Layer 1 blockchains are underlying networks that straight assist varied functions on prime of the protocols, whereas layer 2 blockchains function on prime of those foundational layers to boost scalability and effectivity. Evaluating the utilization and effectivity of EVM-compatible L1 and L2 blockchains and sidechains may help you higher perceive the place many of the market worth and DeFi exercise is coming from.

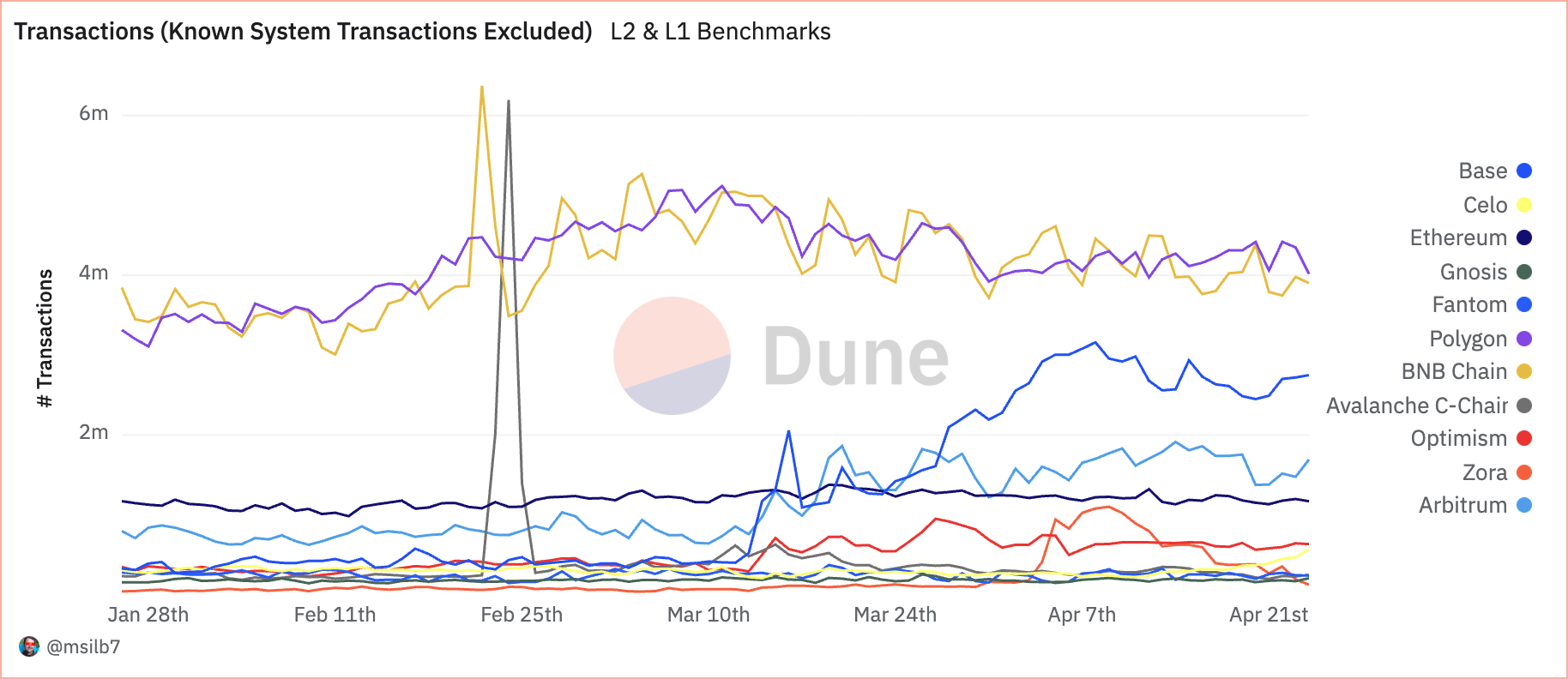

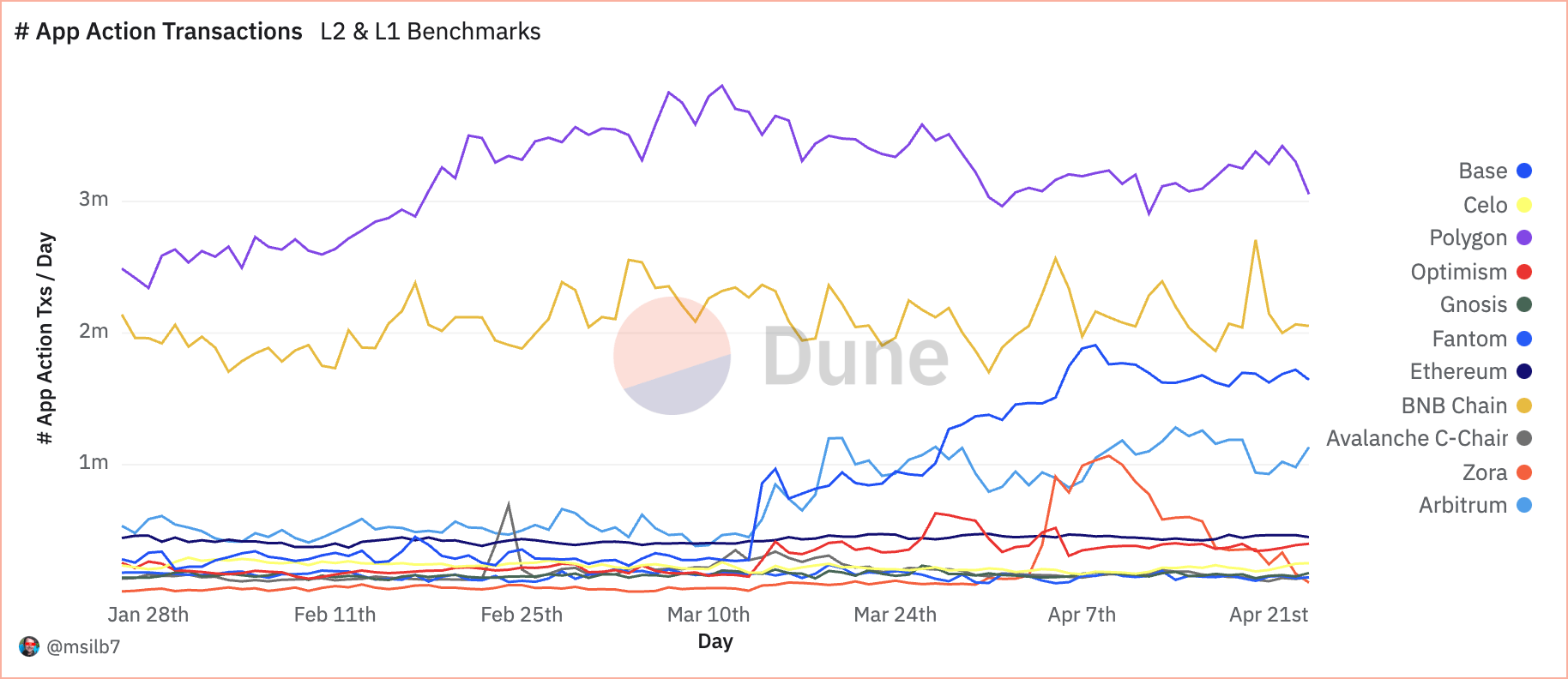

Dune Analytics knowledge analyzed by currencyjournals confirmed that Polygon, a layer 2 sidechain, is a significant participant within the DeFi ecosystem, carefully adopted by BNB Chain, an EVM-compatible layer 1 blockchain.

One of the necessary metrics when analyzing L1 and L2 is the each day fuel utilization, or the quantity of computation required to carry out operations on the blockchain. Fuel charges are paid within the native blockchain forex, and excessive fuel utilization normally signifies strong community exercise. Particularly, if the L2 resolution maintains excessive fuel utilization at low USD prices, it displays an environment friendly scaling resolution that makes transactions inexpensive with out sacrificing blockchain exercise.

Polygon makes use of a median of 579.97 billion models of pure fuel on daily basis, with related prices of simply $65.48 million. This works out to a median of solely $0.76 per second, regardless of processing a excessive quantity of 48.37 transactions per second. Every transaction on Polygon prices roughly 138,782 fuel models. The BNB mainnet additionally has a excessive buying and selling quantity, however presents a special value construction, with 454.89 billion models of pure fuel used every day and charges of USD 1.02 million per day. The associated fee per second jumps to $11.81, which is way increased than Polygon. The upper value per transaction of 108,513 fuel models on common displays BNB's increased computational calls for per transaction, suggesting that it’s a extra resource-intensive operation than Polygon.

| chain | Common pure fuel used per day | Common USD fuel value per day | Common variety of sends per day | Common native fuel per transmission | Common pure fuel used/sec | Common USD fuel value/sec | Common variety of sends/sec |

|---|---|---|---|---|---|---|---|

| polygon mainnet | 579.97b | $65.48,000 | 4.18m | 138,782 | 6.71m | $0.76 | 48.37 |

| BNB mainnet | 454.89b | $1.02 million | 4.06m | 108,513 | 5.26m | $11.81 | 47.03 |

| Arbitrum One | 273.96b | $250.05,000 | 1.14 meters | 241,207 | 3.17m | $2.89 | 13.15 |

| base fundamental internet | 222.37b | $378.72,000 | 1.26m | 174,229 | 2.57m | $4.38 | 14.59 |

| OP mainnet | 213.30b | $160.26,000 | 490.83k | 429,129 | 2.47m | $1.85 | 5.68 |

| Gnosis mainnet | 109.77b | $105,000 | 182.58k | 601,244 | 1.27m | $0.01 | 2.11 |

| ethereum mainnet | 108.14b | $12.63 million | 1.19 meters | 90,758 | 1.25m | $146.20 | 13.79 |

| phantom mainnet | 94.86b | $489,000 | 248.93k | 372,521 | 1.10m | $0.06 | 2.88 |

Arbitrum makes use of 273.96 billion models of fuel on daily basis, costing customers $255,000. This equates to him $2.89 per second and 241,207 fuel models per transaction. This means that it’s cheaper than BNB however lower than Polygon. Base Mainnet recorded an identical development, with 222.37 billion models and a each day charge of $378,72,000, and a barely increased value per second of $4.38 and 174,229 models per transaction.

Ethereum has the most important value impression, utilizing 108.14 billion fuel models on daily basis and incurring a hefty $12.63 million in charges. The bounce in prices to $146.20 per second regardless of a median of 90,758 fuel models per transaction demonstrates Ethereum's strong safety and computational breadth, in addition to the scalability challenges that the L2 community seeks to handle. is highlighted.

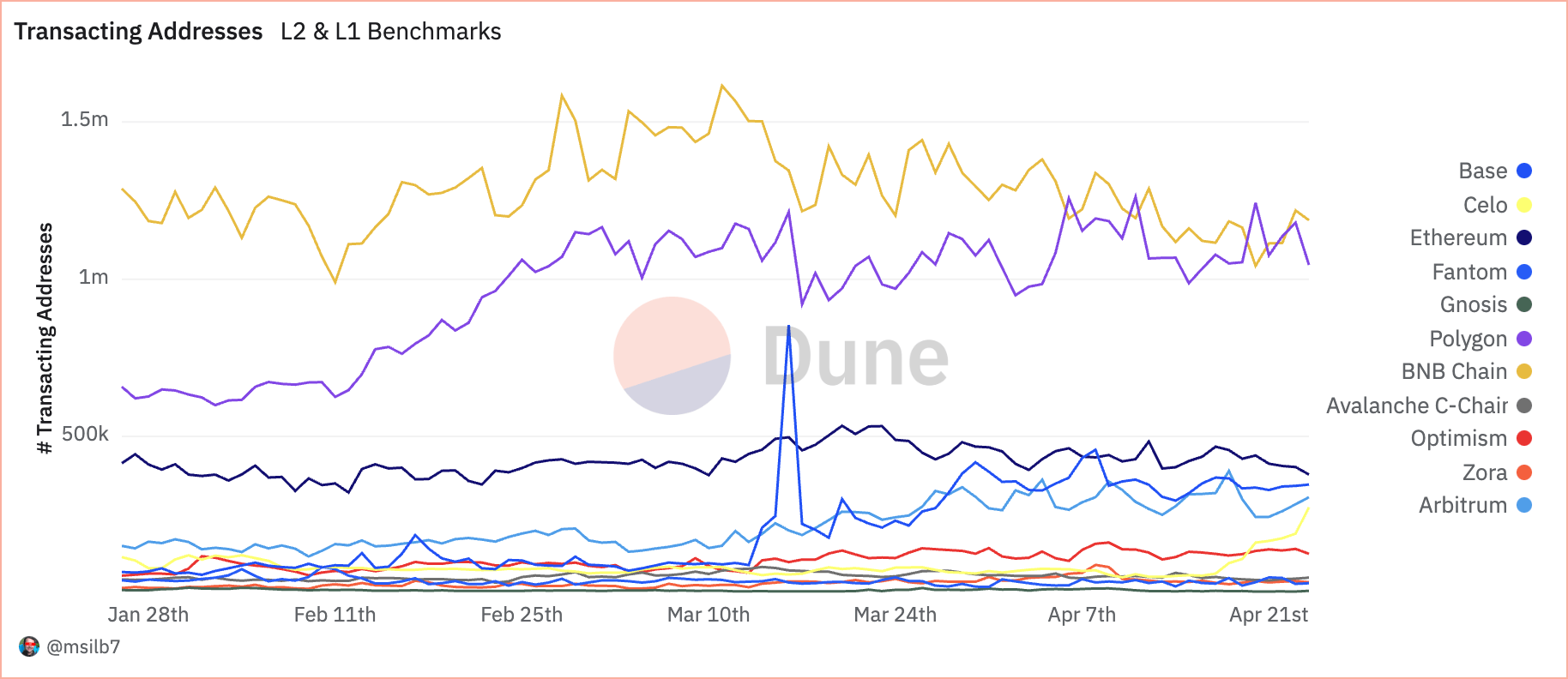

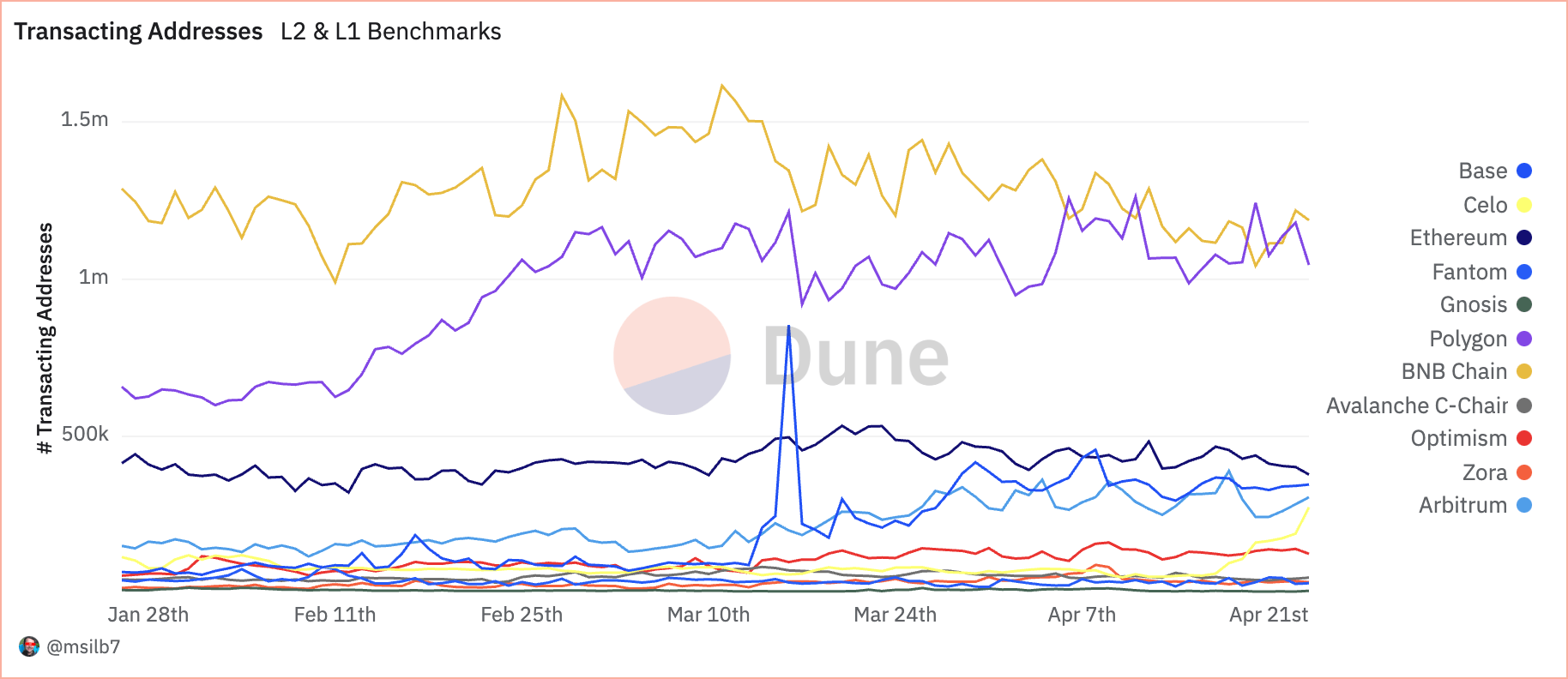

Taking a look at transaction metrics, Polygon topped the checklist with 4.02 million transactions, adopted by BNB Chain with 3.9 million, in keeping with April 23 knowledge. These numbers show sturdy person engagement and community utility, accounting for a 25.8% and 25.1% share of whole transactions (excluding recognized system transactions), respectively.

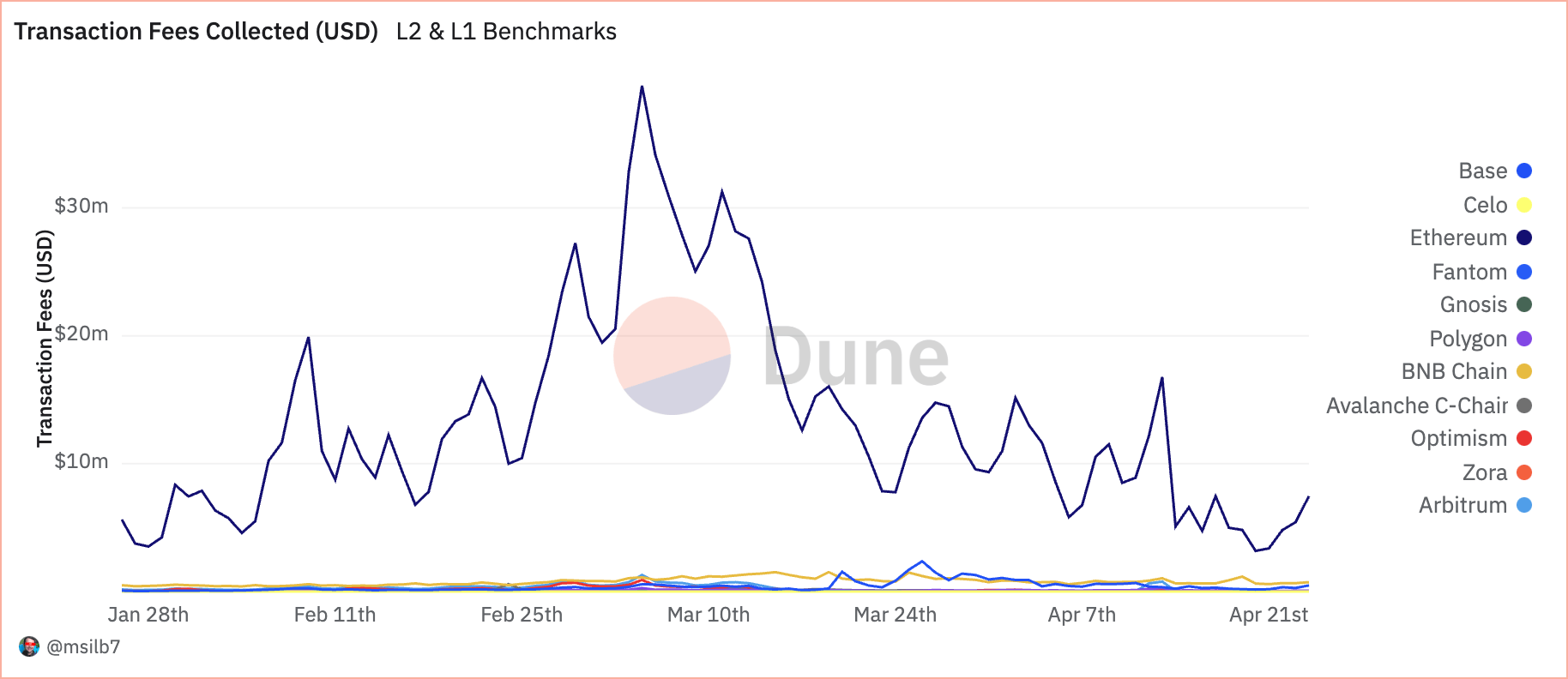

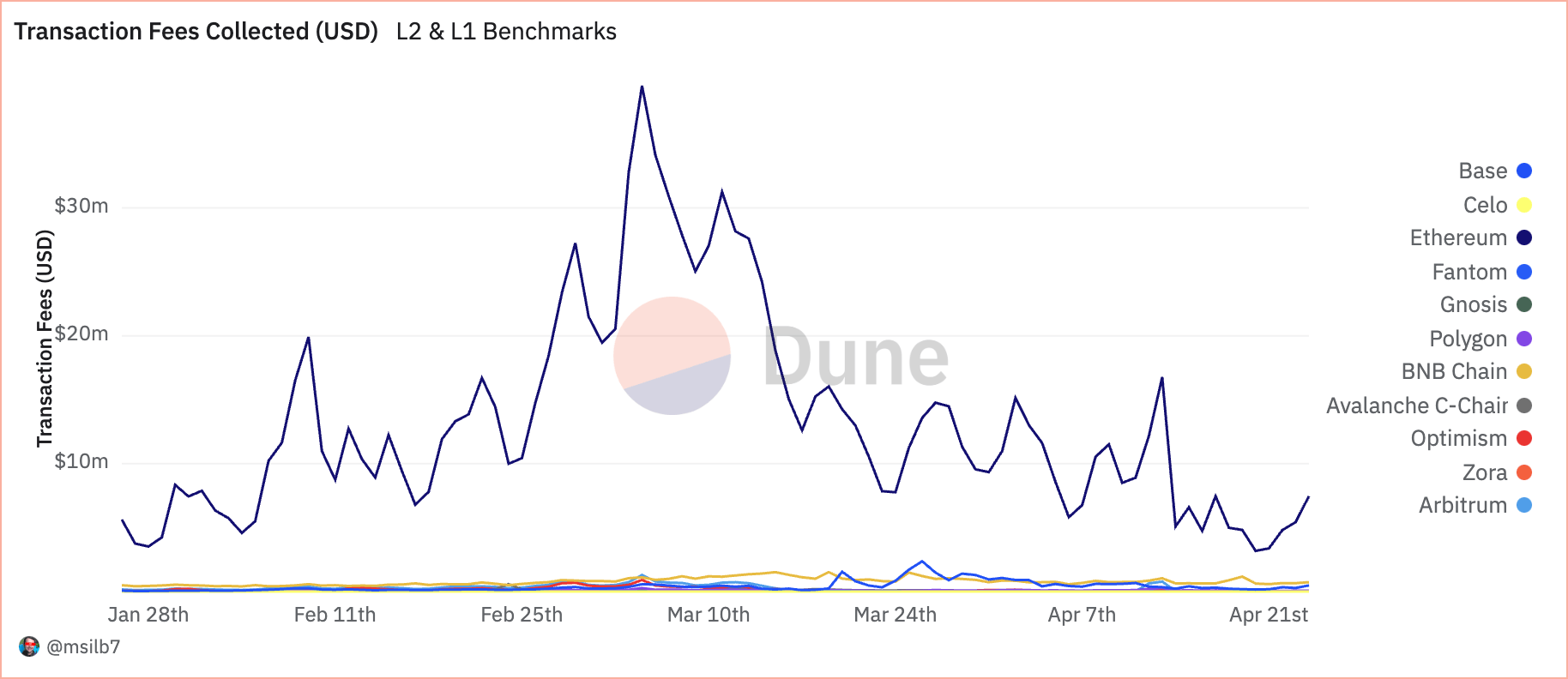

However if you have a look at transaction charges, a special story emerges. Regardless of the low variety of transactions, Ethereum collected his $7.46 million in charges, which equates to his staggering 83.9% of whole charges collected. This discrepancy means that though Ethereum processes fewer transactions, its increased transaction prices mirror the standing of its major layer and the intensive computational assets required for its operations.

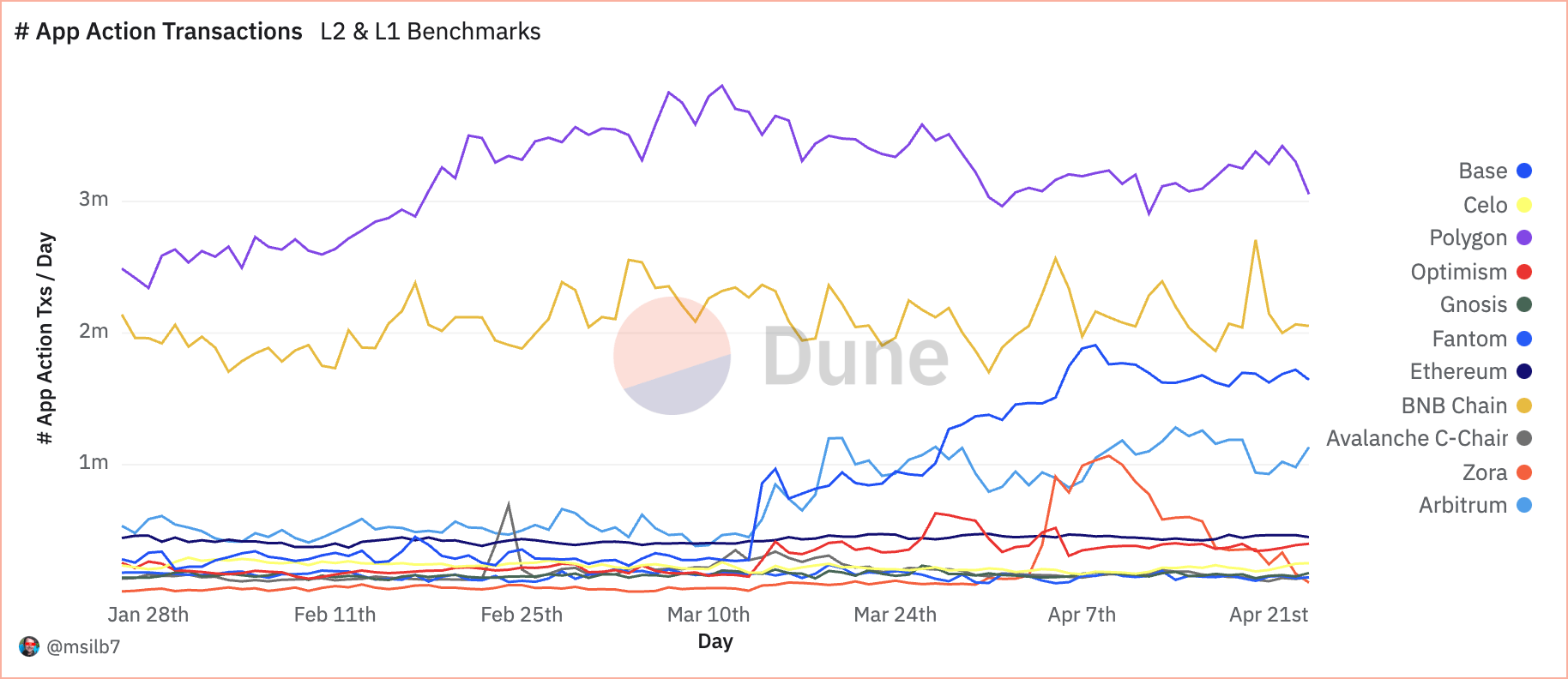

Relating to DeFi apps, Polygon as soon as once more leads the transaction rely with 3.3 million app transactions, demonstrating that it’s the go-to platform for DeFi actions.

BNB Chain had 1.22 million buying and selling addresses, whereas Polygon was barely behind with 1.18 million. These numbers recommend that different EVM-compatible networks have gotten the popular platform for normal DeFi customers resulting from their decrease value construction, in distinction to Ethereum's 402.77k.

Analyzing the efficiency of those blockchains aspect by aspect reveals the battle between primary safety and enhanced scalability. Whereas L1 blockchains like Ethereum proceed to safe high-value transactions with hefty charges, scaling options like Polygon seize the vast majority of day-to-day transactions and utility interactions. It marks the transition to extra environment friendly and user-friendly blockchain infrastructure in DeFi.

Regardless of being categorized by many as a Layer 2 blockchain, Polygon operates as an L2 sidechain for Ethereum, because it depends by itself set of validators and isn’t depending on Ethereum for safety. It is very important be aware that. This enables Polygon to assist extra experimental actions than a “true” L2 blockchain with out impacting Ethereum. One other truth value mentioning is that though the BNB chain is an EVM-compatible layer 1 blockchain, it’s positioned out there as a competitor to different L2s, relatively than a competitor to a different L1, Ethereum. It's about being there.

talked about on this article

(Tag translation) Ethereum