Following the announcement earlier this month, Robinhood will finish assist for a lot of crypto tokens right now, June twenty seventh. Among the many delisted tokens are Polygon (MATIC) and Cardano (ADA).

The costs of each tokens fell after the preliminary announcement of the crypto buying and selling platform had an general draw back within the wake of the U.S. Securities and Trade Fee’s (SEC) lawsuit towards crypto exchanges Binance and Coinbase.

With Bitcoin (BTC) making an attempt to carry above the psychological $30,000 degree, what would be the value outlook for the 2 tokens?

Porygon value outlook

After Robinhood introduced its delisting on June 9, MATIC’s value fell 35% in two days, plummeting from practically $0.79 to $0.50. The bulls are dealing with stress close to $0.66, however maybe a rally close to $0.75 may materialize and spur patrons.

One of many components in favor of the polygon bulls is the elevated foreign exchange outflow into MATIC. Information means that extra holders are transferring tokens into self-custody wallets, and the potential affect may additional scale back promoting stress.

Based on cryptocurrency analyst Michael van de Poppe, the drop to $0.50 has resulted in a “chain response of liquidations on the lengthy facet.”

he Notice All of those have since been picked up and thought of probably breakouts. Nevertheless, MATIC/USD must convert to assist at $0.75 to supply a foundation for renewed upward momentum.

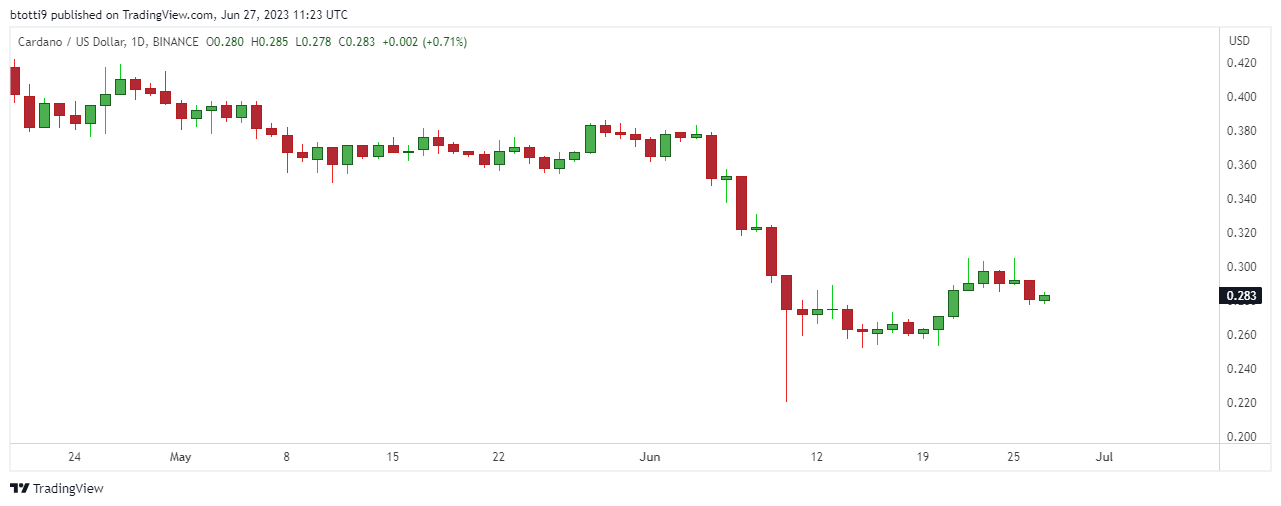

Cardano, like Polygon, plummeted after the SEC declared ADA a safety earlier this month. ADA misplaced greater than 42% of its worth within the week from June fifth to June tenth, falling from a excessive of $0.37 to $0.22.

That was earlier than the current crypto-wide rally noticed the bulls rally to $0.30.

Cardano value chart. Supply: TradingView

Nevertheless, whereas ADA/USD rose practically 10% final week, the loss during the last 30 days reaches 24% on the present value of $0.28. The neighborhood of $0.25 and $0.22 is vital if the bear market intensifies within the quick time period.

On the flip facet, a break above $0.30 once more highlights that the subsequent large hurdle is $0.40.

(Tag Translation) Market

Comments are closed.