- PancakeSwap DEX exercise elevated and BNB chain buying and selling quantity surged.

- CAKE was oversold at RSI 29.12, however the lack of liquidity might stop the worth development from reversing.

- Uniswap outperforms PancakeSwap’s TVL regardless of widespread drop in metrics.

In an uncommon scenario, PancakeSwap (CAKE) surpassed Uniswap (UNI) in every day lively customers (DAU). Uniswap has a DAU of 59,600 and PancakeSwap registered 123,100 lively customers, in keeping with Token Terminal knowledge.

Often called the 2 prime decentralized exchanges (DEXs), Uniswap has the best variety of buying and selling pairs. Nonetheless, PancakeSwap has confirmed to be the popular platform for customers excited by tokens engaged on Binance Sensible Chain.

PancakeSwap overtakes the chief

Subsequently, the rise in DAU means that the variety of distinctive public addresses transacted on PancakeSwap exceeded these on Uniswap.

One of many principal causes for that is that PancakeSwap has upgraded to v3 and has elevated entry to liquidity suppliers. Because of this, this led to a 65% enhance in gross sales quantity throughout his BNB chain from April to his early June.

Uniswap matched PancakeSwap’s progress with its v4 launch, however the value volatility of their respective tokens was not the identical. The worth of CAKE has decreased by 4.18% over the past 24 hours. In the meantime, UNI has gained 2.41% on the time of writing.

CAKE is on its solution to all-time low

From a technical perspective, the every day value of CAKE has fallen for the reason that value hit $2.80 on April 28. It could be in the same scenario to many property out there, however CAKE has carried out a lot worse.

In keeping with the Relative Energy Index (RSI) indicator, the token has slumped beneath the oversold zone for a month. From April twenty third to Could twenty eighth, CAKE’s RSI fell beneath 30.

Nonetheless, the bullish transfer at $1.54 on Could 29 pushed the RSI as much as 40 as of June 4. Sadly, nevertheless, this was unable to repel the resistance they encountered the following day. On the time of writing, the RSI was again at 29.12.

This quantity signifies that CAKE is oversold. Often bullish motion at this level can set off a reversal. However CAKE appeared to lack the liquidity wanted for such a transfer. Subsequently, CAKE’s bearish momentum might proceed within the brief time period.

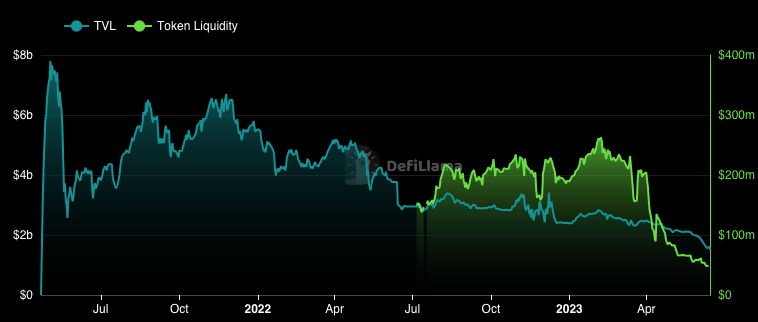

Automated market makers, however, have did not outperform Uniswap when it comes to Whole Worth Locked (TVL). Within the DEX class, Uniswap and Curve Finance (CRV) lead the standings.

Moreover, virtually each mission, together with PancakeSwap, skilled TVL drops.

On the time of writing, the mission had a TVL of 1.51 billion. This means that curiosity in utilizing good contract protocols operating underneath DEXs is declining.

Disclaimer: The views, opinions and knowledge shared on this value forecast are revealed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly liable for their very own actions. Coin Version and its associates are usually not liable for any direct or oblique damages or losses.

Comments are closed.