- Analysts consider that privacy-focused crypto property will profit from the criminalization of privateness within the coming years.

- Crypto builders are advocating zero-knowledge proofs to reinforce blockchain privateness.

- The 10x rise in Zcash (ZEC) has elevated the demand for privacy-focused tokens.

A brand new funding narrative round crypto privateness is gaining momentum resulting from a worldwide regulatory crackdown that analysts say is successfully the “criminalization of privateness.” This strain paradoxically legitimizes privacy-centric property.

The market is already reacting, with sector chief Zcash (ZEC) up 10x, indicating what analyst Miles Deutscher believes might be a very powerful Web3 story of the following 5 years.

Regulatory backlash will increase demand for privateness

Deutscher mentioned the rising demand for privacy-focused property is a direct response to authorities overreach. He particularly factors to the European Union’s new anti-money laundering (AML) rules, that are scheduled to return into drive in 2027.

New EU guidelines will ban nameless crypto accounts and privateness cash, require identification verification for transactions over 1,000 euros, and restrict money funds to 10,000 euros.

Deutscher argues that aligning all cryptocurrency transactions with conventional monetary oversight is a key purpose this privateness area will thrive as customers search options.

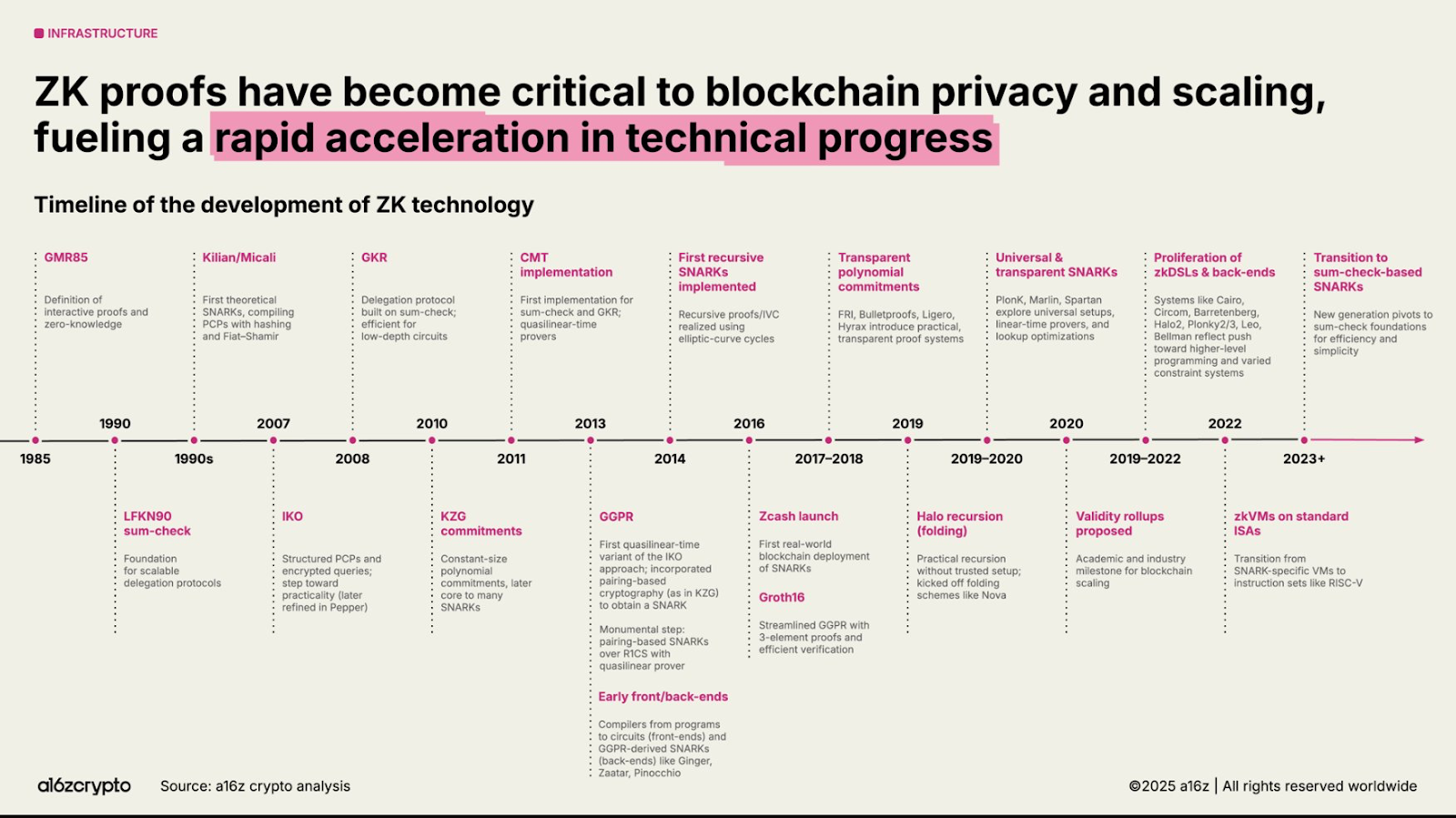

Zero-knowledge proofs acquire institutional assist

This regulatory push coincides with the maturation of privacy-enhancing applied sciences led by Zero-Data Proofs (ZKP). ZKP’s reliability has garnered consideration throughout the trade, with leaders like Vitalik Buterin advocating for on-chain privateness.

This expertise can be gaining recognition inside organizations. Earlier this week, enterprise capital agency a16z requested the U.S. Division of the Treasury to include zero-knowledge proofs into its AML insurance policies upon implementation of the brand new GENIUS regulation.

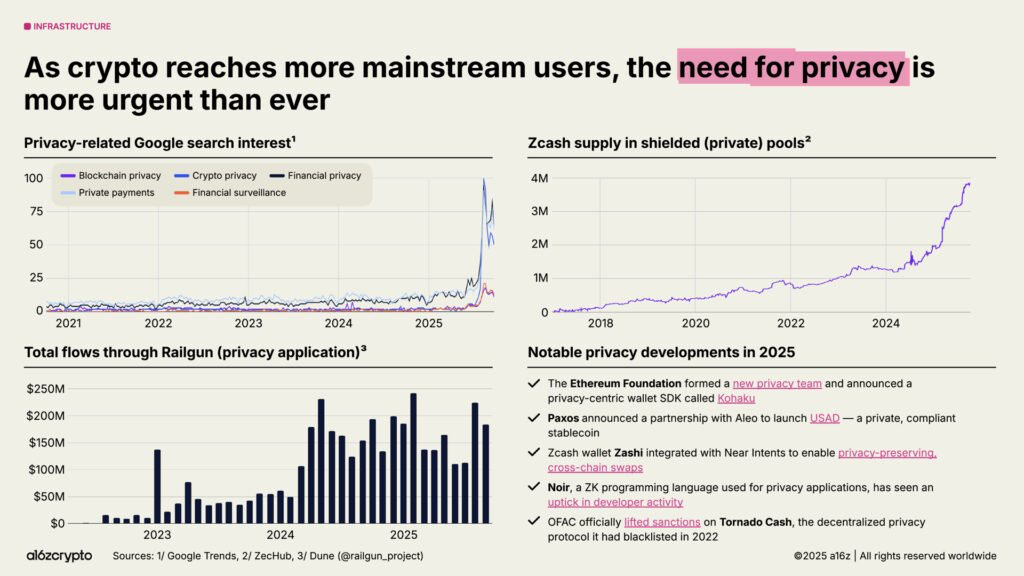

Market proof: 10x rise in ZEC and spike in Google Developments

The market just isn’t ready for a response in 2027. Deutscher factors out that institutional buyers have already signaled their assist, which is mirrored within the surge in demand for privateness property.

The provision of the ZEC Protect pool has elevated to just about 4 million cash, and Google searches for privacy-related crypto tasks are rising. This development is additional fueled by ZEC’s current 10x rally, which has captured market consideration and elevated demand for different privacy-focused tokens.

Prime 3 Privateness Ciphers to Take into account Subsequent

Humanity Protocol (H)

The Humanity Protocol (H) makes use of an analogous strategy to Worldcoin (WLD), however pays extra consideration to privateness. By defending person identities, the H token has elevated quickly over the previous few days.

In line with the newest digital foreign money oracle on the time of writing, H’s market capitalization was roughly $305 million, and the typical 24-hour buying and selling quantity was roughly $30 million. H’s important development is partially pushed by its current partnership with Mastercard.

Canton Community (CC)

Backed by Goldman Sachs, Canton (CC) has grown right into a mid-cap mission with a completely diluted valuation of roughly $4 billion on the time of writing. Deutscher believes CC will turn out to be a serious cryptocurrency participant within the coming years by serving to to allow privateness for main blockchains akin to Ethereum (ETH) and Solana (SOL).

Railgun (RAIL)

Railgun (RAIL) is a small-cap altcoin centered on democratizing privateness in cryptocurrencies. In 2025, the RAIL value elevated tenfold, reaching an all-time excessive of roughly $5.66 on November 6, 2025.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.