The Bitcoin derivatives market skilled important volatility final week, with fluctuations in open curiosity (OI) in addition to buying and selling volumes fluctuating wildly.

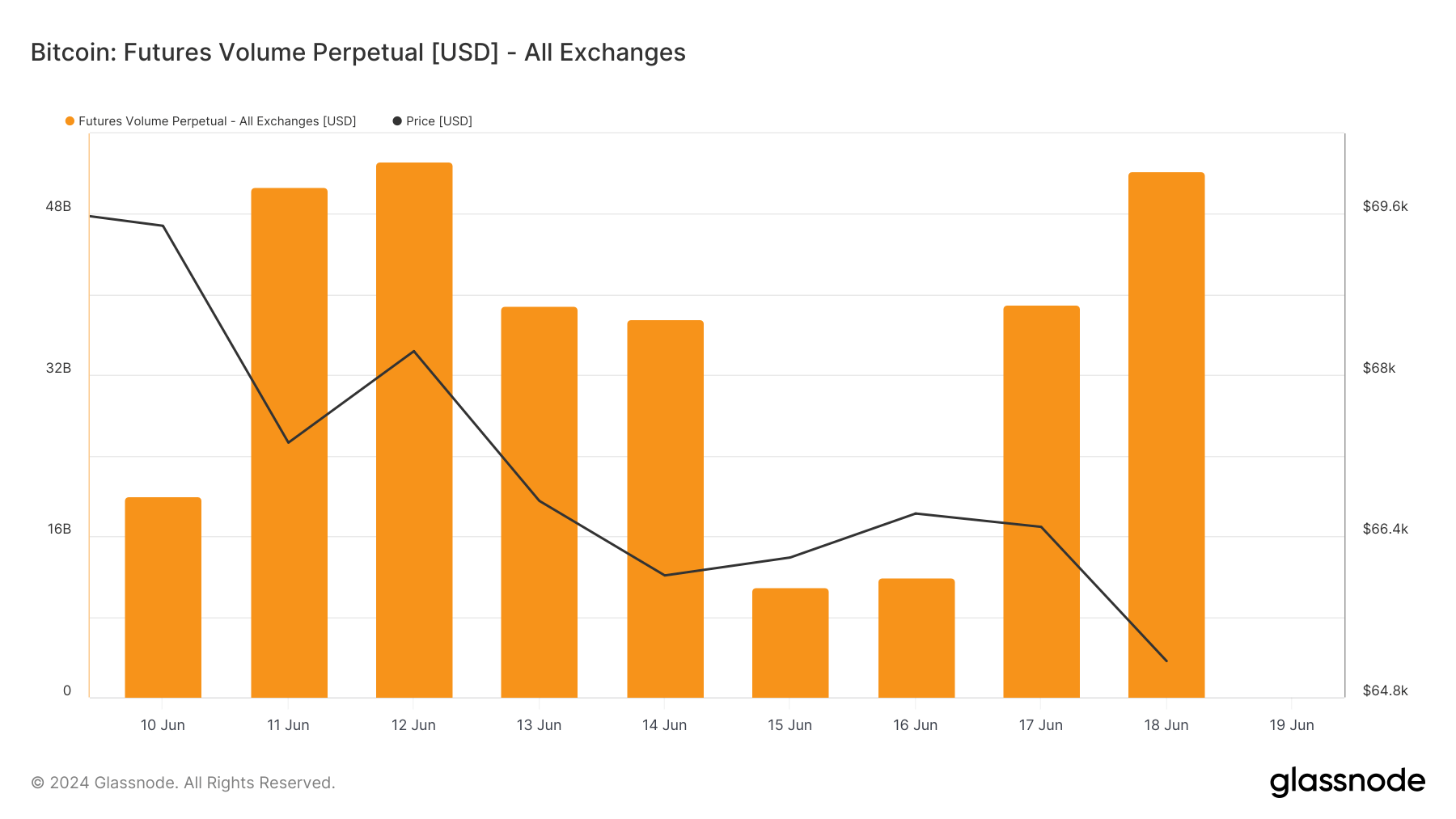

In response to Glassnode knowledge, mixed 24-hour buying and selling quantity of perpetual futures throughout all exchanges fell from $53.156 billion on June 12 to $10.91 billion on June 15. Quantity had recovered to $51.239 billion by June 18.

Evaluating these fluctuations to the value of Bitcoin over the identical interval (which fell from $68,237 on June 12 to $65,160 on June 18), we will see that perpetual futures buying and selling quantity doesn’t transfer in strict correlation with value. For instance, whereas buying and selling quantity dropped considerably on June 15 and 16, Bitcoin's value remained comparatively steady, indicating that perpetual futures buying and selling quantity is influenced by elements aside from value fluctuations.

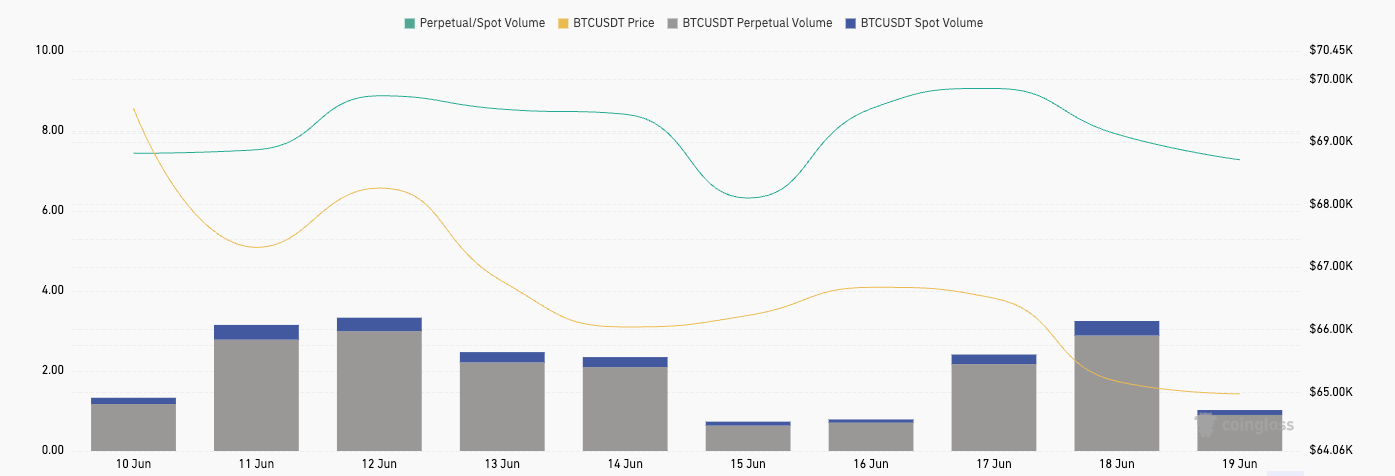

Wanting on the buying and selling quantity of BTCUSDT perpetual futures on Binance, we see an identical sample of fluctuations, with a excessive of $22.65 billion on June 12, a low of $4.79 billion on June 15, after which rising to $21.82 billion by June 18. That is extra consistent with the general market development and exhibits how essential Binance's position is within the perpetual futures market.

One other inconsistency emerges when evaluating Binance perpetual futures buying and selling quantity with spot buying and selling quantity for the BTCUSDT pair: spot quantity was considerably decrease, peaking at $2.75 billion on June 18, in comparison with $21.82 billion for perpetual futures on the identical day. The perpetual to identify quantity ratio ranged from 6.32 on June 15 to 9.06 on June 17, indicating a constant desire for perpetual futures buying and selling over spot buying and selling on the alternate.

The distinction between low spot quantity and excessive perpetual futures quantity might be a sign that not a lot new cash is coming into the market. Spot buying and selling includes the precise shopping for and promoting of Bitcoin and is usually related to new market entrants trying to purchase the asset straight. A decline or stagnation in spot quantity means that there are fewer new traders shopping for Bitcoin, which might be an absence of latest capital coming into the market.

Perpetual futures, alternatively, are sometimes most well-liked by extra skilled and complicated traders who wish to leverage their positions to maximise earnings from value fluctuations. Skilled merchants might choose perpetual futures as a result of means to hedge positions and the chance to amplify earnings by means of leverage. Market makers and institutional traders can also be accountable for the excessive volumes we now have seen. They typically use derivatives to handle danger and supply liquidity, which has a major impression on buying and selling quantity within the perpetual futures market.

One other essential issue to think about is the severity of the market situations. In markets characterised by uncertainty and an absence of clear path, reminiscent of these seen final week, merchants might choose the liquidity and suppleness of derivatives. The power to rapidly open and shut positions in futures markets permits merchants to reply to information and market modifications extra effectively than in spot markets.

The publish Perpetual Futures Quantity Surges As Bitcoin Spot Buying and selling Stagnates appeared first on currencyjournals