- POL’s help at $0.4250 stays vital for stability amid declining buying and selling quantity.

- SAND faces a serious help degree at $0.3350, and declining quantity suggests a decline in momentum.

- AAVE has consolidated help close to $161.00 and is eyeing a doable breakout above $165.00.

Polygon (POL) is holding regular at $0.37 regardless of current declines, whereas The Sandbox (SAND) and Aave (AAVE) are going through bearish stress. Let's discover out if these altcoins can recuperate and observe Polygon's lead.

Polygon (POL) Navigating unstable conditions

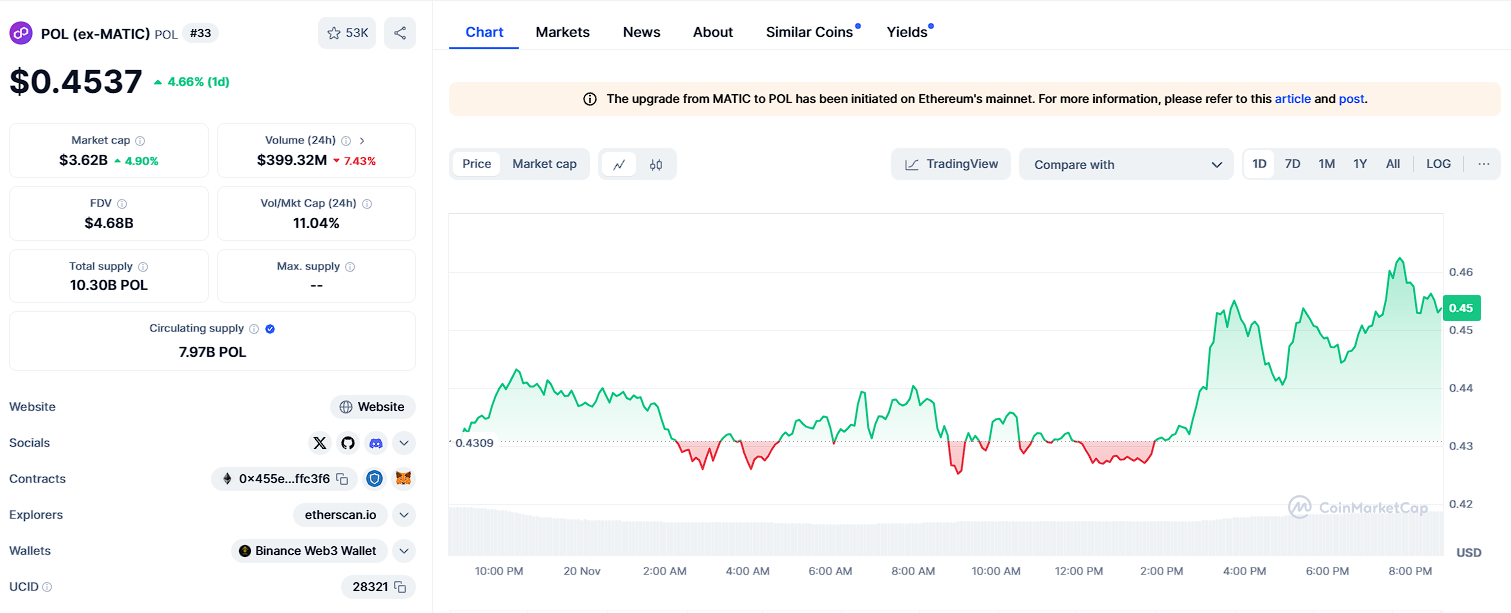

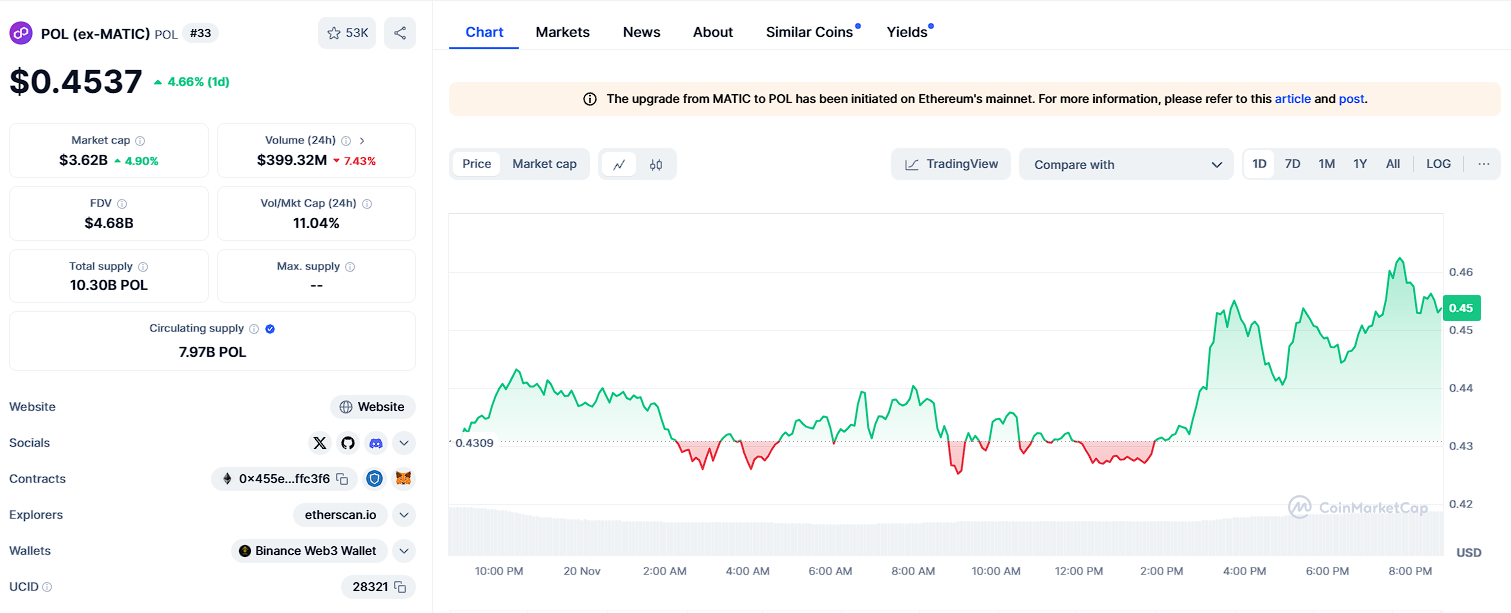

POL worth is going through downward stress and is at present buying and selling at $0.4537, up 5.50% on the day.

Importantly, $0.4400 will act as robust resistance, adopted by $0.4350, limiting any upward momentum in the course of the restoration. On the draw back, $0.4250 might be an important help, but when the bearish pattern continues, $0.4200 may emerge as a flooring.

Supply: CoinMarketCap

Subsequently, if the worth sustains above $0.4250, it may encourage consolidation throughout the $0.4300-$0.4350 vary. Nonetheless, a break above USD 0.4250 may result in additional decline. Quantity decline of 26.10% and market capitalization decline of two.32% spotlight the decline in exercise.

Sandbox to fight persistent downward stress (SAND)

SAND is struggling to take care of its upward momentum and is buying and selling at $0.3402 after falling 1.99%. The value initially examined $0.3477 however encountered robust promoting stress, resulting in a constant decline. Resistance lies at $0.3477 and $0.3450, with $0.3350 serving as an vital help and $0.3300 performing as a possible pullback if the bearish pattern continues.

Excessive intraday volatility helps energetic buying and selling, however momentum stays troublesome to take care of. Quantity decreased by 34.07% and market capitalization decreased by 1.90%, reflecting the cooling market sentiment.

If it sustains above $0.3350, SAND could stabilize and consolidate between $0.3400 and $0.3450. Alternatively, a break beneath USD 0.3350 may immediate additional decline.

Aave (AAVE) Look ahead to a breakout in a slender vary

AAVE is buying and selling at $162.89, reflecting a modest decline of 0.64%. The value reached $163.93 earlier than rebounding, indicating a range-bound transfer. Resistance at $163.93 and $165.00 signifies robust vendor exercise, whereas help at $161.00 and $159.50 supplies a security internet.

A 9.43% decline in quantity and a slight decline in market capitalization to $2.44 billion spotlight the restricted exercise. If it sustains above $161.00, AAVE may retest $163.93 and get away above $165.00. Nonetheless, failure to maintain $161.00 may set off a transfer in the direction of $159.50.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.