- Peter Thiel has offered all of his Nvidia shares amid rising issues concerning the AI market overheating.

- Bitcoin ETFs have seen large-scale capital outflows, and the momentum of the cryptocurrency is weakening.

- Bitcoin miners are turning to AI and high-performance computing to outlive amid losses.

Billionaire investor Peter Thiel offered all of his Nvidia inventory, in one of many largest pullbacks from the AI increase this quarter. His departure comes amid rising issues that the AI market is overheating.

On the similar time, Bitcoin ETFs are experiencing their worst withdrawals this 12 months. Because the cryptocurrency market loses steam, even Bitcoin miners are turning to AI and high-performance computing to outlive.

Thiel’s departure raises questions on AI commerce

Teal Macro LLC offered all of its 537,742 shares within the July-September quarter, a holding that after represented 40% of the fund’s total portfolio, in accordance with new filings.

He additionally offered 208,747 shares of Vista Corp., lowering his stake from $212 million to simply $74.4 million. Tesla is now the fund’s largest remaining place.

Nvidia has been a significant participant within the AI increase, turning into the world’s first $5 trillion firm in October, reporting a 56% enhance in income to $46.7 billion. However there are rising issues that the AI market is overheating.

Some share this skepticism. Michael Burley, recognized for predicting the 2008 housing crash, has a bearish place on about 1 million shares of Nvidia inventory.

Associated: Michael Burry shorts the inventory market with $1.6 billion value of put choices

In one other sudden transfer, SoftBank liquidated its $5.8 billion Nvidia stake with the intention to direct the funds to OpenAI. This provides to the suspicion that Nvidia’s valuation is overextended.

Threat-off contagion: Bitcoin ETF loses $1.1 billion

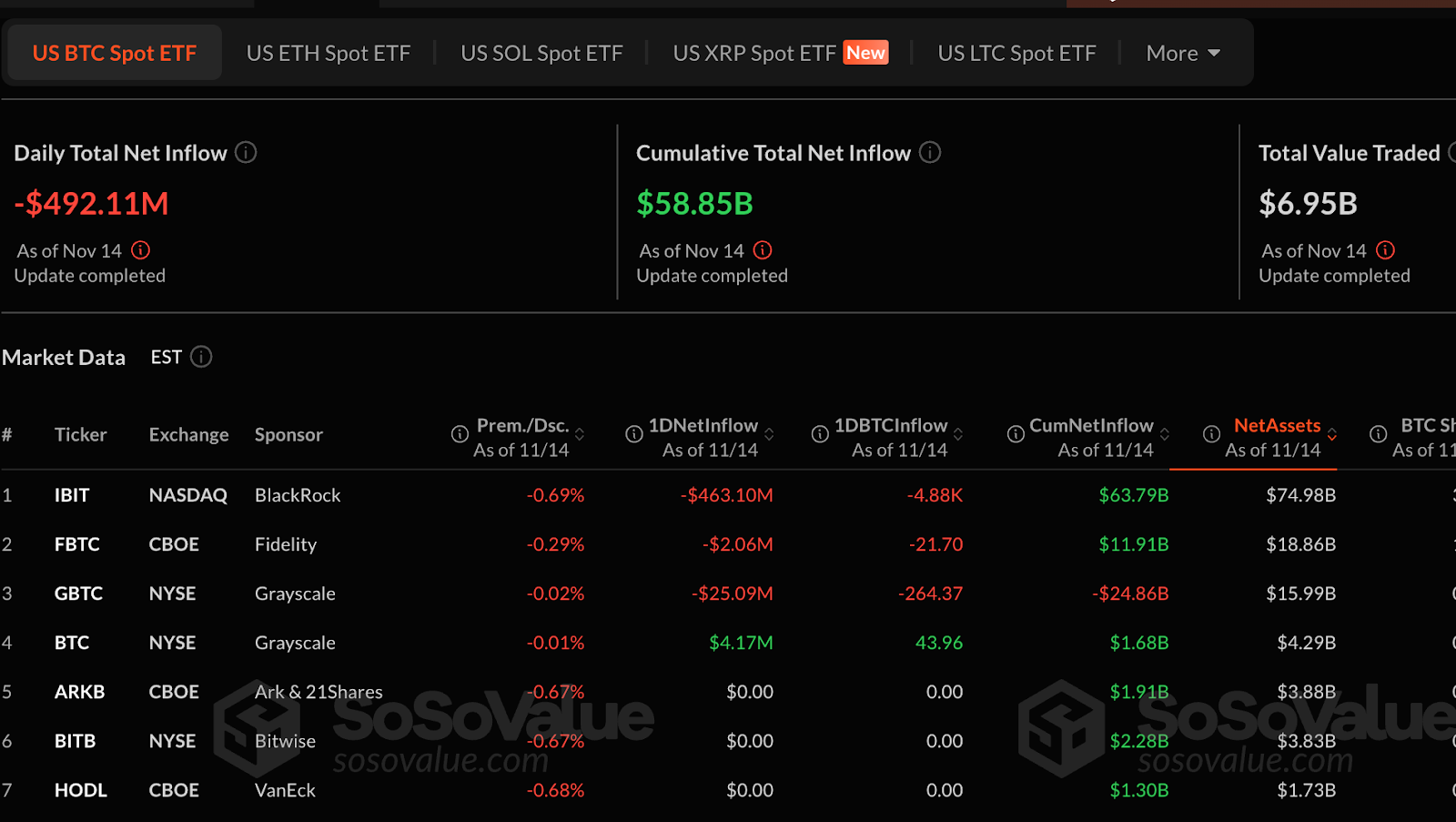

Notably, Thiel’s withdrawal from NVIDIA comes at a time when momentum within the cryptocurrency market is weakening. The U.S. Spot Bitcoin ETF recorded $1.1 billion in withdrawals, marking the third consecutive week of outflows and the fourth largest weekly decline on report.

Bitcoin has fallen almost 10% over the previous week to round $92,900, however Matrixport now warns that this development seems to be within the early phases of a “mini bear market.”

Their view is that weak ETF demand, promoting by long-term holders, and an absence of main macro catalysts will hold Bitcoin in place till the Federal Reserve’s subsequent coverage replace.

Ethereum ETFs additionally skilled important outflows, however Solana stood out as an exception. Particularly, the Solana ETF recorded 13 consecutive days of inflows, although SOL fell 15% for the week.

Bitcoin miners flee to AI after Thiel withdraws

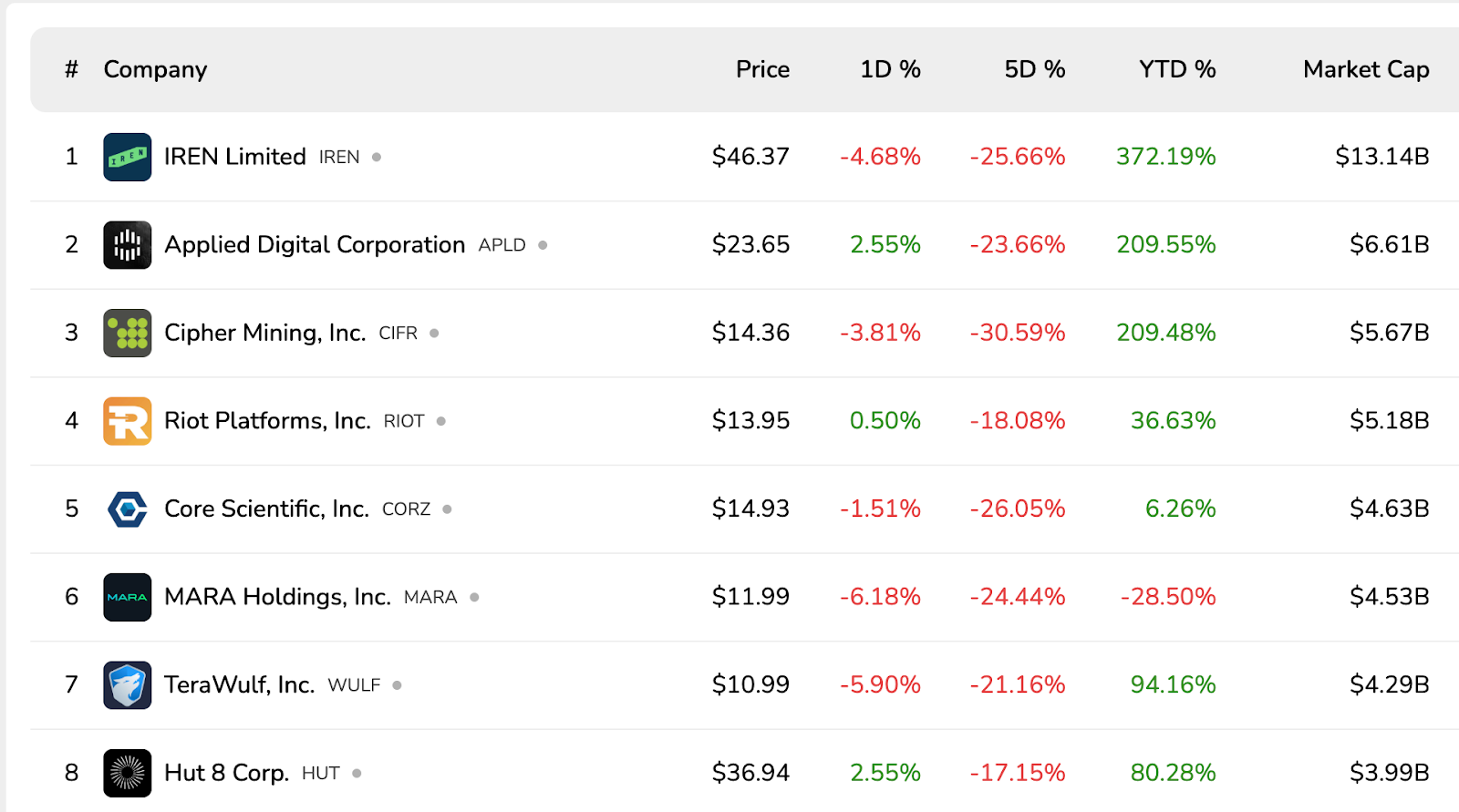

Public Bitcoin miners are going via one of many hardest occasions this 12 months. Shares of firms like Cipher, Utilized Digital, Bitdeer, and CleanSpark fell 23% to 52% in a single week. Greater than $20 billion in market worth was worn out in a single month.

This squeeze is accelerating miners’ transition to AI and high-performance computing. BitFarms plans to finish Bitcoin mining inside two years and remodel the location into an AI knowledge heart.

Core Scientific signed a $3.5 billion AI cloud deal, and IREN signed a five-year, $9.7 billion deal to host Nvidia GPUs for Microsoft. Thiel’s exit from NVIDIA appears well timed as issues about an AI bubble develop and miners depend on AI to outlive.

What it means for cryptocurrencies and AI tokens

Whereas Thiel’s transfer doesn’t straight goal cryptocurrencies, it indicators a cooling in threat urge for food throughout AI and digital belongings. As confidence in AI large shares continues to wane, capital may transfer elsewhere or stay on the sidelines.

For AI-themed crypto tokens, rising demand for AI infrastructure is a optimistic, however issues about buoyant valuations may spill over. Within the case of Bitcoin, ETF outflows point out that institutional demand is softening.

Though the bearish temper stays excessive, trade leaders like Tom Lee stay extraordinarily bullish.

Associated: The Finish of “Free Cash”: Rising Japanese Yields Threaten International Markets and Cryptocurrencies

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.