Coinbase Prime, a crypto platform explicitly designed for institutional traders, trusts, and high-net-worth people, has seen a dramatic enhance in buying and selling exercise following the launch of the US Spot Bitcoin ETF.

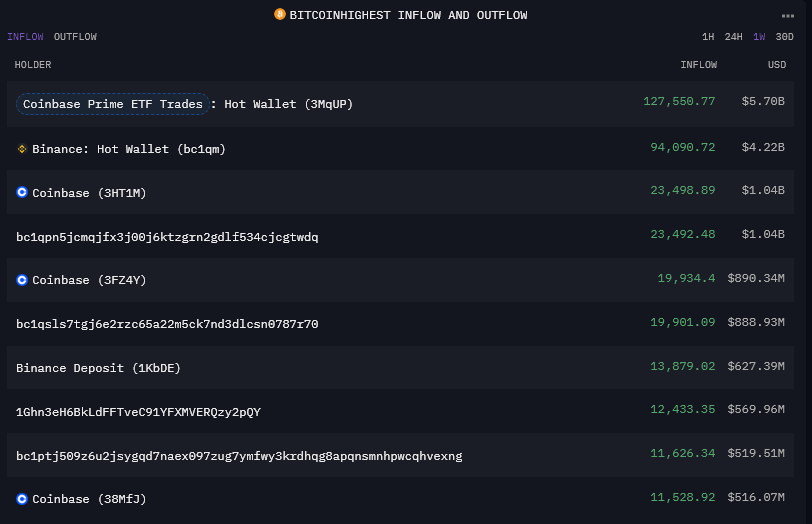

crypto slate Our evaluation recognized a sizzling pockets on Coinbase Prime that has skyrocketed to the highest of the Bitcoin influx chart over the previous week. This pockets is used for buying and selling exercise inside the platform, and all through 2023 he noticed modest inflows and outflows of tons of of thousands and thousands of {dollars} monthly. However over the previous week, it has seen inflows of $5.7 billion and outflows of the identical quantity. . Traditionally, Binance sizzling wallets have dominated the move leaderboard, and from the info analyzed, this seems to be the primary time Coinbase Prime has outperformed Binance in 7 days.

Over the previous 30 days, Binance nonetheless leads with inflows and outflows of round $14 billion, whereas Coinbase Prime is barely behind with round $12 billion. It’s price noting that in Arkham Intelligence different buying and selling wallets are tagged as belonging to his Coinbase Prime. Nevertheless, this pockets seems to be able to dealing with massive transactions.

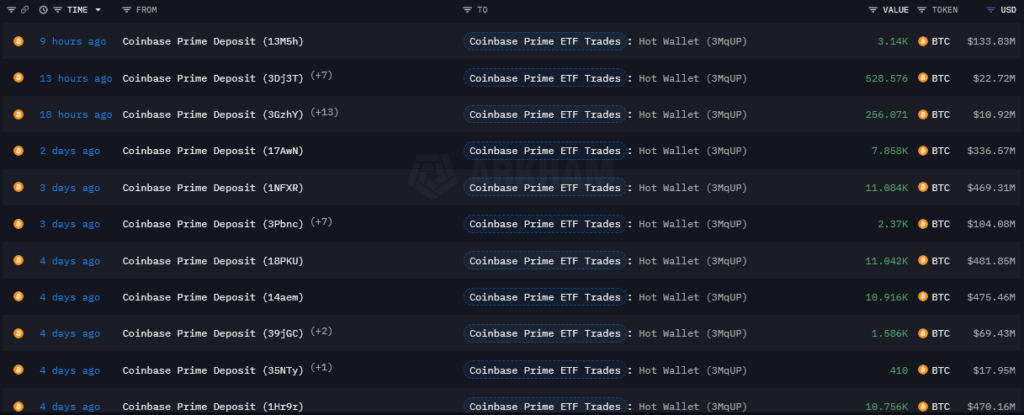

The spike in exercise can be seen within the desk under, which solely reveals transactions over $10 million. Up to now 4 days alone, he has had a number of deposits of over $400 million in a single commerce.

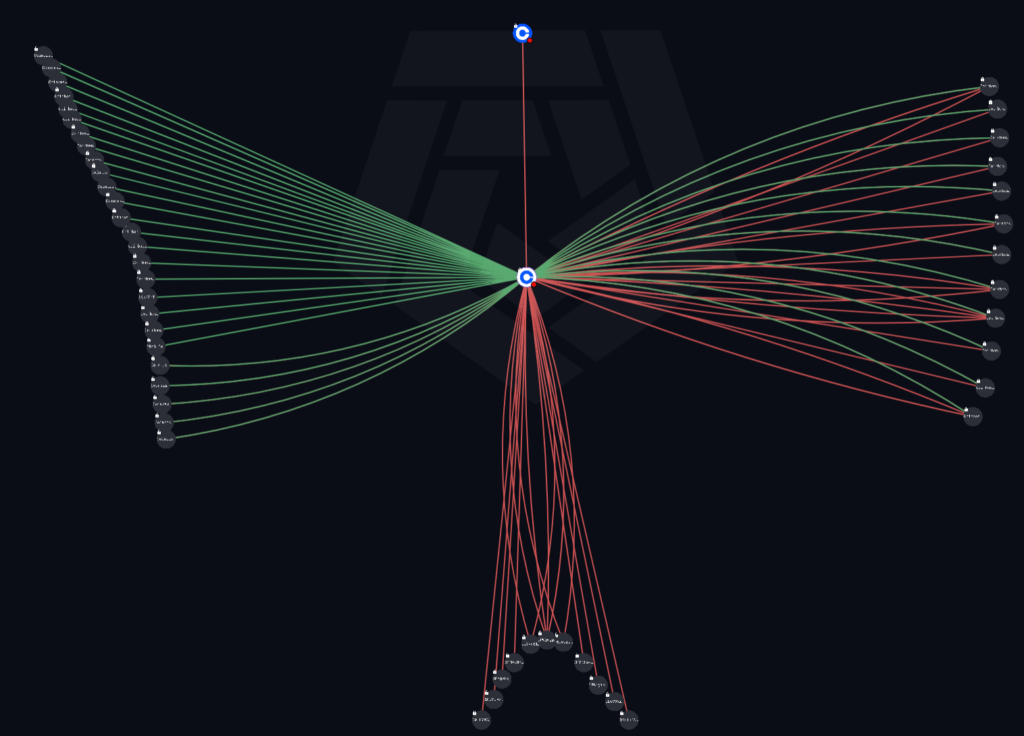

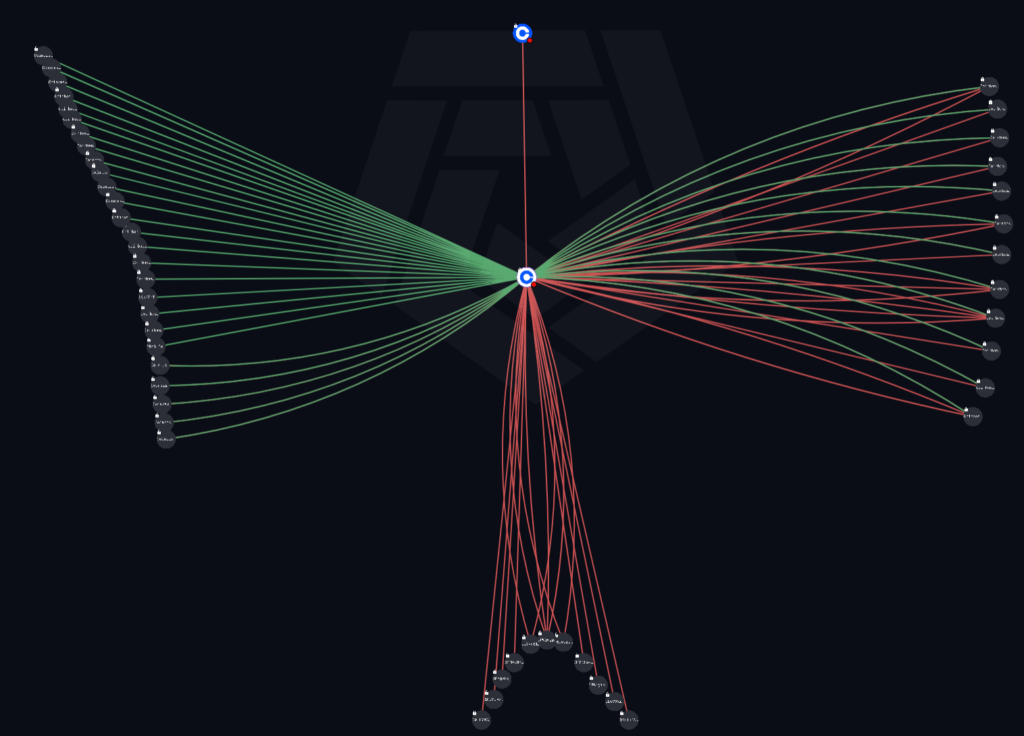

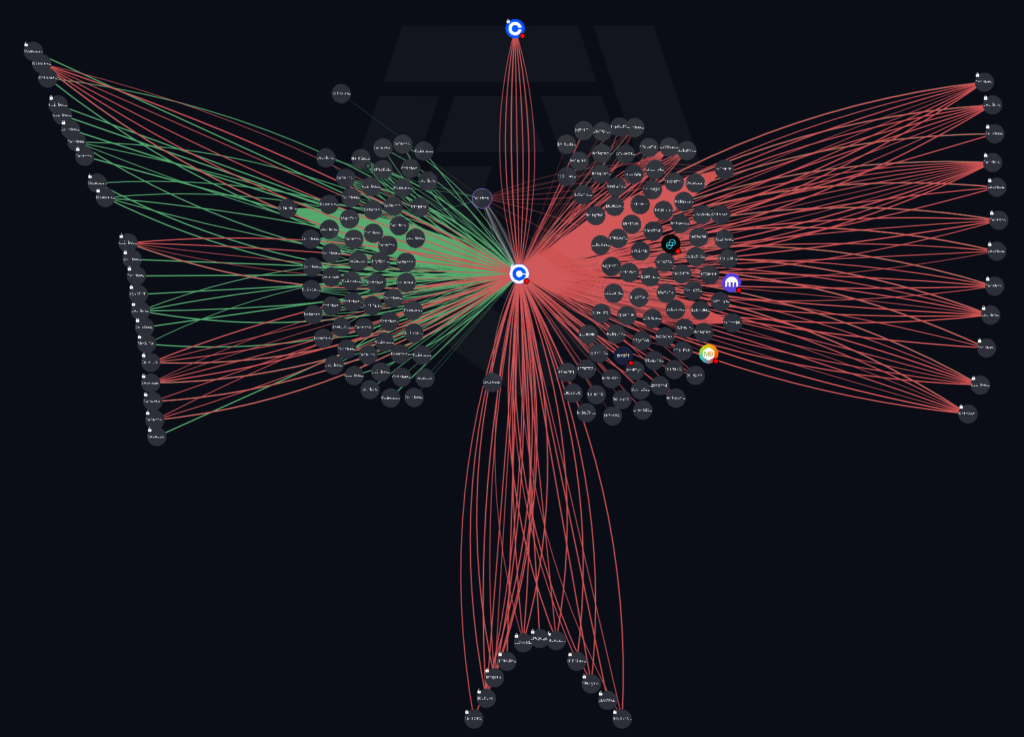

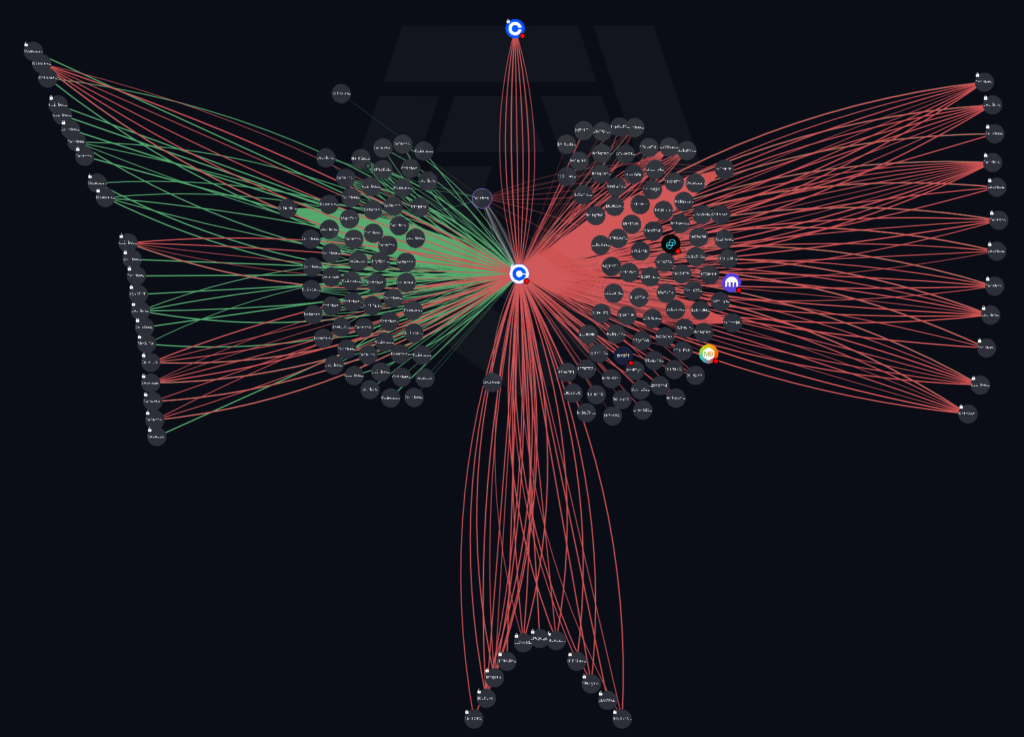

The visualization under reveals over $50 million in transaction move for the Coinbase Prime sizzling pockets. The cluster on the left is tagged as his Coinbase Prime deposit deal with, which all move into his sizzling pockets. The cluster on the suitable consists of wallets additionally tagged as Coinbase Prime deposit addresses, however exhibiting inflows and outflows. The wallets within the backside cluster are untagged and solely present outflows from sizzling wallets. The highest outlier is the Coinbase alternate, with a single outflow of $78 million.

Speculatively, the cluster on the left might symbolize institutional deposit addresses, the wallets on the suitable could possibly be buying and selling wallets, and the wallets on the backside could possibly be chilly storage. None of that is verifiable at the moment, however it could be per the info supplied within the ETF prospectus about how Bitcoin buying and selling will work for the fund. Observe that the above solely reveals transactions over $50 million, or roughly 1,100 BTC.

The picture under comprises a transaction of round $1,000 with all the wallets talked about above locked in place. Notably, dozens of recent wallets are coming into the sector at these decrease values, whereas the underside cluster nonetheless sees no inflows.

Trying to determine and analyze wallets related to ETF exercise might present essential insights into the Bitcoin market if buying and selling volumes proceed to comply with launch information. CoinShares reported that the buying and selling quantity of crypto monetary devices was round $17.5 billion final week, and this exercise can have a disparate affect on the spot value of Bitcoin.

The value at which the ETF values Bitcoin every day is calculated by the CF Benchmark Index (BRR), which represents the Bitcoin Reference Fee. This charge is calculated every day between 3pm and 4pm GMT by analyzing a sequence of trades throughout a number of exchanges. The BRR is then used to calculate the fund's internet asset worth, or the worth of the Bitcoins held by the fund. This charge, and the truth that the creation and redemption of shares takes place outdoors of normal buying and selling hours, provides a brand new dynamic to Bitcoin buying and selling that was not an element earlier than.

(Tag translation) Bitcoin

Comments are closed.