- The uptrend is above the foremost EMA and buys on the dip are defending momentum regardless of latest volatility.

- Improve in open curiosity signifies leverage rotation, elevating volatility with out deleveraging

- The chance of whale lengthy dominance skew will increase, growing the potential of brief stress on an higher worth break.

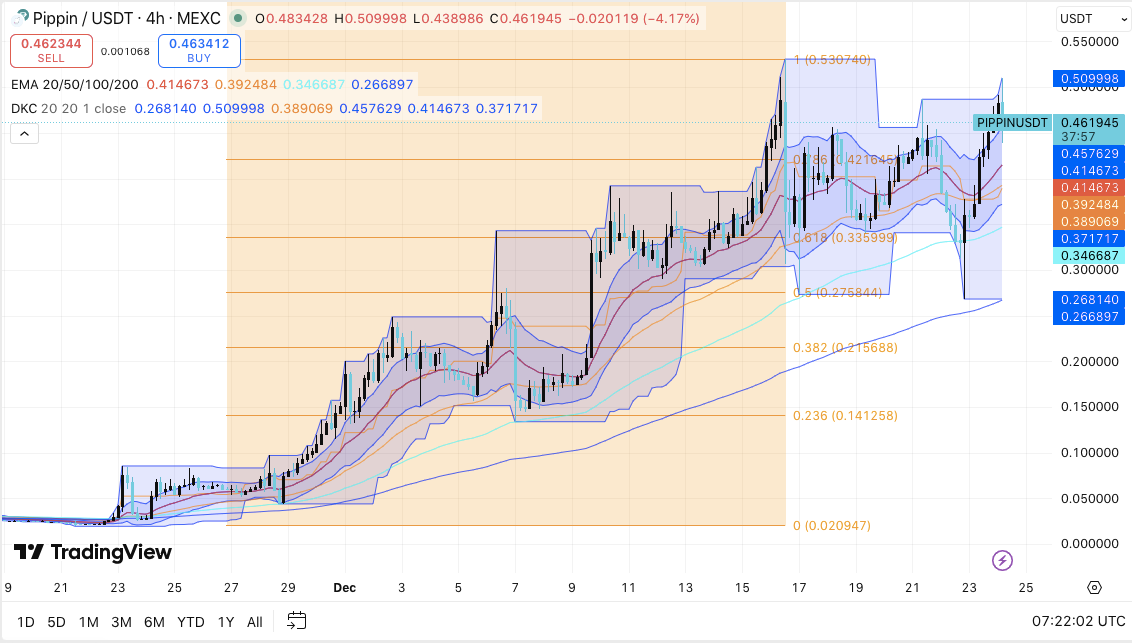

Pippin stays out there’s highlight as merchants assess whether or not latest power can lengthen to additional upside. On the 4-hour chart, the token maintains a transparent medium-term uptrend regardless of a pointy decline earlier this month.

Patrons shortly reacted to this decline, reinforcing confidence that dip demand stays robust. In consequence, market contributors at the moment are targeted on whether or not momentum and spinoff positioning can assist additional upside.

Worth construction is above main pattern ranges

PIPPIN continues to document highs and lows on the 4-hour timeframe. Subsequently, the broader pattern stays in place. Worth stays above the 50-period and 100-period exponential transferring averages, reinforcing near-term assist. Moreover, the 200-period EMA is effectively under present worth, supporting a broader bullish construction.

Volatility has elevated through the latest selloff, however promoting stress has eased close to dynamic assist. In consequence, costs rebounded sharply, displaying robust purchaser curiosity close to the decrease band. Analysts presently see the $0.457 to $0.462 zone as rapid assist. A deeper pullback may check the $0.414 to $0.420 space the place the transferring averages converge.

On the upside, resistance between $0.510 and $0.531 stays necessary. A decisive transfer above this vary may open up room for pattern continuation, particularly if quantity expands. Nonetheless, a lack of $0.414 will shift consideration to deeper defenses round $0.39 and $0.35.

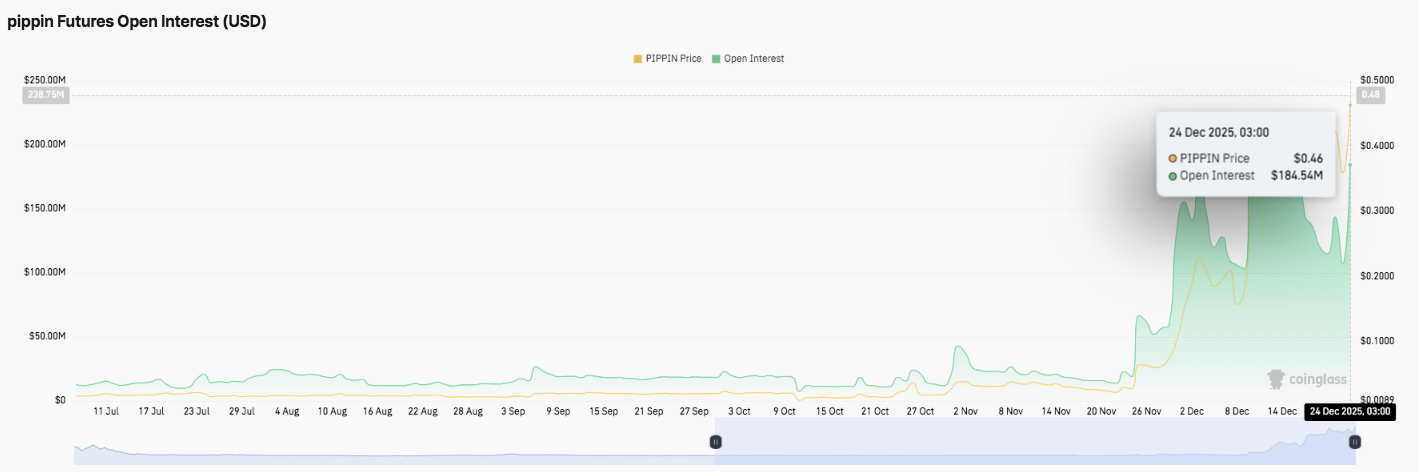

Open curiosity signifies modifications in dealer conduct

Futures information reveals clear modifications in market contributors. From July to mid-November, open curiosity in PIPPIN futures remained subdued, reflecting a cautious and low leverage place. Furthermore, at this stage worth discovery was orderly and speculative stress was restricted.

In late November, open curiosity expanded quickly as merchants elevated their leverage publicity as costs rose. This accumulation accelerated in December, with open curiosity exceeding $180 million by December twenty fourth. The present volatility subsequently suggests aggressive place rotation fairly than widespread deleveraging and growing short-term volatility threat.

Whale positioning is advantageous for lengthy exposures

The information highlighted by CryptonautX provides additional context to the derivatives image. The analyst famous that whale-sized lengthy positions are predominant throughout the PIPPIN futures market. In response to the numbers shared, 77 whales presently maintain lengthy positions price practically $22.11 million.

In the meantime, 50 whales maintain brief positions price about $2.17 million. Moreover, lengthy exposures have been practically 11 instances extra widespread than brief exposures, reflecting constructive orientation beliefs. This imbalance will increase the chance of short-side stress if costs regain upward momentum.

Technical outlook for PIPPIN worth

PIPPIN’s technical construction stays clearly outlined as worth buying and selling inside a broader bullish framework. The token continues to respect increased timeframe assist whereas holding agency under latest highs, suggesting compression forward of a directional transfer.

High degree: Quick resistance lies between $0.510 and $0.531, indicating the latest swing excessive zone. A confirmed breakout above this vary may open the door for continued upside towards increased pattern extension ranges, particularly if quantity and open curiosity increase together with worth.

Lower cost degree: Preliminary assist stays stable on the present stable space of $0.457-$0.462. Under that, $0.414-$0.420 exists as an necessary EMA cluster and former breakout base. A deeper pullback may check $0.389-$0.392 according to the 100 EMA. Main pattern assist lies between $0.346 and $0.371 close to the 200 EMA and historic demand zone.

Pattern construction: PIPPIN continues to commerce above the foremost transferring averages, sustaining its medium-term pattern constructively. Worth motion suggests a narrowing vary following latest pullbacks and rebounds, indicating compression in volatility. Subsequently, a decisive breakout of this vary may set off an expansionary transfer in both course.

Will Pippin go even increased?

The near-term outlook will depend on patrons holding the $0.414 degree whereas gaining momentum in direction of the $0.51-$0.53 resistance band. If the power above this ceiling persists, the bullish streak will likely be strengthened.

Nonetheless, if the EMA assist can’t be sustained, the main target may shift to deeper pattern safety zones. For now, PIPPIN stays in a pivotal technical zone, the place positioning, volatility and follow-through will decide the subsequent leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.