The entire charges generated from the highest 10 DeFi dApps tracks through DefiLlama quantity to $4.8 billion yearly based mostly on previous 24-hour exercise. Previously day, we generated $13.15 million in charges throughout staking, DEX, lending, and wallets.

| identify | Class | 24 hour fee | 24 hour earnings |

|---|---|---|---|

| lido | liquid staking | $3.38 million | $337,749 |

| uniswap | dex | $2.62 million | $0 |

| pancake swap | dex | $2.1 million | $426,372 |

| curve finance | CDP | $1.54 million | $659,343 |

| AAVE | lending | $1.2 million | $172,860 |

| Maker | CDP | $1.08 million | $545,105 |

| Radium | dex | $1.01 million | $124,524 |

| Dealer Joe's | dex | $623,784 | $69,357 |

| metamask | pockets | $391,846 | $391,846 |

| camelot | dex | $271,722 | $63,802 |

Nonetheless, complete income for the previous day was solely $2.78 million, which is 21% of complete charges.

Whereas Lido tops the chart in charge technology, Curve maintains the primary slot in income, adopted by Maker and Lido. Two of the most important gaps between charges and income are seen in Aave and Raydium, which generated greater than $1 million in charges up to now day. Nonetheless, their revenues have been $172,860 and $124,524, respectively.

Notably, Uniswap ranks second when it comes to charge technology, whereas DefiLlama studies $0 in income as Uniswap facilitates charge assortment. Nonetheless, we don’t retain these charges as income for the protocol. As an alternative, the charge will increase the worth of the liquidity token and serves as a fee to all liquidity suppliers in proportion to their share of the pool.

There have been discussions and proposals inside the Uniswap group for the introduction of “protocol charges” that might be enabled by UNI governance. This charge permits the Uniswap protocol to earn income by receiving a portion of swap charges paid to liquidity suppliers.

The ballot discovered that step one, a “temperature examine,” handed by a vote of 55 million to 144, that means the improve has not but been applied. Subsequently, Uniswap doesn’t report this as income.

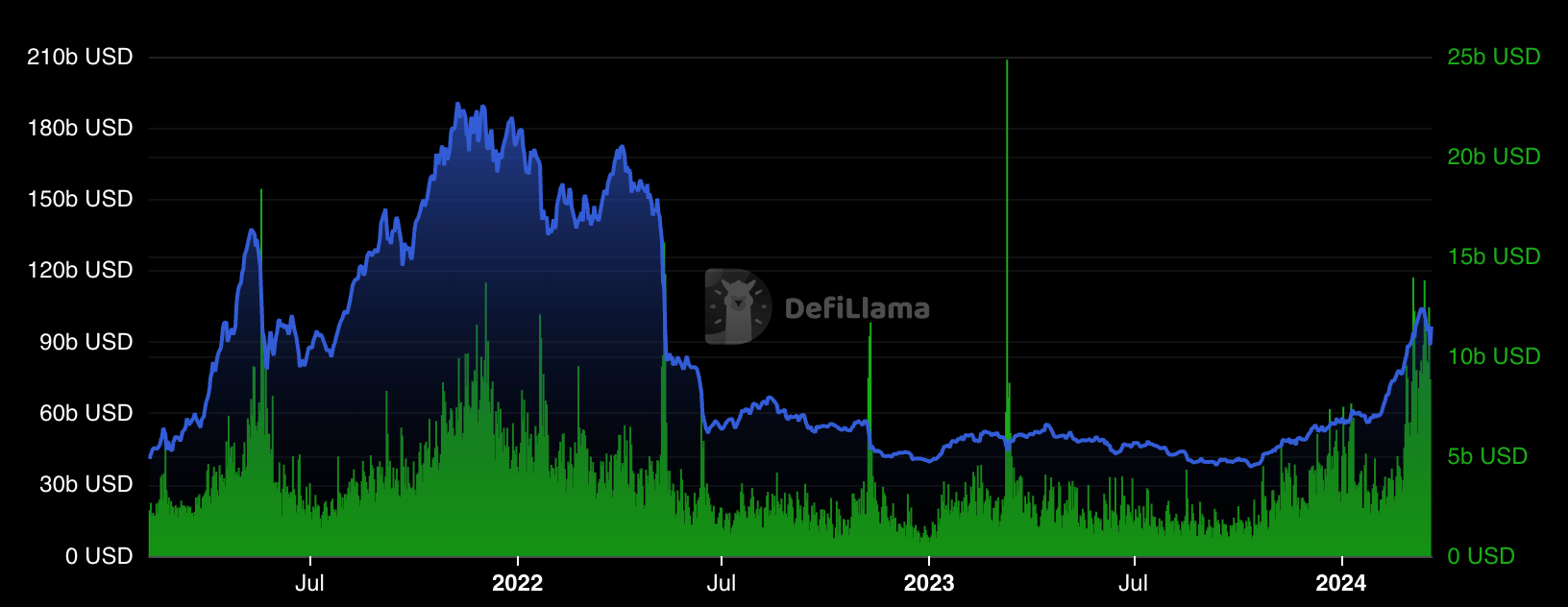

At the moment, the full market capitalization of the DeFi market is $101 billion. crypto slate Knowledge exhibits the sector is up 5% over the previous day. DefiLlama information exhibits that the DeFi market capitalization restoration has not but reached its 2021 peak. Nonetheless, volumes have risen to comparable ranges and are exhibiting a extra constant development. Though it has approached $5 billion for the reason that starting of the 12 months, buying and selling volumes round $10 billion have been widespread over the previous month.

The submit Prime 10 DeFi dApps producing a mean of $4.8 billion in charges per 12 months appeared first on currencyjournals.

(Tag translation) Ethereum