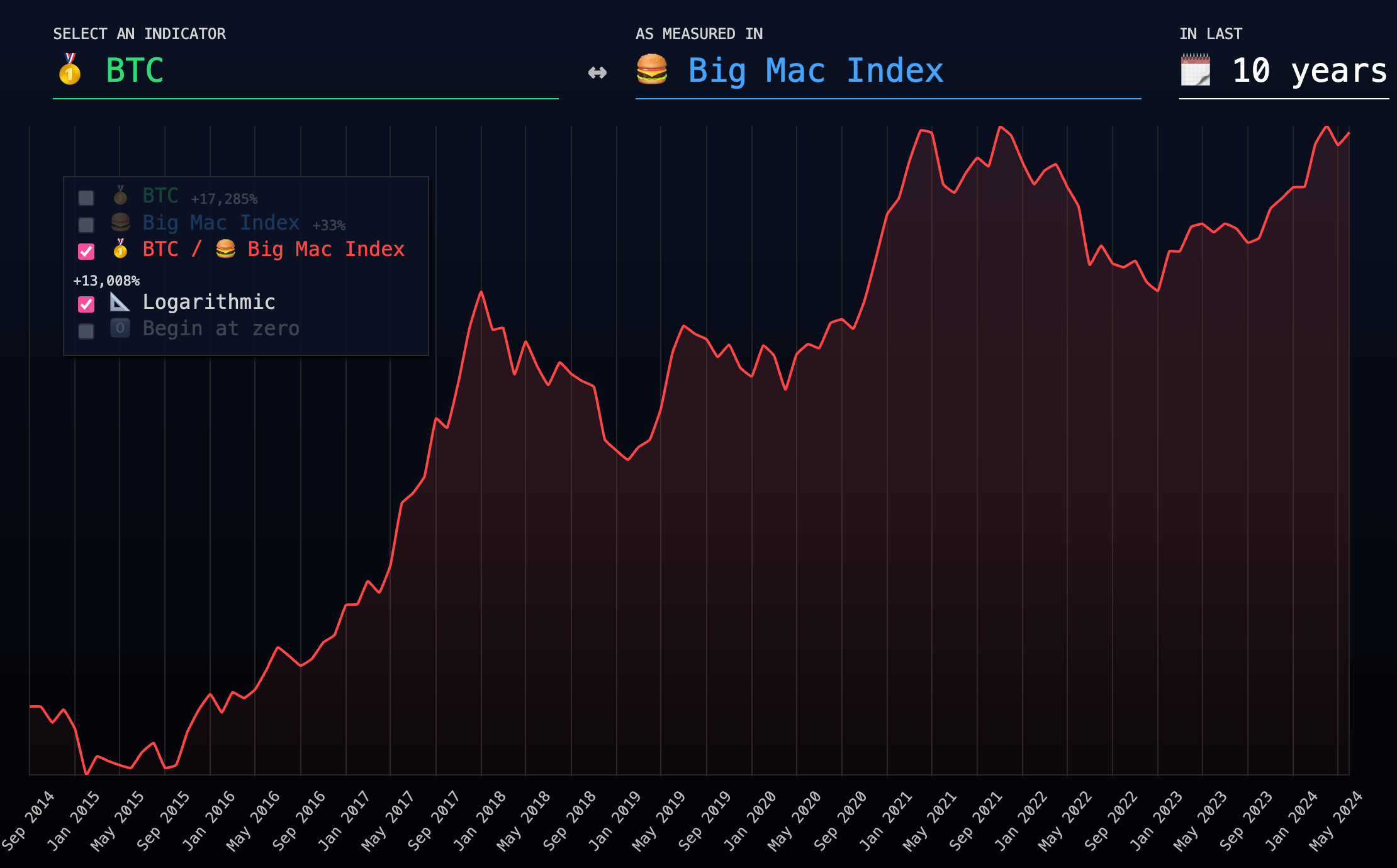

Bitcoin's buying energy, as measured by the Massive Mac Index, has grown considerably over the previous decade. In 2024, one Bitcoin will be capable to buy roughly 10,500 Massive Macs, a large 20,488% enhance from simply 51 in 2015. This development highlights the dramatic enhance in Bitcoin's worth relative to on a regular basis objects like Massive Macs.

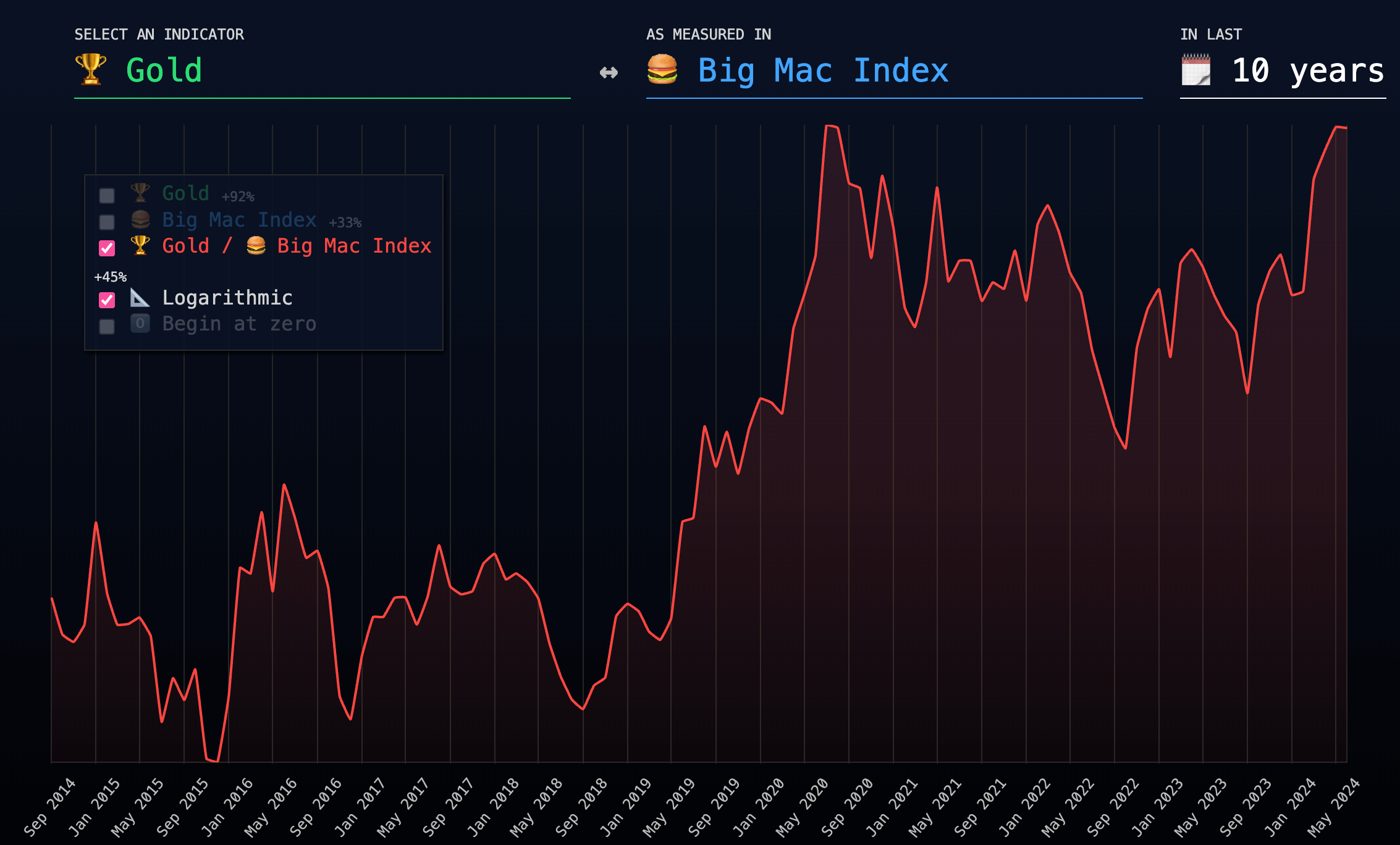

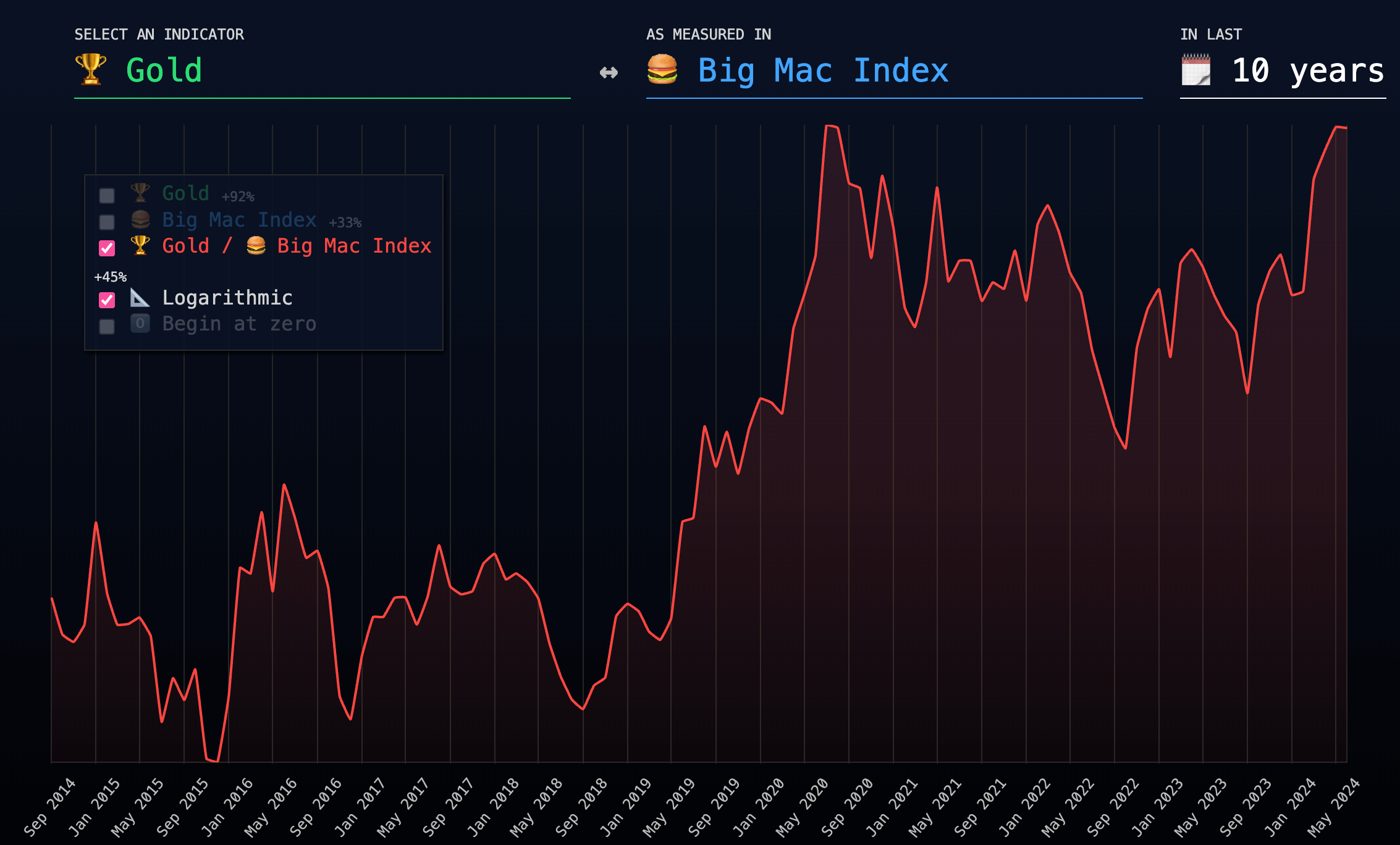

The Massive Mac Index was initially developed by The Economist journal and serves as an off-the-cuff measure of buying energy parity, evaluating the value of a Massive Mac in several international locations to evaluate the worth of a foreign money. The index reveals that whereas Bitcoin has skyrocketed in worth, conventional belongings resembling gold have additionally seen development, albeit at a slower tempo. Over the identical interval, the buying energy of gold relative to a Massive Mac has elevated by about 35%, displaying a extra modest enhance in comparison with Bitcoin.

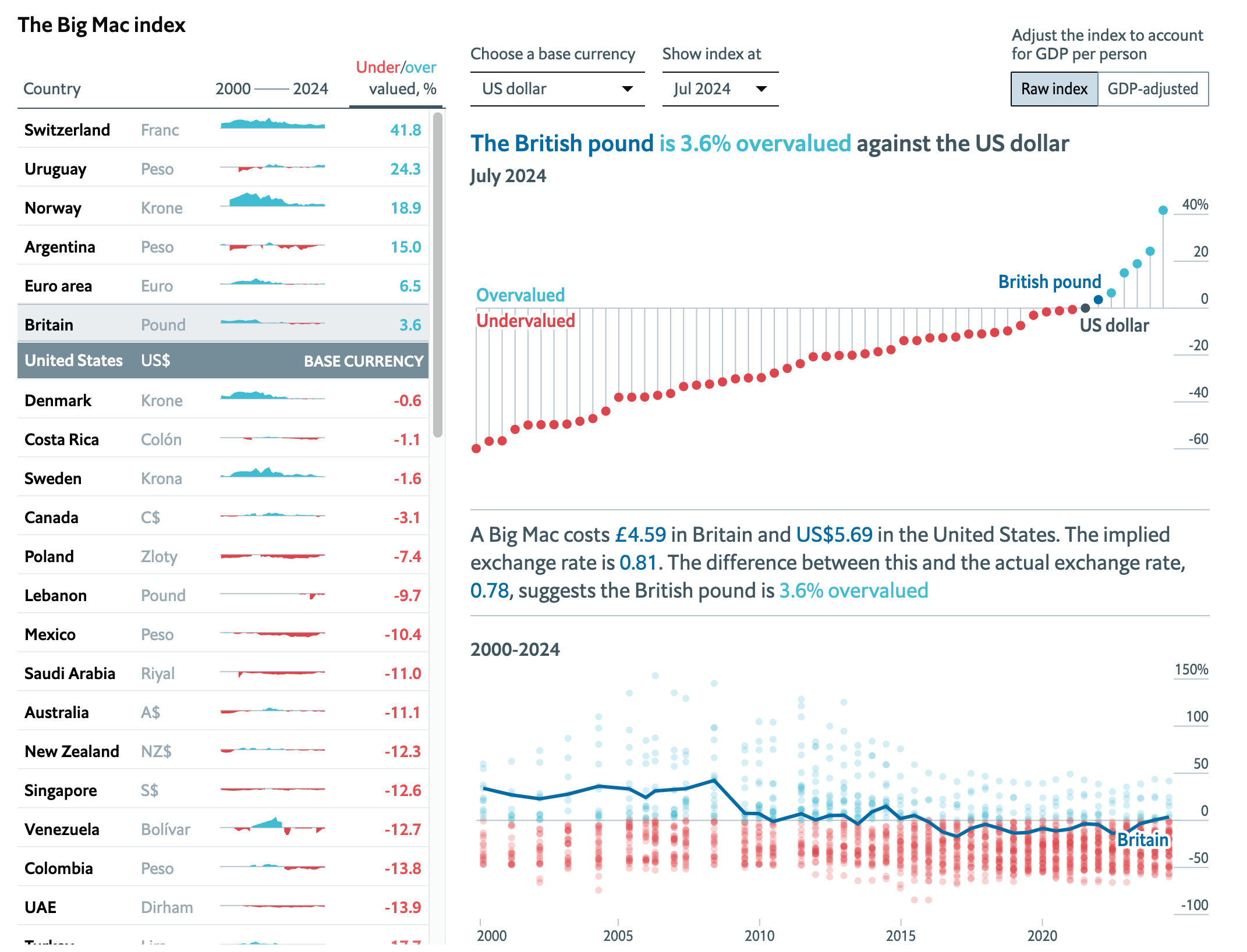

The Official Economist Massive Mac Index additionally reveals tendencies in foreign money valuation, such because the British pound being 3.6% overvalued towards the US greenback as of July 2024. The index displays broader market tendencies and supplies perception into the state of the worldwide economic system and foreign money fluctuations.

Of all of the currencies tracked, solely the British pound, Swiss franc, Uruguayan peso, Argentine peso, Norwegian krone and euro are at the moment overvalued towards the greenback.

The information highlights Bitcoin's unstable but upward development, positioning it as a singular asset class with large development in buying energy over the previous decade.

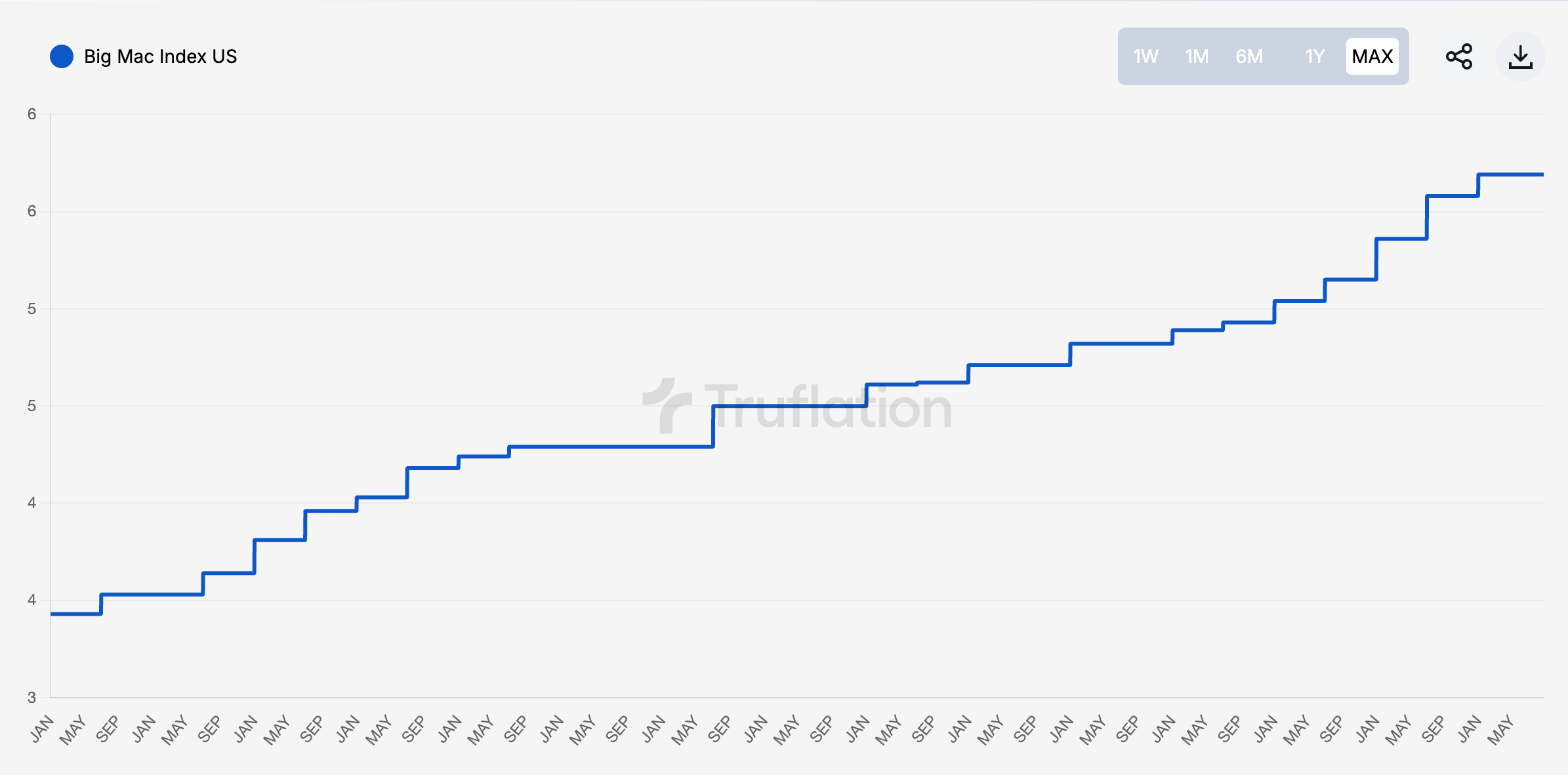

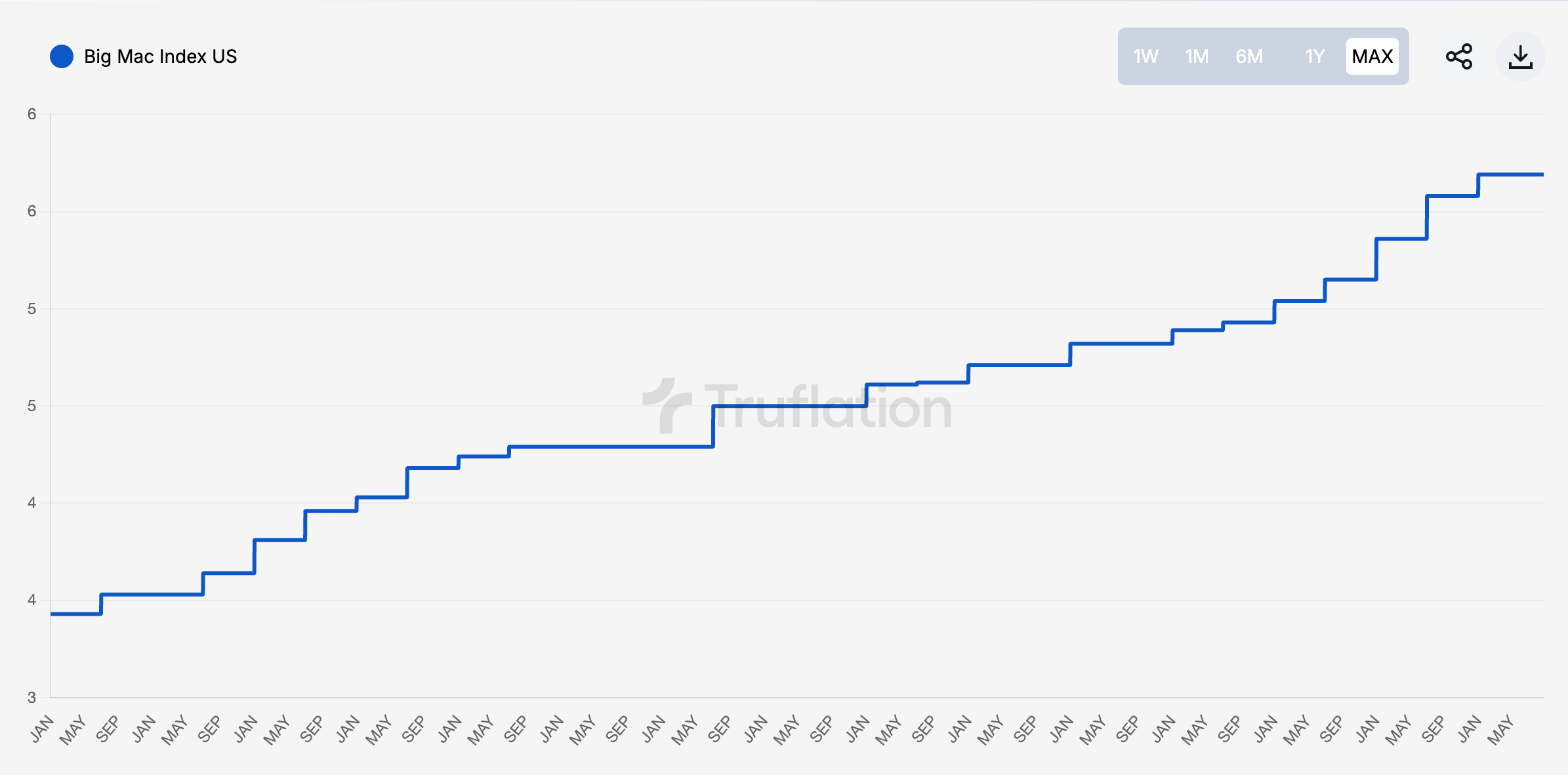

The value of a Massive Mac within the US was $4.29 in 2015; it now prices $5.69, a 32% enhance.

The argument that Bitcoin isn’t a hedge towards inflation is barely legitimate within the brief time period. Over the course of a day or month, Bitcoin is unlikely to compete with extra steady belongings resembling US Treasuries or many fiat currencies. However over the previous decade, even gold has not been in a position to compete with Bitcoin by way of pure buying energy.

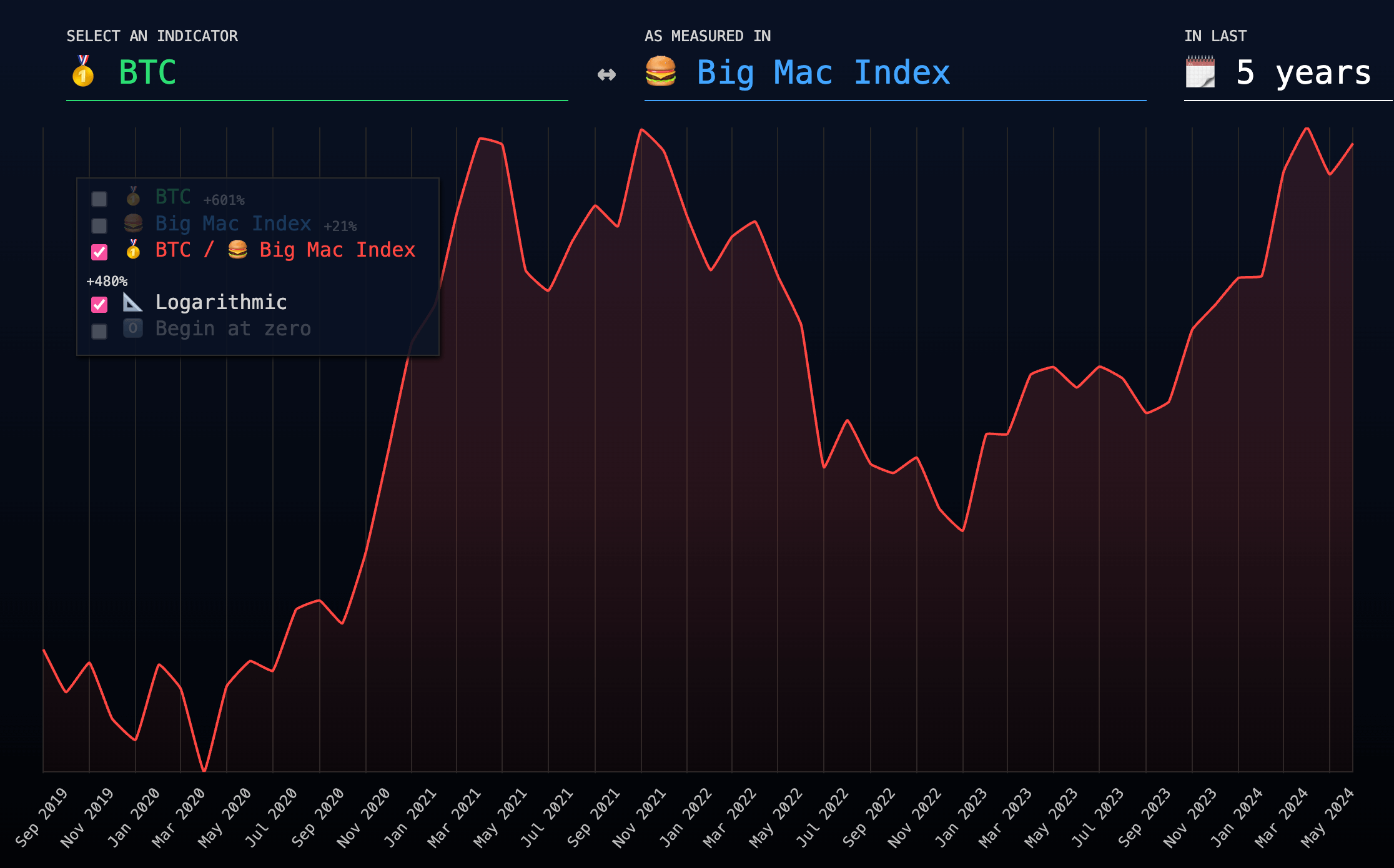

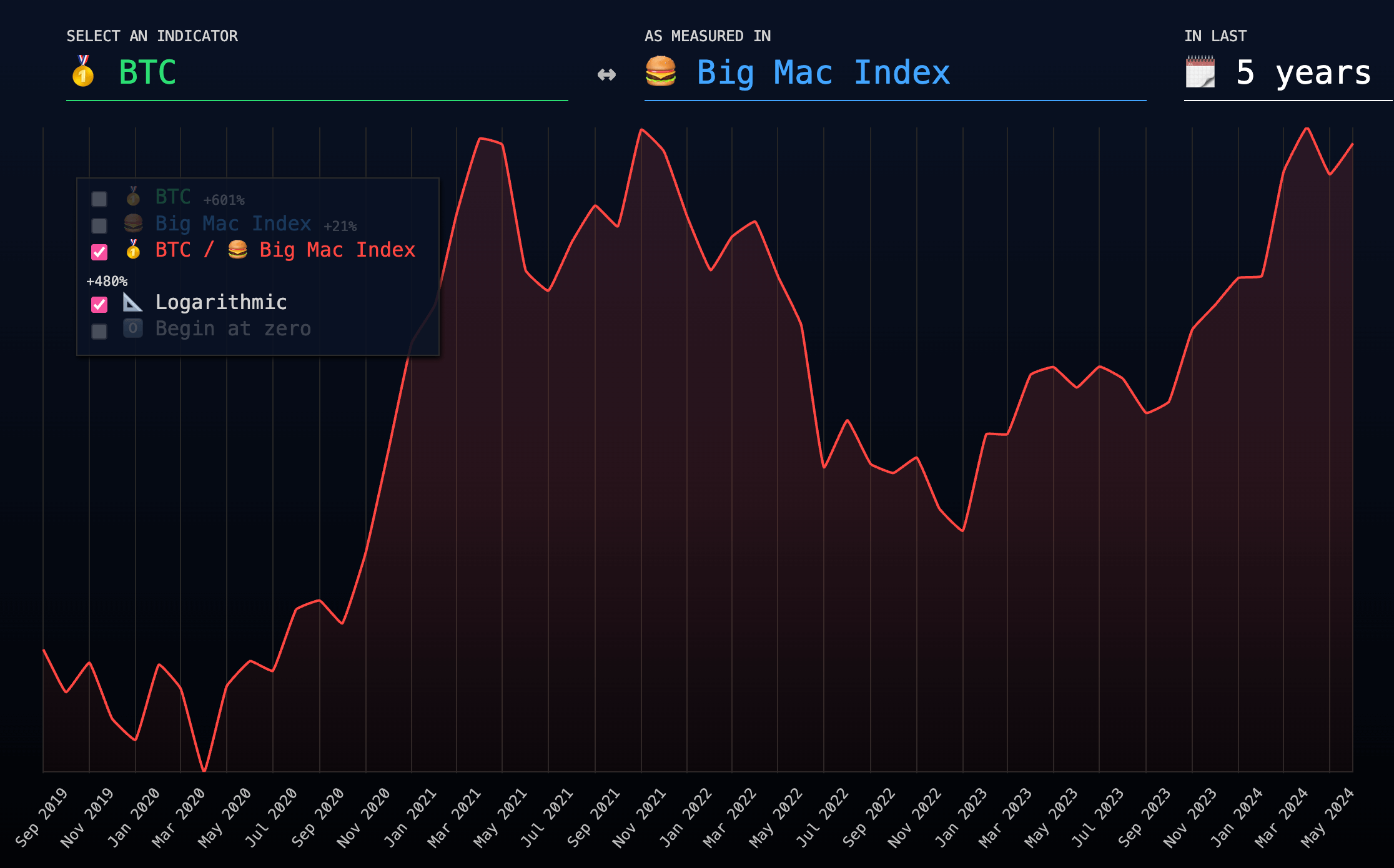

If we shorten the timeframe to 5 years, Bitcoin would be capable to purchase over 8,500 Massive Macs per coin. So whereas it’s extra convincing to argue that Bitcoin is a hedge towards irresponsible central financial institution insurance policies, you can nonetheless argue that Bitcoin beats inflation (Massive Macs-wise).