- Bitcoin is buying and selling above $126,000, however when it comes to gold it’s nonetheless 15% beneath its all-time excessive.

- Peter Schiff says BTC wants to achieve round $148,000 to match its earlier gold-denominated peak.

- He argues that the present rally is a bear market transfer as gold costs method $4,000 an oz..

Veteran economist and gold advocate Peter Schiff has argued that Bitcoin’s latest rally is “nothing greater than a bear market rally,” even after the forex hit a brand new all-time excessive close to $126,198.

Schiff mentioned the gold worth should surpass its all-time excessive earlier than calling Bitcoin (BTC) a bull market. Primarily based on present gold costs close to $4,000 per ounce, he estimated that BTC would want to achieve round $148,000 in gold phrases to match its earlier peak. Roughly 15% beneath file. On the time of writing, 1 BTC exchanged for 31.33 ounces of gold, down from a excessive of 40 ounces in December 2024.

Schiff says rising gold worth will make Bitcoin a shifting goalpost

“As gold continues to rise, so does the goal,” Schiff mentioned in response to X’s query about what worth Bitcoin would want to achieve to match gold’s strikes.

He used the chance to double down on his long-standing criticism that Bitcoin can not change into a dependable retailer of worth till it surpasses gold in actual worth.

Schiff argues that gold’s continued momentum, with costs approaching $4,000 an oz., exhibits why we proceed to desire the metallic over digital property.

Associated: Wall Road veteran Paul Tudor Jones updates Bitcoin name on rising institutional income

Macro backdrop accelerates gold momentum and investor warning

Gold’s parabolic rally occurred towards a broader backdrop of macroeconomic stress within the US, together with the US authorities shutdown and rising public debt ranges.

Moreover, Ray Dalio, founding father of Bridgewater Associates, warned that the U.S. authorities should cope with rising debt. Notably, the US authorities is spending greater than it’s taking in, leading to extra debt being gathered.

These considerations are driving capital towards safe-haven property like gold after which Bitcoin as an inflation hedge, however Schiff believes Bitcoin’s rally will stay speculative till it outperforms gold in relative phrases.

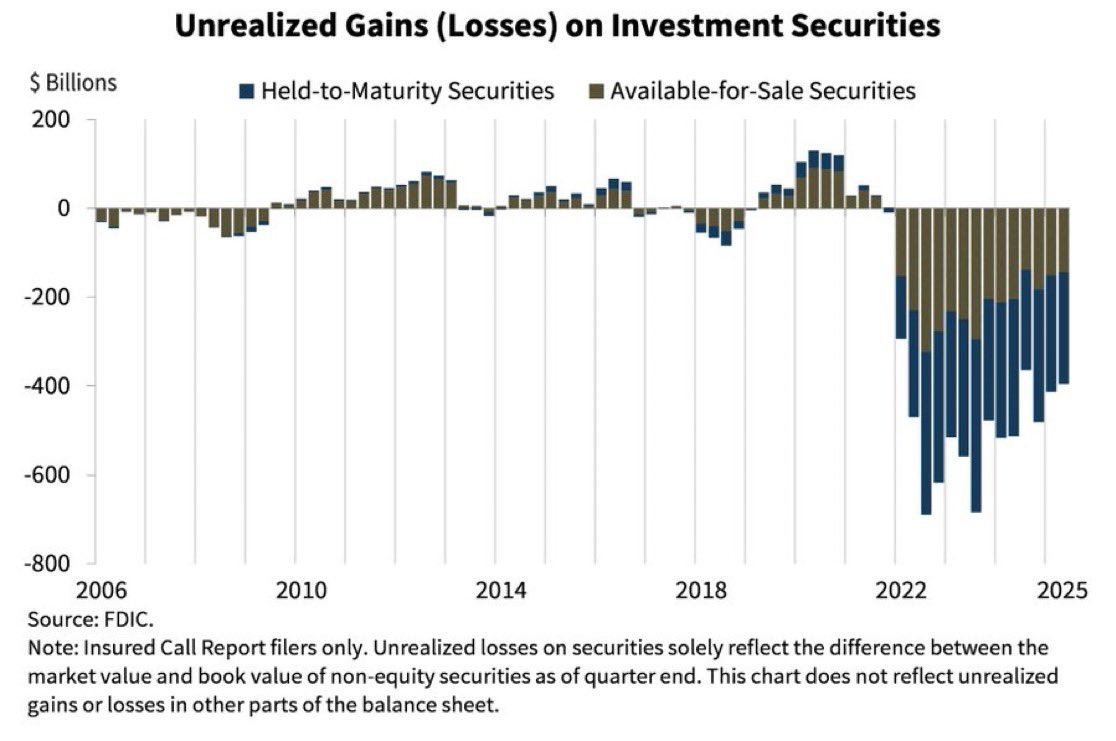

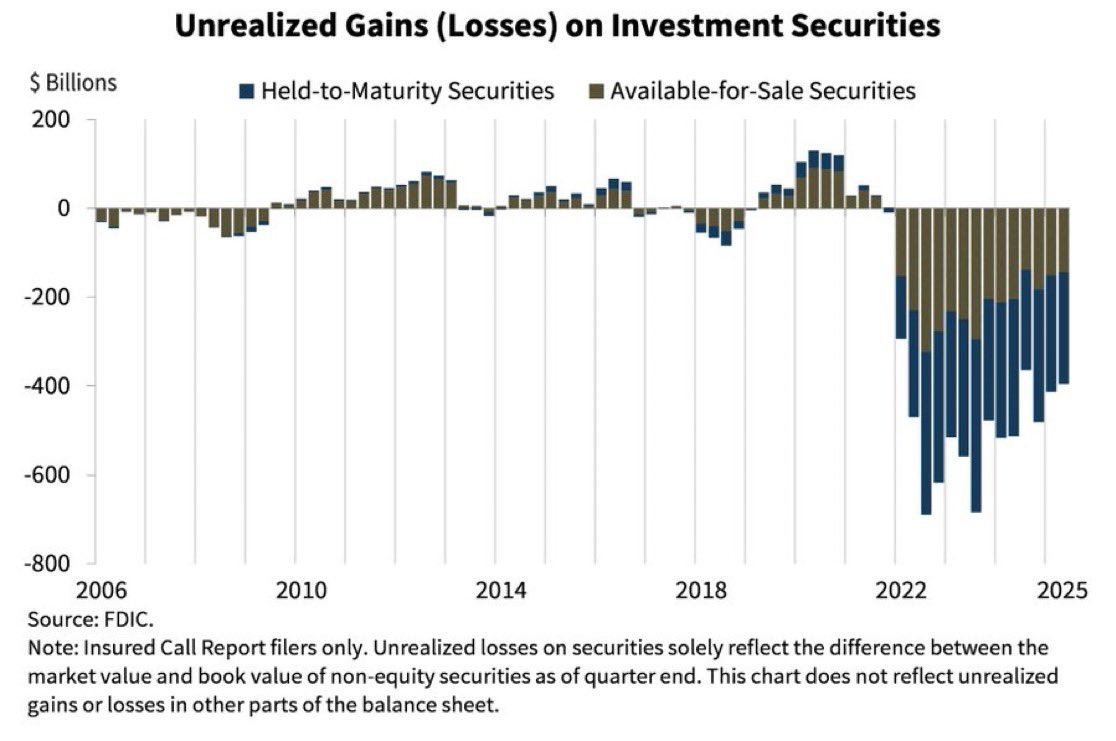

US banks nonetheless scuffling with unrealized losses

Financial pressures are additionally seen within the banking sector. U.S. banks have about $395 billion in unrealized losses as of the second quarter of 2025, increased than through the 2008 monetary disaster, based on FDIC knowledge. Mr. Schiff cited this as proof of fragility in a system that continues to strengthen gold’s dominance.

Establishments are nonetheless divided on Bitcoin valuation

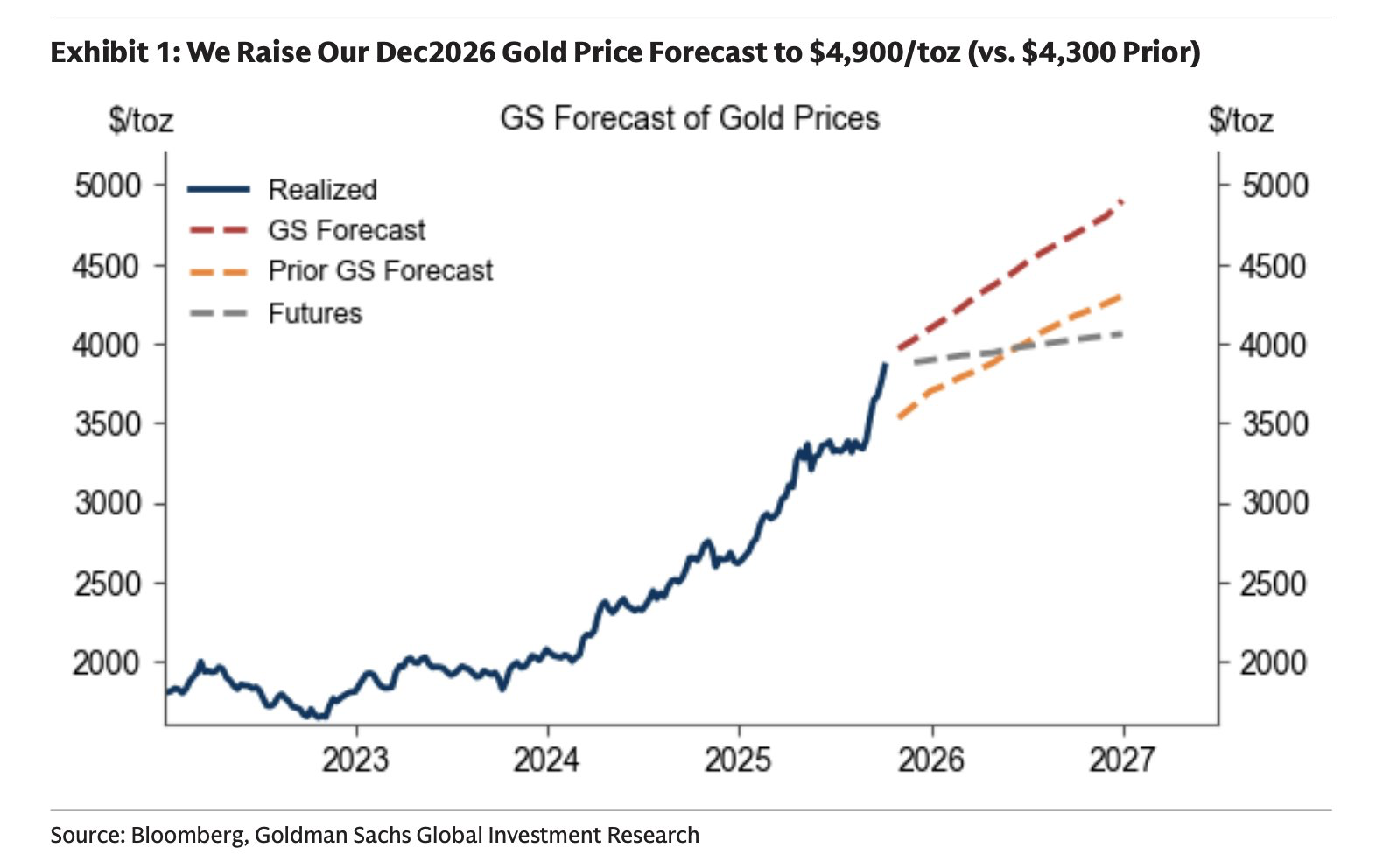

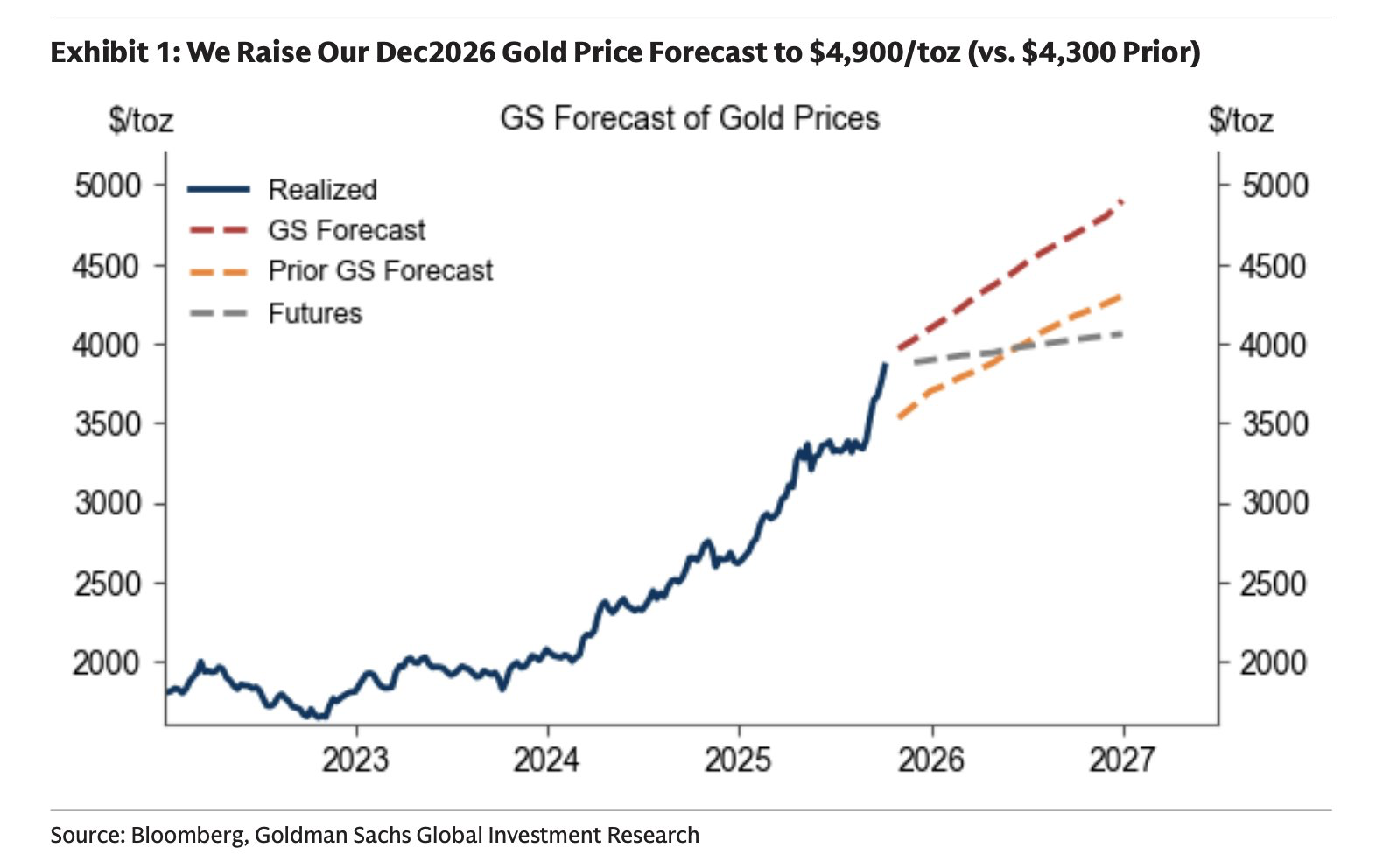

Large banks and funds stay divided on what’s subsequent for Bitcoin. Goldman Sachs not too long ago raised its 2026 gold goal to $4,900 an oz., citing institutional demand and geopolitical tensions.

In the meantime, JPMorgan mentioned Bitcoin is “undervalued relative to gold” and predicted a attainable rotation from gold to BTC as liquidity strikes again into danger property.

Final week, Citigroup lowered its Bitcoin worth goal for the tip of this yr from $135,000 to $133,000. Nonetheless, Citi raised its BTC worth goal to $181,000 by the tip of subsequent yr.

Associated: From money to gold: How the Reddit group feels about Bitcoin’s identification change

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.