- Dozens of nations with low cryptocurrency taxes plan to start automated information sharing underneath CARF by 2027-2028.

- The zero-tax crypto coverage will proceed to be carried out, however underneath sure authorized circumstances.

- The OECD framework targets transparency, not new crypto taxes.

International locations recognized for having low or no taxes on cryptocurrencies are getting into a brand new part of world transparency. Many of those jurisdictions are taking part within the OECD’s Cryptoassets Reporting Framework, which is scheduled to be rolled out in 2027. This framework expands cross-border reporting with out straight altering nationwide tax charges.

Low-tax crypto jurisdictions proceed to draw buyers

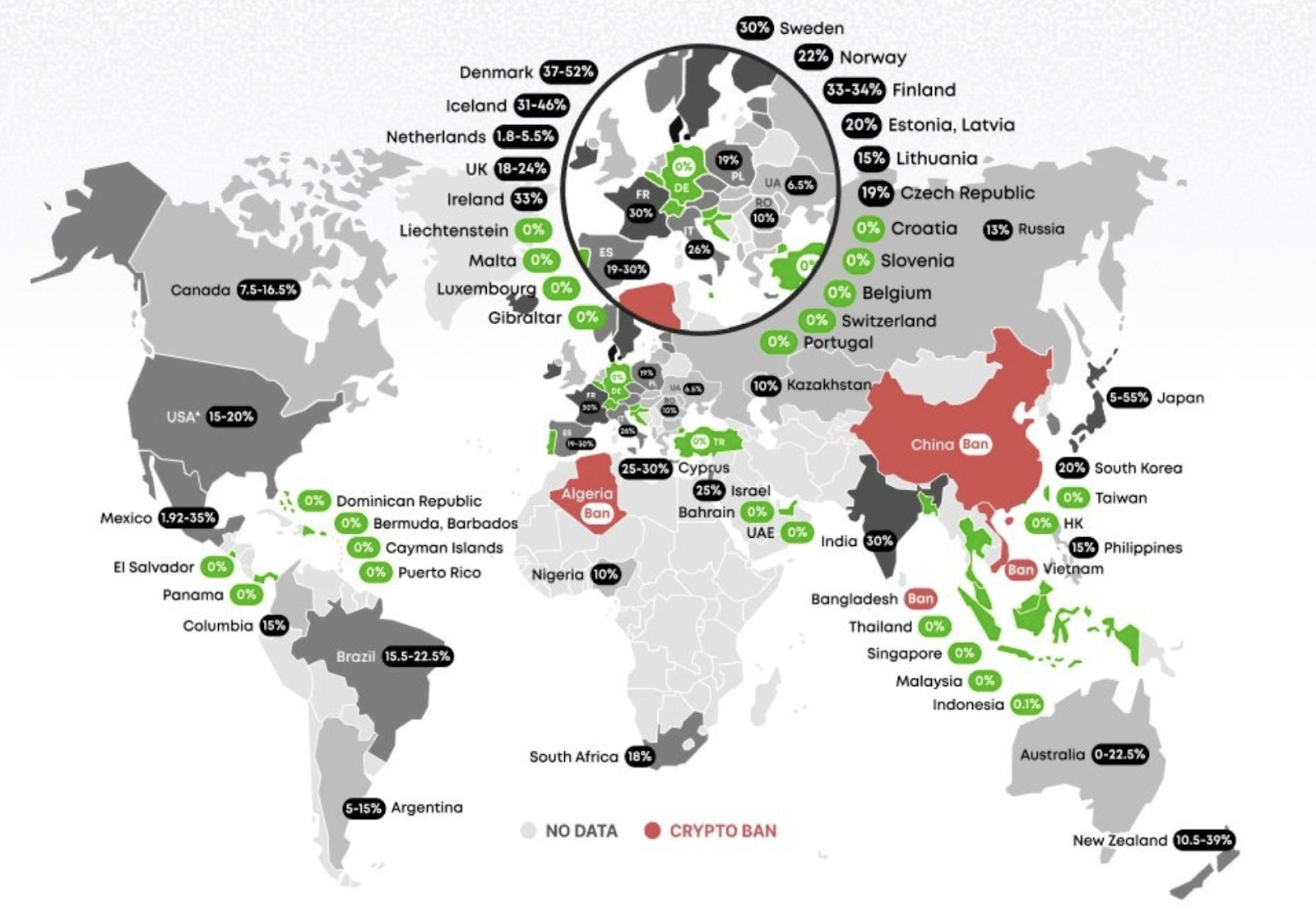

A number of international locations proceed to supply tax incentives to crypto holders. In a latest submit, X customers Star Platinum and Alex Mason revealed an inventory of nations with low or no taxes on cryptocurrencies.

The listing included jurisdictions such because the United Arab Emirates, Singapore, the Cayman Islands, Bermuda, Portugal, Germany, Switzerland, Hong Kong, Panama, and El Salvador.

Star Platinum’s submit outlined the totally different tax remedies, noting that some international locations don’t impose capital positive aspects or revenue taxes on private cryptocurrencies, whereas others solely apply exemptions underneath sure circumstances.

Examples embrace Germany and Portugal, which don’t tax earnings on crypto belongings if the belongings are held for greater than 12 months. In Germany, earnings from shorter holding durations are taxed at charges starting from 14% to 45%. Portugal applies a 28% tax on earnings from belongings offered inside one 12 months.

Conditional exemptions apply in different jurisdictions. Switzerland doesn’t tax particular person buyers’ capital positive aspects, however it does impose a wealth tax of 0.5% to 0.8% yearly. Slovenia applies a ten% tax on digital foreign money withdrawals and funds, whereas Malta and Cyprus solely tax digital foreign money whether it is handled as enterprise revenue.

In the meantime, Alex Mason’s submit targeted on international locations with 0% crypto tax, together with the UAE, Cyprus, Malta, Switzerland, Slovenia, Puerto Rico, and the Cayman Islands.

CARF introduces international cryptocurrency reporting customary

In a notable growth, the OECD has launched an up to date listing of jurisdictions working to implement the Crypto Asset Reporting Framework (CARF). CARF requires cryptocurrency service suppliers to gather and share person transaction information with tax authorities, and for tax authorities to alternate data throughout borders.

A complete of 48 jurisdictions are anticipated to start preliminary exchanges by 2027. This group consists of Germany, France, Japan, the UK, Italy, Spain, Portugal, Malta, Gibraltar, Liechtenstein, South Africa, and the Cayman Islands.

Twenty-seven different jurisdictions, together with the UAE, Singapore, Switzerland, Hong Kong, Panama, Bermuda, Barbados, Malaysia and Mauritius, have dedicated to launching exchanges in 2028. America plans to start the alternate in 2029.

International locations that haven’t but dedicated stay within the minority.

5 jurisdictions recognized as related by the World Discussion board haven’t but dedicated to a CARF implementation schedule. These embrace El Salvador, Georgia, Vietnam, Argentina, and India.

Argentina is adhering to the joint assertion of intent to implement CARF, and India is making progress on its political commitments.

Regardless of the present state of affairs, these jurisdictions should face strain to align with international reporting requirements as worldwide cooperation expands.

CARF doesn’t impose new taxes or standardize tax charges throughout the nation. As an alternative, it focuses on data sharing to scale back tax evasion and enhance compliance. Cryptocurrency tax coverage will proceed to be decided on the nationwide stage, however authorities could have broader visibility into cross-border crypto exercise.

As this framework takes impact, tax residence and revenue classification are anticipated to play a better function in figuring out a person’s tax legal responsibility.

Associated: South Korea indicators OECD Cryptocurrency Reporting Settlement, aiming for implementation in 2027

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.