- President Trump has predicted that $20 trillion could possibly be injected into the U.S. economic system by the top of 2025 attributable to tariffs and reshoring.

- Ash Crypto factors out that the easing of financial coverage might enhance liquidity in cryptocurrencies.

- Bitcoin and different altcoins stay bearish, however traders like Robert Kiyosaki see potential good points.

Famend cryptocurrency commentator Ash Crypto not too long ago highlighted President Donald Trump’s declare that as much as $20 trillion could possibly be injected into the US economic system by the top of 2025.

The assertion, made in an interview on FOX Enterprise, fueled hypothesis in regards to the broader liquidity outlook and potential influence on crypto belongings.

Tariffs, Reshoring, and Huge Financial Enlargement

Throughout the interview, President Trump claimed that his tariff-heavy reshoring plan is driving an enormous wave of financial development. He stated industries akin to prescription drugs and semiconductor manufacturing are quickly returning to the USA, growing home manufacturing.

President Trump says U.S. financial output might exceed $17 trillion inside eight months and attain $20 trillion by the top of his first yr in workplace.

He attributed this development to tariffs on international items and argued that firms want to construct in the USA somewhat than pay greater import prices. President Trump stated this development is a historic financial increase, larger than what’s taking place in China and different international locations.

Expectations for liquidity

In response, Ash Crypto famous that macroeconomic components akin to potential rate of interest cuts, an finish to quantitative tightening, and speak of resuming quantitative easing might have a big influence in the marketplace.

President Trump’s projected financial development is according to straightforward financial coverage, and the ensuing enhance in liquidity might circulate into riskier belongings akin to cryptocurrencies. Traditionally, Bitcoin bull markets have occurred in periods of straightforward funding and rising liquidity.

Associated: Stablecoin issuance stalls, ETF outflows enhance — Cryptocurrency enters “self-funded” stage

Potential influence on Bitcoin, altcoins and on-chain flows

The outlook comes at a time when the Bitcoin and crypto markets are largely bearish and plenty of are searching for the subsequent catalyst to push costs greater.

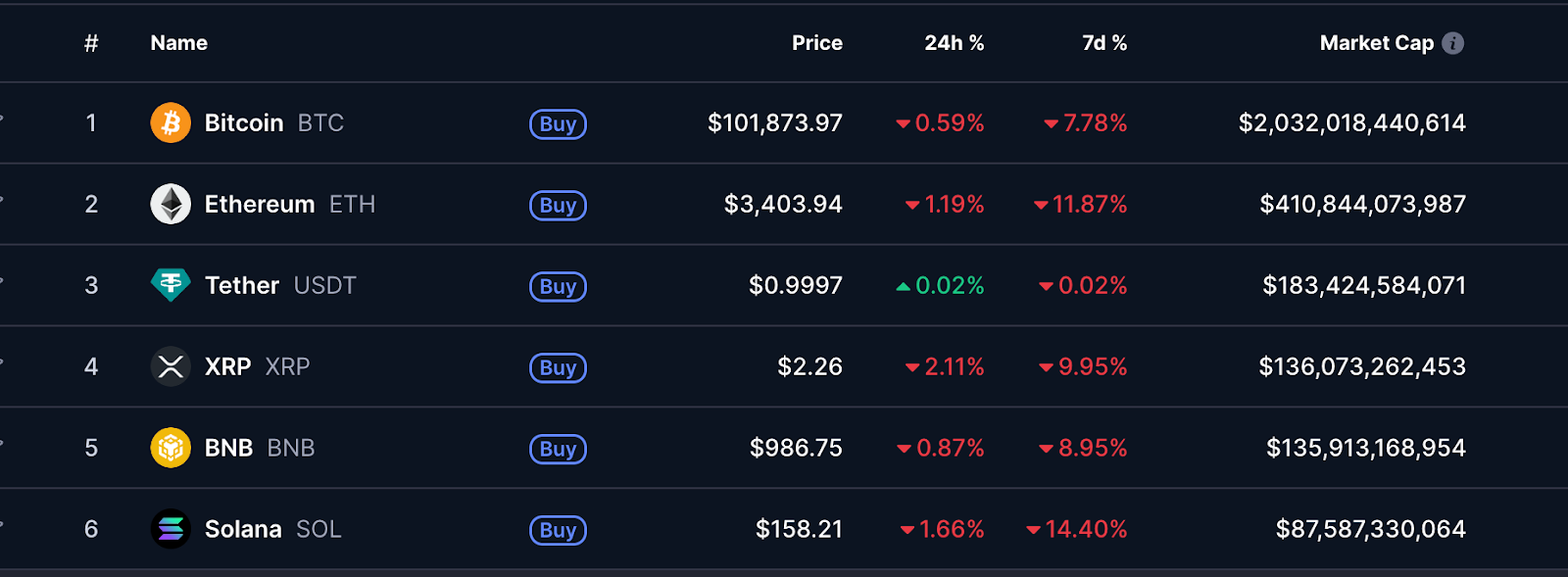

Bitcoin is buying and selling at $101,800, dropping 8% in worth over the previous week. The scenario for Ethereum was even worse, falling 12% in the identical interval whereas buying and selling at $3,400. Different altcoins akin to XRP and Solana are additionally in pretty bearish positions.

On Friday, Bitcoin ETFs bought $550 million price of BTC, with the bulk coming from BlackRock, Constancy, Bitwise, and ARK.

In the end, the potential for a $20 trillion increase to the economic system, mixed with straightforward financial coverage, might result in extra capital flowing into crypto belongings. Stablecoin issuers, liquidity suppliers, and crypto infrastructure tasks can also profit from the brand new risk-on atmosphere.

Traditionally, elevated greenback liquidity has led to elevated buying and selling quantity, institutional capital inflows, and demand for spot ETFs.

Robert Kiyosaki focuses on $250,000 in Bitcoin and $27,000 in gold amid market crash

Within the ongoing atmosphere, monetary writer Robert Kiyosaki stated he was shopping for gold, silver, Bitcoin, and Ethereum, predicting an impending financial collapse.

Citing economist Jim Rickards and his view that BTC protects in opposition to the Fed’s “faux cash,” he has set a objective of $27,000 for gold, $100 for silver, and $250,000 for bitcoin by 2026.

He urged traders to carry “actual cash” belongings and criticized the U.S. Treasury and Federal Reserve for debt-driven cash printing.

Associated: Benjamin Cowen predicts Bitcoin’s subsequent massive peak in late 2025, adopted by a decline in 2026

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.