The cryptocurrency market has taken the market by storm over the previous week, with Bitcoin (BTC) making essentially the most notable good points, surpassing the $30,000 degree for the primary time in two months, much-needed by society. It will likely be an necessary psychological milestone that restores the boldness that was misplaced. market.

On the time of writing, Bitcoin is buying and selling at $30,343.

Over the weekend, Bitcoin managed to carry the $30,000 degree, briefly surpassing $31,000. This worth leap was fueled by a collection of stories about institutional introductions. This means rising mainstream acceptance and potential demand for digital belongings, which has been a significant driver of Bitcoin worth because the starting of the 12 months.

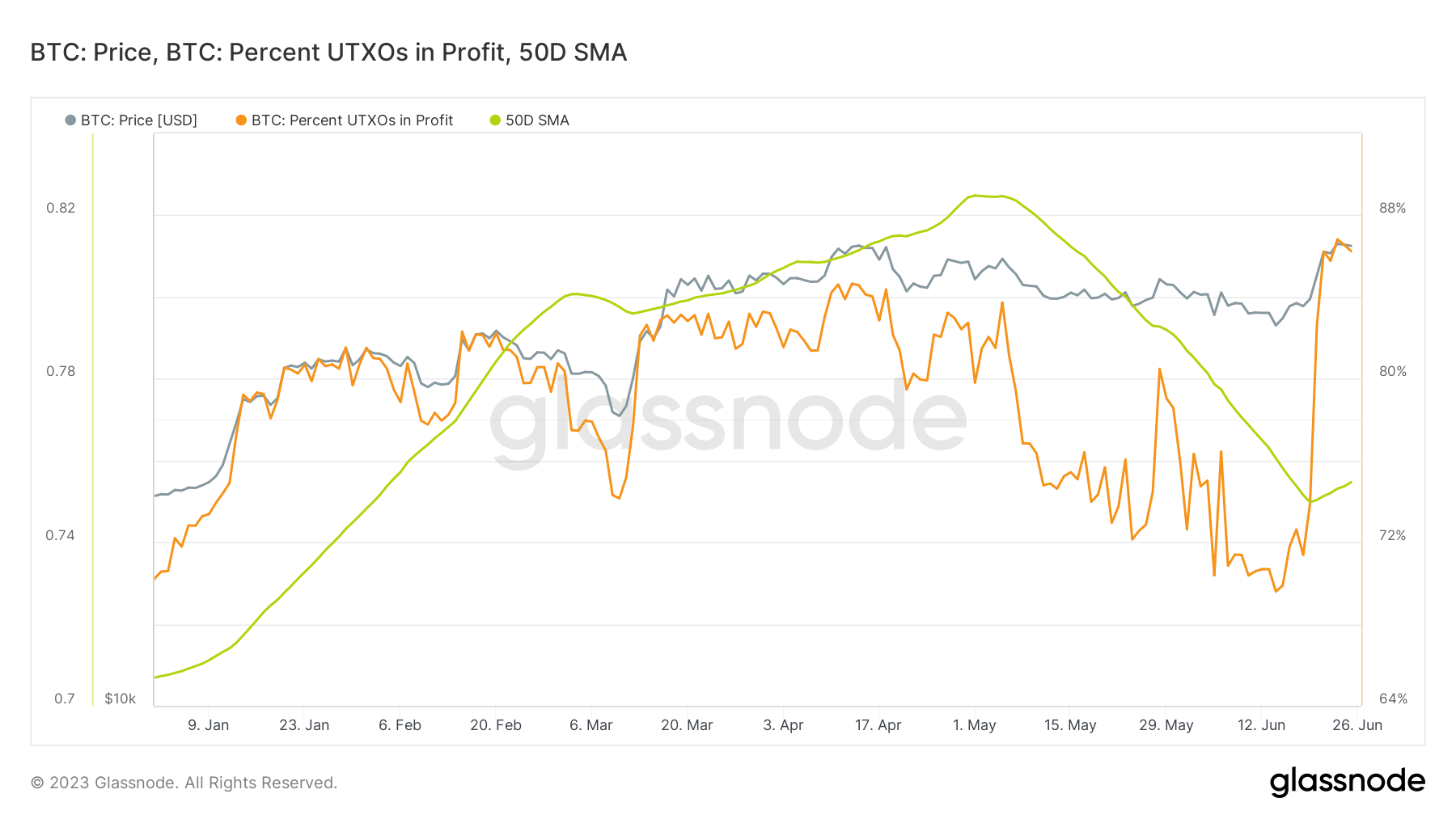

This Bitcoin worth surge has elevated profitability for many holders. That is evident when analyzing on-chain information, particularly worthwhile UTXOs. Unspent transaction output (UTXO) is the output of a Bitcoin transaction that has not been spent, and will be considered particular person “cash” or coin fragments residing in a Bitcoin pockets. They’re essential when analyzing the market as they supply a snapshot of financial exercise on the Bitcoin community.

Estimating the revenue and lack of Bitcoin provide is necessary because it offers perception into market sentiment and potential future worth actions. One technique to assess that is to research the present variety of UTXOs which are in revenue or loss.

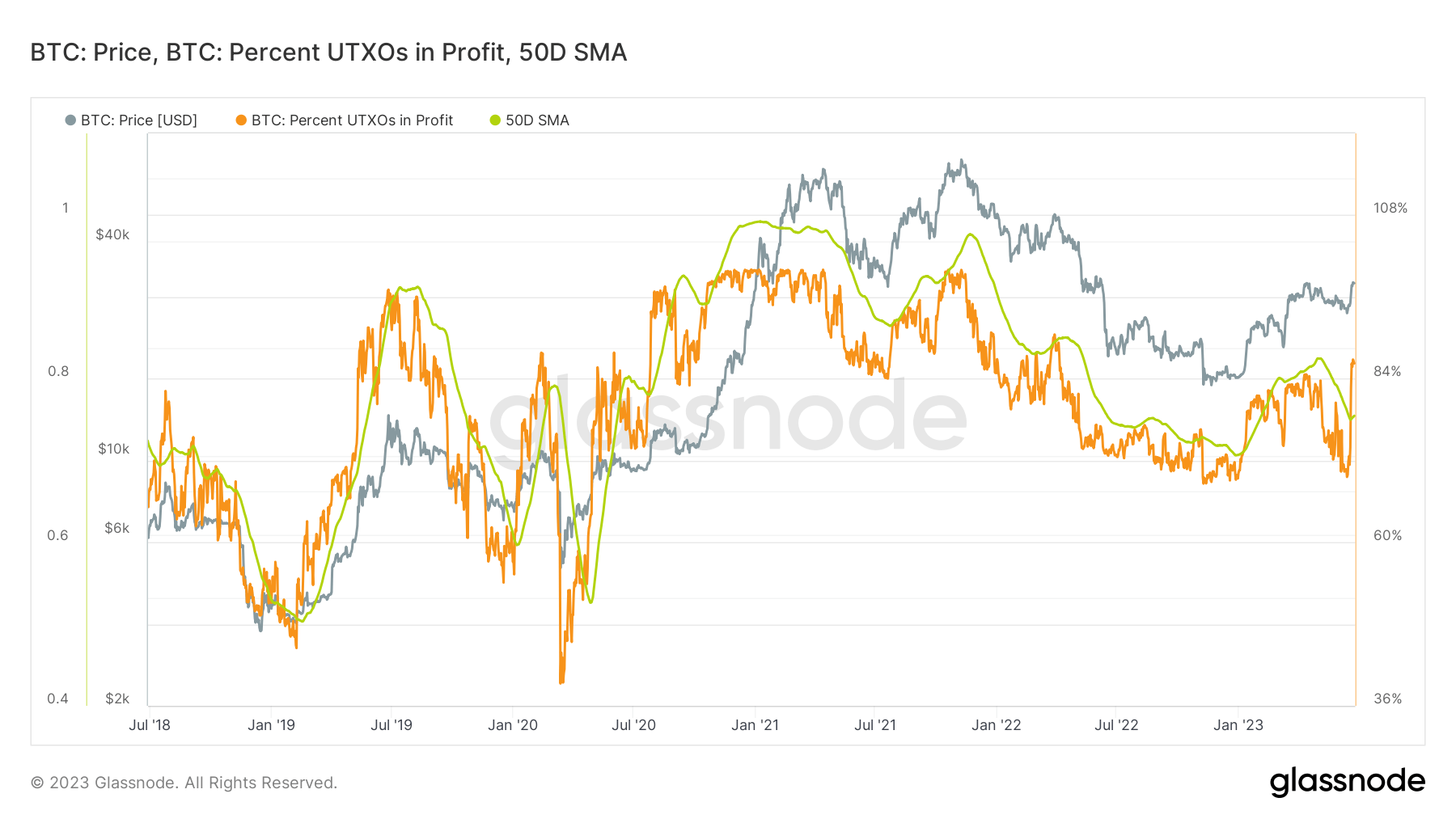

Glassnode calculates the variety of UTXOs in P&L by counting all present UTXOs whose worth was decrease or larger than the present worth when created. Contemplating the rising variety of UTXOs over time, the information is normalized by his UTXO measurement to get the relative quantity, or share, of UTXOs in revenue and loss.

UTXO as a share of income approaches 100% with every new report excessive. In accordance with Glassnode, making use of the 50-day Easy Transferring Common (SMA) to the information most closely fits the historic information and produces a greater sign for each world and native Bitcoin cycle tops.

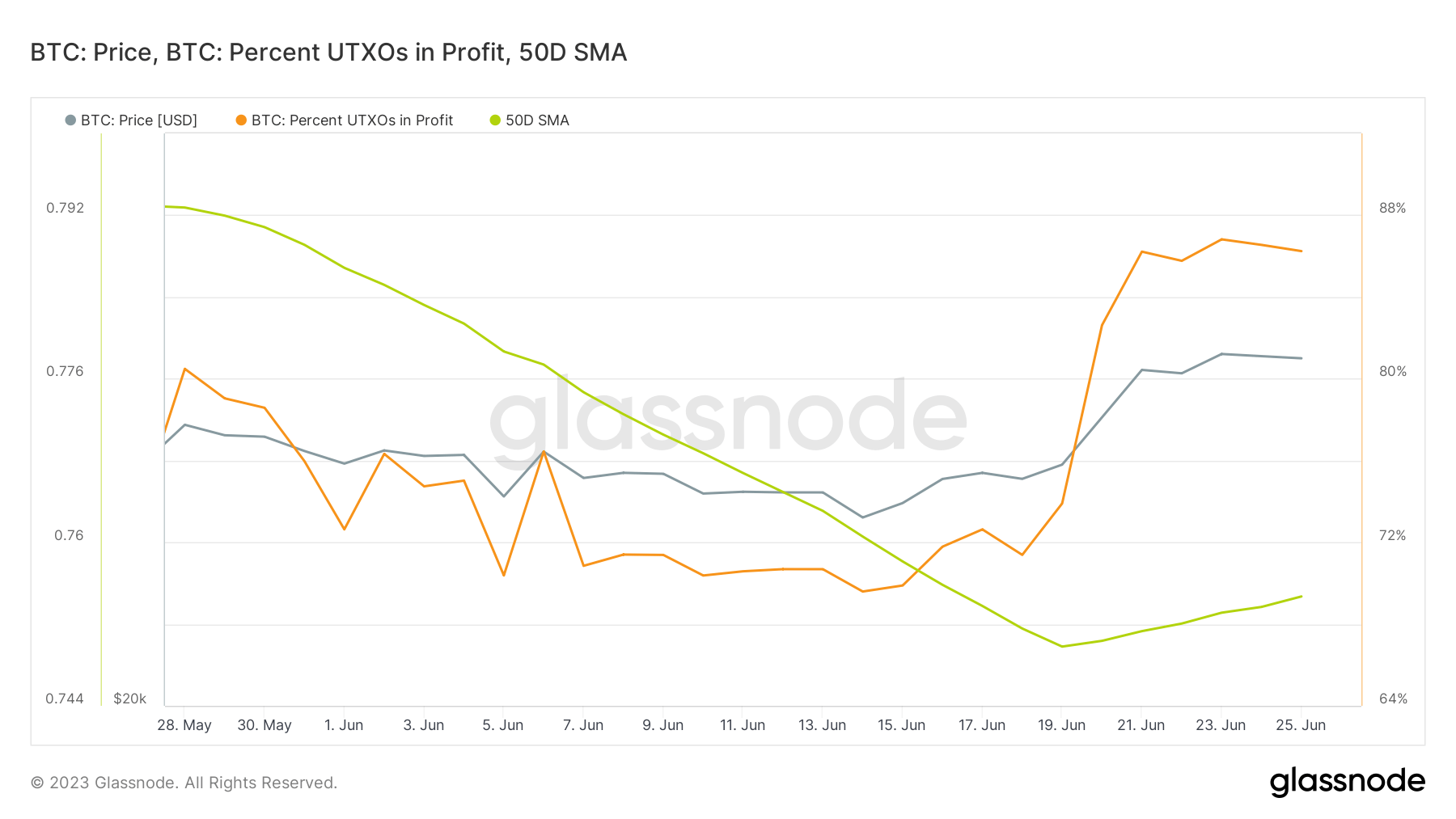

currencyjournals’s evaluation discovered that 86.24% of Bitcoin UTXOs are at present worthwhile. That jumped from 69.59% recorded on June 14th and fell barely from the 14-month excessive of 86.8% recorded on June twenty third. This exhibits that the majority Bitcoin holders are at present worthwhile, which may have a big affect on the long run trajectory of the market.

Nonetheless, the 50-day easy transferring common (SMA) in Bitcoin UTXO income is at present at 75%, down considerably from the 82.4% degree recorded in Could.

SMA is a generally used technical indicator that helps clean worth information by making a continually up to date common worth. On this context, we are able to get a clearer image of the general pattern of Bitcoin UTXO profitability during the last 50 days. The decline within the SMA means that UTXO’s general profitability has been on a downward pattern over the previous two months, regardless of the current surge within the Bitcoin worth.

This could possibly be as a result of numerous elements reminiscent of bitcoin holders shedding cash or creating new UTXOs at larger worth ranges. Nonetheless, it stays to be seen whether or not this pattern will proceed, because the current worth surge has pushed UTXO to greater than 86% of income.

Over 86% of Unspent Bitcoin Good points as BTC Continues to Commerce Above $30,000 This text first appeared on currencyjournals.

Comments are closed.