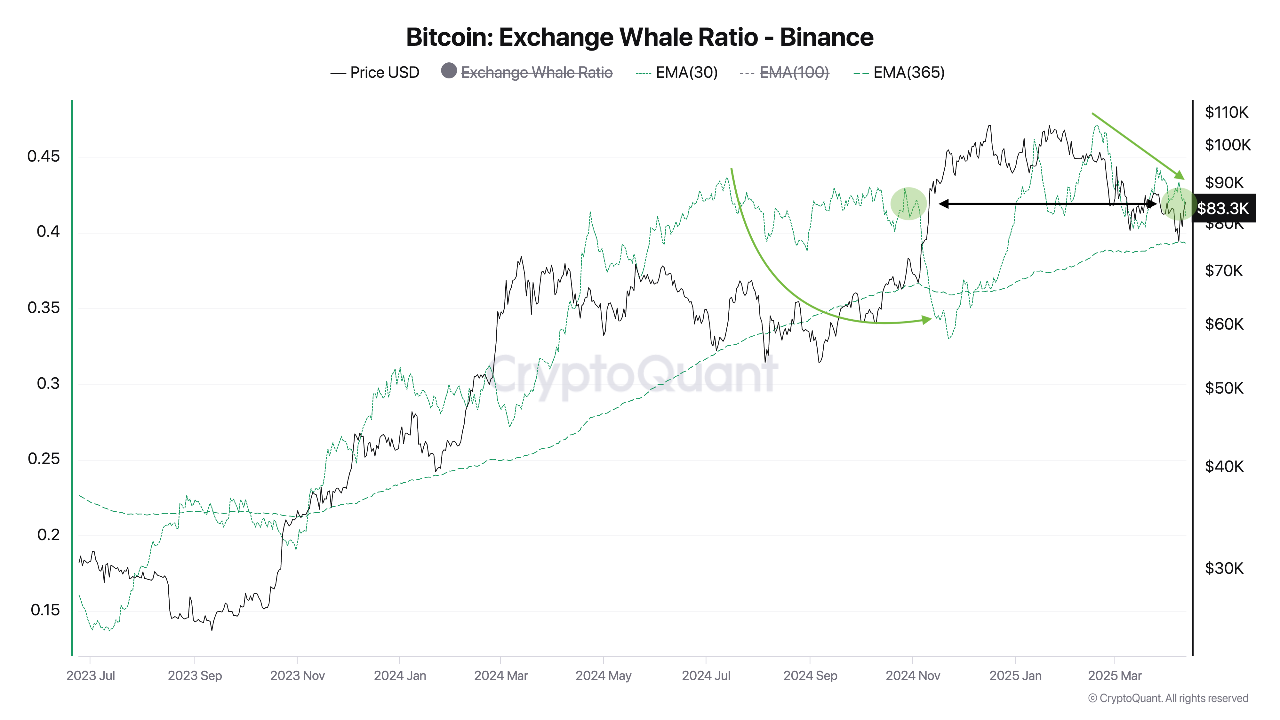

Particularly, analyst DarkFost stated current on-chain knowledge from Binance reveals that giant holders or whales don’t present panic-driven conduct.

On-Chain View: Whale Conduct Exhibits Low Gross sales Strain

DarkFost famous that the 365-day shifting common of change whale ratios is on a constant upward development.

Which means that whales can have a major impression on the stream of the vinance fund over an extended time period, suggesting a basic conviction.

Nonetheless, the 30-day common for a similar metric has declined, returning to the extent it was final seen in late 2024. This short-term decline in exercise signifies that these main gamers are again in gross sales stress.

In assist of this, the overall whale influx has dropped by greater than $3 billion. This can be a motion that displays the conduct seen throughout earlier revisions.

Associated: “Preserve a Watch”: Hayes hyperlinks to Bitcoin earnings which might be coming stress within the bond market

Total, this development signifies that whales usually are not presently in a rush to exit. As a substitute, they most likely select to take a seat tight and keep away from main sellers.

Warning Recommendation: Historical past exhibits that restoration takes time

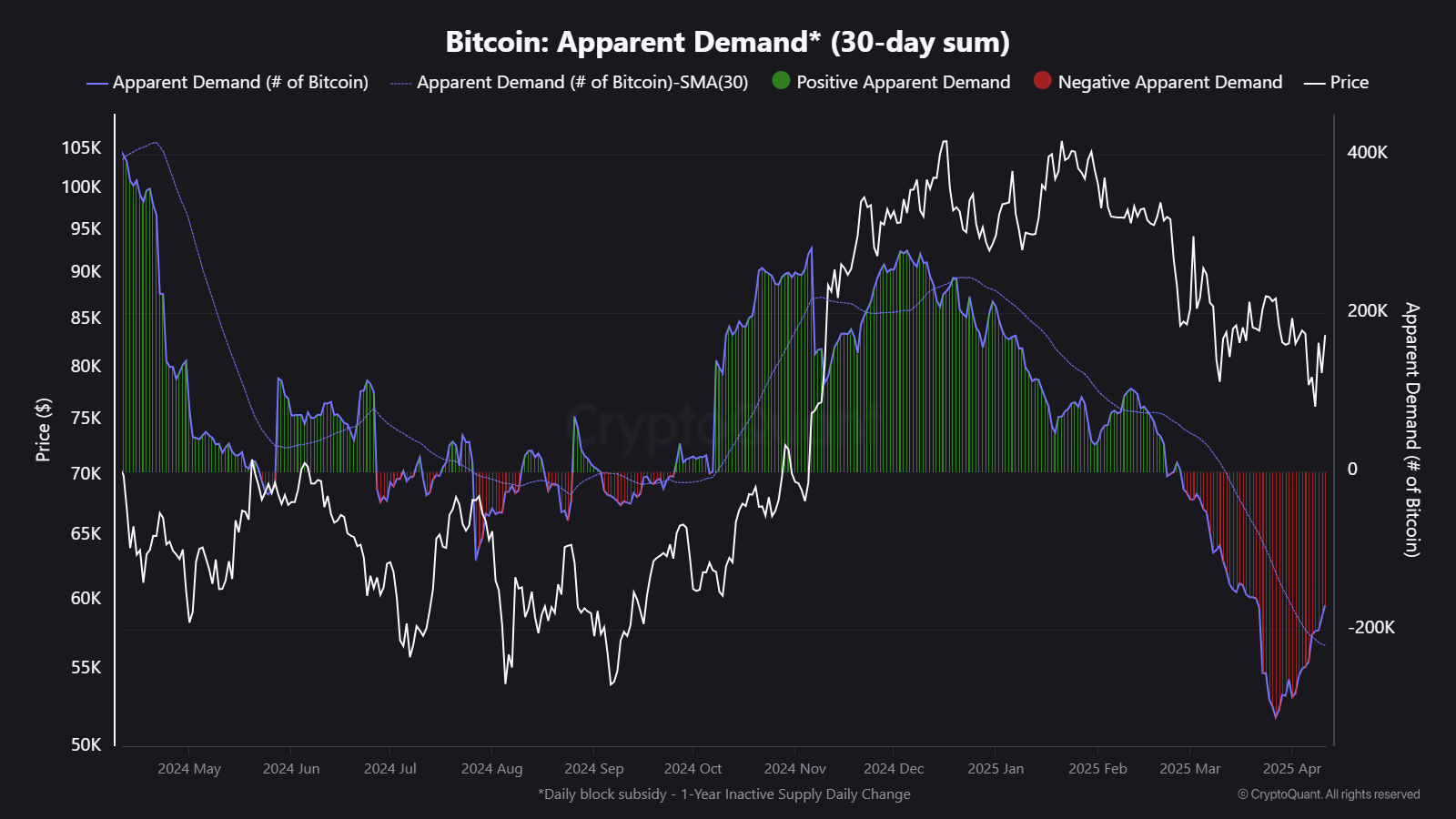

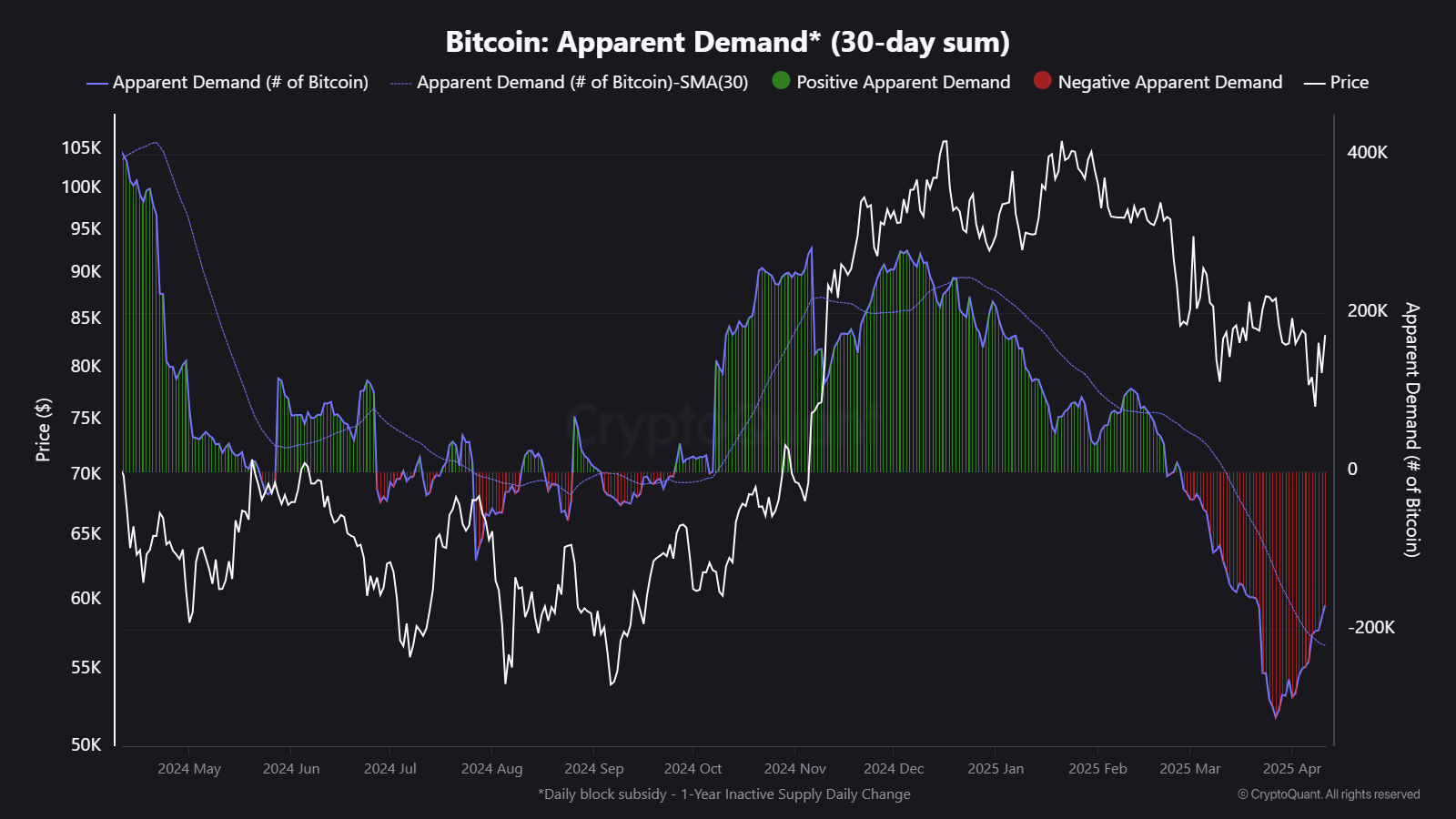

Regardless of the enhancements in technical and on-chain images, some analysts encourage persistence. Analysts say Kripto Mevsimi, significantly the historic sample from the 2021 cycle, exhibits that true structural restoration can take months, even when metrics equivalent to demand and costs start to bounce again.

Throughout earlier cycles, demand metrics remained unfavourable or zero for an extended time period earlier than sustainable bullish traits took maintain.

The clear demand for Bitcoin over the past 30 days exhibits bounce, however might mirror momentary aid that doesn’t affirm accumulation or affirm a crucial backside. You continue to want the quantity of purchases and time you have maintained to see your full market flip.

Technical setup offers constructive short-term photographs

Bitcoin’s day by day charts now coincide with cautious optimism. Plotted on the prime of the $88,772 from the $74,434 native backside, Fibonacci’s retracement exhibits Bitcoin has recovered key ranges.

BTC is presently buying and selling above the 0.618 degree ($83,195) and is testing the 0.786 degree ($85,704). The earlier excessive of $88,772 stays an enormous instant resistance.

Associated: North Carolina’s “Digital Asset Freedom Act” seems to be like a Bitcoin invoice

If the worth breaks previous $88,772, the subsequent main goal is a 1.618 Fibonacci extension of $97,633, adopted by $111,971, $126,309, and even $135,170.

Momentum indicators like MACD additionally assist bullish outlook. The MACD line has not too long ago crossed above the sign line, and the histogram bar has climbed into constructive areas. That is the traditional sign that consumers are regaining management.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.