The next is a visitor put up by Rajagopal Menon, Vice President of WazirX.

When a bull market arrives, fashions emerge to foretell the worth of Bitcoin. Over the last bull market of 2021, the stock-to-flow (S2F) mannequin grew to become a function of the season. The mannequin created by Plan B assessed asset shortage by evaluating stock to annual manufacturing. Making use of the S2F mannequin to Bitcoin highlighted its “digital gold” potential and offered long-term worth predictions primarily based on shortage. Nevertheless, the S2F mannequin will disappear within the crypto winter of 2022.

However don't fear. The present bull market has seen the emergence of a brand new mannequin referred to as the facility regulation mannequin, which claims to foretell the worth of Bitcoin with wonderful accuracy.

Perceive energy legal guidelines

In a world seemingly crammed with chaos and randomness, scientists have uncovered hidden patterns and relationships often called energy legal guidelines. These legal guidelines present a framework for understanding how completely different phenomena work together and reveal constant mathematical patterns that govern completely different points of the universe.

Energy regulation in day by day life

Energy legal guidelines are fascinating mathematical relationships that seem in quite a few phenomena and supply perception into the underlying simplicity of complicated techniques. They describe how two portions are associated to one another, such {that a} change in a single amount causes a proportional change within the different amount. This relationship spans many scales, from the microcosm to the cosmos, and impacts biology, society, expertise, and pure phenomena.

animal measurement limits

Galileo's square-cube regulation is a traditional instance of an influence regulation in nature and explains how an animal's measurement impacts its energy. As animals develop bigger, quantity and weight enhance a lot quicker than bodily energy. This regulation units pure limits and explains why giant animals have thick bones and why the most important animals are present in aquatic environments the place their weight is offset by buoyancy.

metabolic price

Max Intelligent's work on metabolic price additional demonstrates the applicability of energy legal guidelines. This reveals that an organism's metabolic price is proportional to its mass to the three/4th energy, indicating that bigger animals are extra power environment friendly. This precept has profound implications for our understanding of species life cycles, progress charges, and sustainability.

Pure phenomena and human actions

Energy legal guidelines govern quite a lot of phenomena, from the distribution of earthquake sizes to the frequency of phrases in a language. These clarify why we observe a small variety of necessary occasions together with numerous smaller instances. For instance, Zipf's regulation describes the frequency of phrases in a language and emphasizes that frequent phrases happen disproportionately in comparison with much less frequent phrases.

Past pure phenomena

Energy legal guidelines prolong to human actions reminiscent of economics, finance, and expertise. They elucidate the distribution of wealth, the place a small variety of people personal a good portion of the wealth. An influence regulation in expertise describes how content material interacts on the Web, with a small variety of in style nodes and numerous much less in style nodes forming a protracted tail of distribution.

Bitcoin energy regulation

Astrophysicist Giovanni Santasi found this connection. He stated 15 years of knowledge exhibits that Bitcoin additionally follows the facility regulation precept. Santostasi first shared the facility regulation mannequin on his r/Bitcoin subreddit in 2018. Nevertheless, the mannequin was revived in January after monetary YouTuber Andrei Jeikh talked about it to his 2.3 million subscribers in a video.

Giovanni's concept means that Bitcoin costs should not as random as they appear. Regardless of the randomness, in the long term, the worth of Bitcoin follows a sure mathematical mannequin. It's not only a mathematical system the place somebody drew a line. As an alternative, it follows an influence regulation just like the one noticed all through the universe.

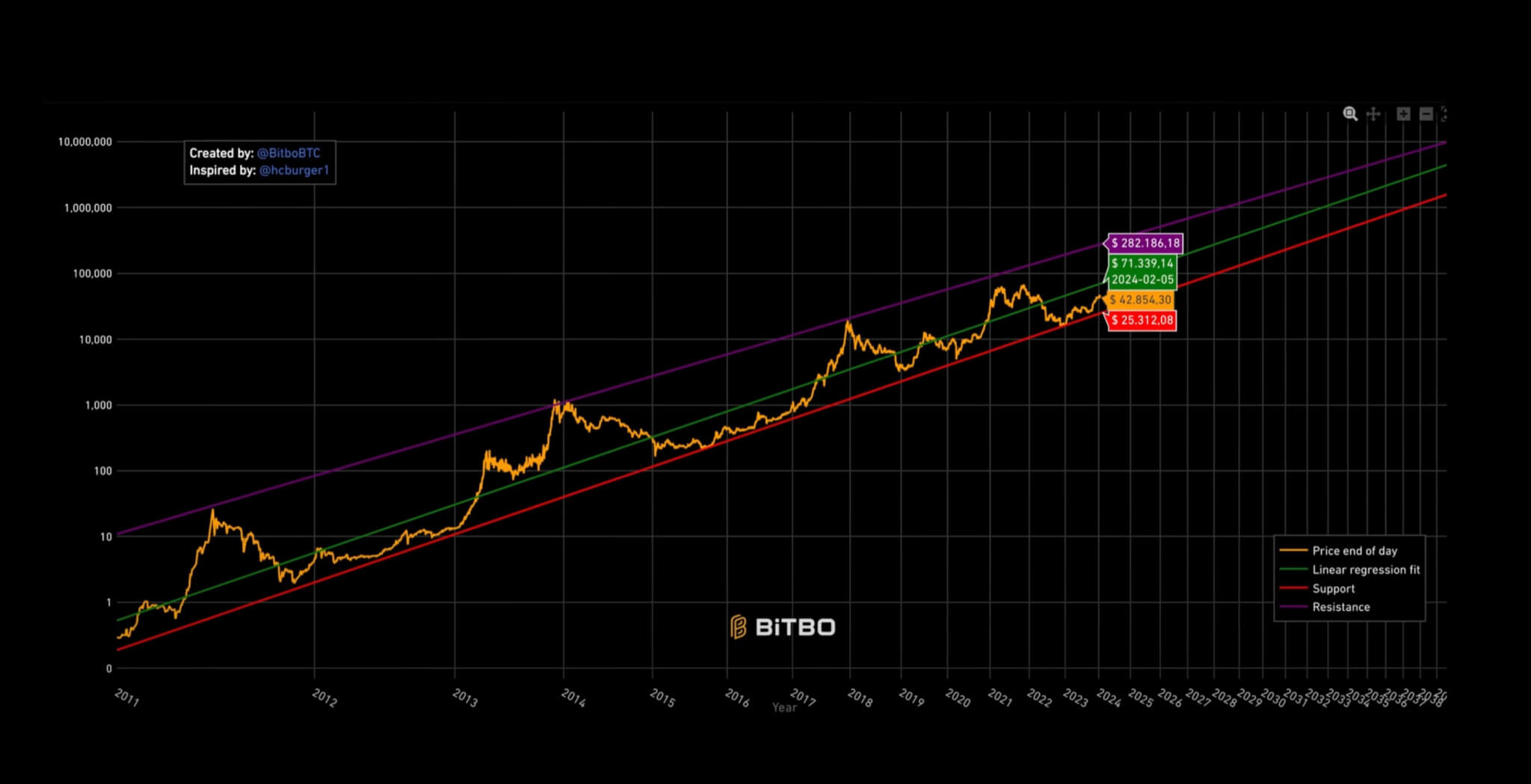

The yellow line represents the present worth and the pink line represents the help line. A help line is a degree under which Bitcoin usually doesn’t fall. The inexperienced line is the linear regression line, which is just like the honest worth worth that Bitcoin will finally return to, and the purple line is the resistance line the place Bitcoin usually reaches its most worth.

Predicting the way forward for Bitcoin

Santostasi's energy regulation mannequin graphs the trajectory of Bitcoin's worth with wonderful accuracy. This can be a graph exhibiting the present worth of Bitcoin, a help line exhibiting the extent Bitcoin often doesn’t fall under, a linear regression line exhibiting the honest worth worth, and a resistance line exhibiting the extent Bitcoin often reaches earlier than falling. is exhibiting.

This mannequin highlights Bitcoin's surprisingly linear progress, particularly when outliers are eliminated. Regardless of occasional fluctuations, Bitcoin's total trajectory follows a transparent sample harking back to different phenomena ruled by energy legal guidelines.

Affect on traders

The ability regulation mannequin offers fascinating perception into Bitcoin's potential future peaks. In keeping with Santostasi's evaluation, Bitcoin might peak at $210,000 in January 2026 after which fall to round $60,000. He went on to foretell that Bitcoin can be value $1 million by July 2033. Whereas mathematical fashions present priceless insights, they aren’t free from error and will not account for unexpected occasions that may have a big influence on costs.

“All fashions are damaged, however some are helpful” implies that the fashions will not be excellent, however can nonetheless present priceless insights. Fashions reminiscent of energy regulation fashions and equity-to-flow fashions for predicting Bitcoin costs have flaws and limitations. For instance, Julio Marino of Crypto Quant identified issues with energy regulation fashions, reminiscent of underestimating errors and giving a deceptive impression of accuracy.

Apparently, each energy regulation and stock-to-flow fashions face related criticisms. Regardless of their flaws, they’ve traditionally made practically equivalent predictions for the worth of Bitcoin. Nevertheless, over time, predictions can diverge.

If these fashions are right, the query arises: why trouble utilizing conventional funding methods just like the 60/40 portfolio? Some argue {that a} new mannequin to elucidate Bitcoin's actions might yield higher returns.

Some might imagine that these fashions haven’t any worth, however others, just like the particular person I'm speaking to, suppose they nonetheless have worth. The shortage brought on by Bitcoin's fastened provide is contributing to the worth rise. Moreover, elements reminiscent of M2 progress additionally have an effect on Bitcoin worth.

Though fashions present helpful insights, they can not predict the longer term. Even when the mannequin is flawed, Bitcoin's trajectory seems to be upwards. Subsequently, it’s important to contemplate these fashions, but in addition to concentrate on their limitations.

(Tag to translate) Bitcoin