- PI maintains its upward construction as patrons defend key EMA and Fibonacci help zones.

- Future unlocks are more likely to improve volatility as provide pressures check short-term demand.

- Neighborhood expectations develop as indicators of a significant Pi Community replace gasoline sentiment.

Pi has pulled again after reaching the $0.27 zone, and merchants are watching to see how the worth reacts because it approaches the important thing Fibonacci space that fashioned final week’s bull run. The current rejection close to the 0.786 degree has led to widespread short-term profit-taking.

Nonetheless, the broader market construction stays tilted to the upside as lows proceed to type over a number of time frames. This pattern continues to generate curiosity as volatility will increase round main Pi community developments and unlock schedules. Moreover, elevated group expectations have added extra focus to how PI will behave within the coming days.

Technical outlook suggests managed pullback

The PI stays above the 9EMA, which served as dynamic help all through the current breakout. Due to this fact, merchants presently anticipate the present decline to stay beneath management so long as the PI stays above the $0.2520 zone. This degree coincides with supertrend help and signifies continued power if patrons maintain on to it throughout the intraday drop.

Moreover, midrange Fibonacci ranges type a major cluster round $0.2495. This zone signifies the equilibrium level of your present swing. A transfer in the direction of $0.2382 might nonetheless appeal to sturdy demand because it overlaps with the earlier consolidation space. Nonetheless, a lack of $0.2227 will weaken the bullish construction and shift consideration to the decrease vary.

Associated: Ethereum worth prediction: Rising channel hints at Ethereum restoration

On the upside, resistance at $0.2608 stays the primary degree of merchants’ focus. A break above this might additional strengthen the momentum in the direction of $0.2769. A clear break above this zone might pave the best way for the bulls’ subsequent main goal, the swing excessive at $0.2974.

Unlocking cycles and market sentiment

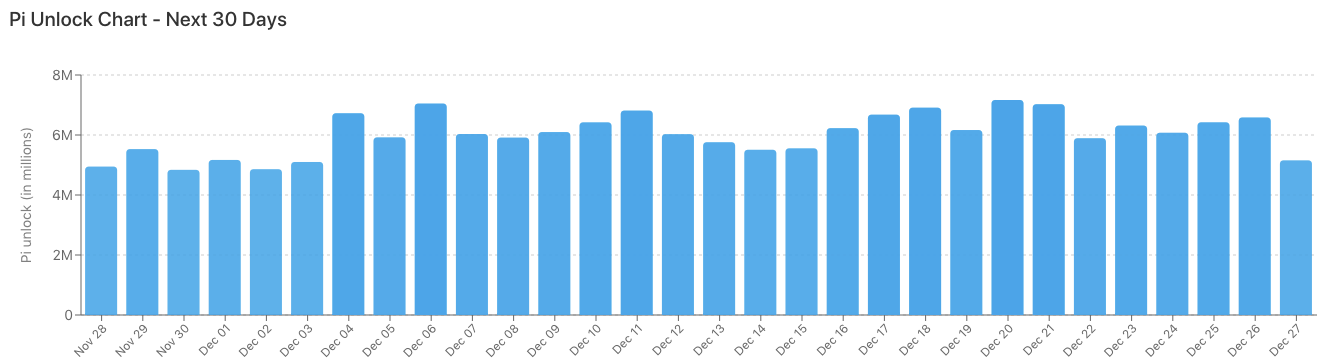

In keeping with Pi Community’s newest unlock information, there are over 5 billion Pis locked, valued at roughly $1.28 billion. Moreover, over 180 million Pis will likely be launched over the following 30 days. This quantity represents roughly 3.6% of the locked provide. The typical every day unlock quantity is sort of 6 million yen, which is equal to roughly $1.54 million. The very best unlock date is over 7.1 million Pi.

Merchants are subsequently seeking to see whether or not the rise in provide will impression short-term volatility. Some anticipate extra exercise round key help ranges, particularly if demand wanes. Some argue that the regular rhythm of unlocking is already factored into current fluctuations.

Neighborhood exercise spiked after the account teased a major replace on November twenty eighth. Nonetheless, response remained blended, with many customers discounting the opportunity of main progress. Nonetheless, the dimensions of the group at all times attracts excessive consideration, and confirmed milestones can rapidly impression sentiment.

Technical outlook for Pi (PI) worth

Even because the market enters a brand new buying and selling section, the important thing ranges of PI stay clearly outlined.

The upside degree contains speedy hurdles of $0.2608, $0.2769, and $0.2974. A breakout of those zones might prolong in the direction of the next extension goal above $0.31.

Associated: Solana (SOL) Worth Prediction: Can Consumers Maintain the Line Above $140?

The draw back zone contains SuperTrend help at $0.2520, adopted by $0.2495 and deeper ranges at $0.2382. The higher restrict of the broader resistance lies within the Fib zone at $0.2769, which would wish to reverse for medium-term momentum to strengthen.

The present construction means that PI is compressed between rising help and Fibonacci resistance, forming a tightening vary. A definitive breakout from this construction might trigger elevated volatility in both path as liquidity will increase close to the swing zone.

Will the worth of Pi improve?

The subsequent transfer will rely upon whether or not patrons can defend the $0.2520-$0.2495 cluster lengthy sufficient to aim a retest of $0.2608 and $0.2769. Historic reactions close to the midrange Fib zone usually create a robust sustained rally, growing the probability of one other try in the direction of $0.2974.

If the bullish momentum strengthens as a result of elevated inflows, PI might clear $0.2769 and problem the earlier swing excessive. Nonetheless, if the worth is unable to carry at $0.2495, there’s a danger of an extra pullback in the direction of the tip of the cumulative vary at $0.2382. Shedding that zone might expose the chart to $0.2227 and neutralize the present bullish bias.

Associated: Bitcoin Worth Prediction: Consumers Maintain $90,000 as Whales Flip to Aggressive Additions

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.