- Over $90,000 of merchants had been liquidated in 24 hours as Ethereum and Bitcoin costs soared to $3,800 and $71,000 respectively.

- Whole liquidation amounted to $383 million, of which $297 million was quick and $86 million was lengthy.

- The market is optimistic concerning the SEC's approval of a spot Ether ETF, following the regulator's newest transfer late Monday.

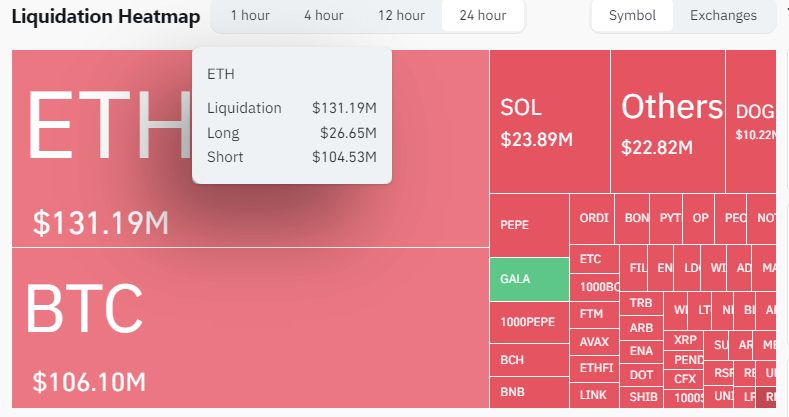

In line with information from Coinglass, greater than 90,000 merchants had been liquidated prior to now 24 hours, bringing the overall liquidation quantity to $383 million.

Greater than $297 million briefly positions had been liquidated as costs of Ethereum, Bitcoin, Dogecoin and different tokens surged, whereas lengthy positions had been liquidated at about $86 million as cryptocurrency costs surged late Monday night time into Tuesday.

The overall variety of liquidated merchants reached 93,833 as of 11:40 a.m. ET on Tuesday, in keeping with Coinglass. The biggest liquidation occurred on BitMEX, the place $4.26 million value of his XBTUSD trades had been liquidated.

Ethereum merchants anticipate over $100 million in short-term liquidations

Ethereum (ETH) led a 24-hour liquidation as the highest altcoin soared above $3,813 on Could twenty first, with losses of over $131 million. Of this, quick positions totaled $104.5 million and lengthy positions totaled $26.5 million.

Just like Ethereum, Bitcoin (BTC) additionally recorded a major value enhance.

The benchmark cryptocurrency has soared from a low of $67,000 on Monday and hit a excessive of $71,650 on Tuesday. This revenue liquidated over $106 million value of positions, together with $88 million quick and $18 million lengthy.

Solana (SOL) totaled round $24 million, with over $17.9 million quick and $5.9 million lengthy.

Different tokens which have seen notable liquidations prior to now 24 hours embrace Dogecoin (DOGE) with $10.2 million, Pepe (PEPE) with $7 million, and GALA (GALA), which suffered a serious safety breach on Monday. ) there’s.

Gala has obtained over $2.69 million value of quick positions and $2.1 million value of lengthy positions prior to now 24 hours, regardless of receiving a bullish forecast from market maker DWF Labs, which introduced the acquisition of 25 million GALA tokens. was liquidated.

SEC more likely to approve Spot Ether ETF boosts bulls

Huge liquidations occurred as renewed sentiment surrounding the approval of the Spot Ethereum ETF boosted the cryptocurrency market.

This is available in response to the SEC's request for Ether ETF issuers to file a 19b-4 by 10 a.m. Could 21, main Bloomberg ETF analysts to foretell the likelihood of SEC approval. elevated from 25% to 75%.

Normal Chartered Financial institution's Jeff Kendrick stated in a word on Tuesday that the SEC might give the inexperienced mild to the primary spot Ethereum ETF for the U.S. market this week.

Normal Chartered additionally predicts that the value of ETH might surge to $8,000 by the tip of the yr.

In March, the financial institution's analysts predicted that Bitcoin might soar to $15,000 in 2024 and $250,000 by the tip of 2025, pushed by ETF traction.