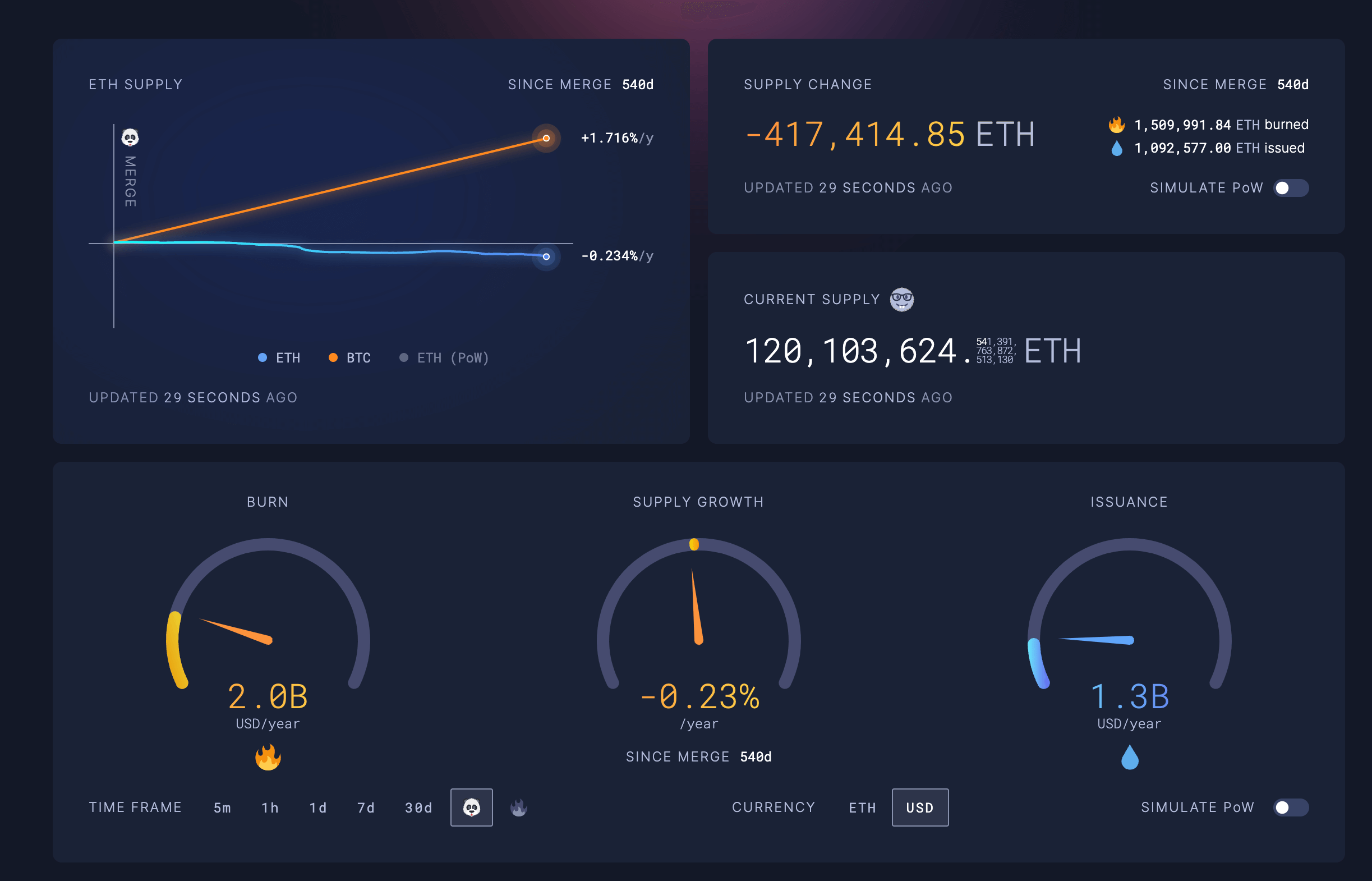

Since transferring to a proof-of-stake (PoS) consensus mechanism in September 2022, the Ethereum community has seen a lower in provide by 417,413 ETH, in response to knowledge from Ultrasound.cash. Within the 540 days for the reason that merge, 1,509,991 ETH has been burned, whereas the community has issued 1,092,578 new ETH, a internet loss.

On the time of writing, the market worth of ETH faraway from provide is $1,653,797,635, with an annual inflation fee of -0.23%.

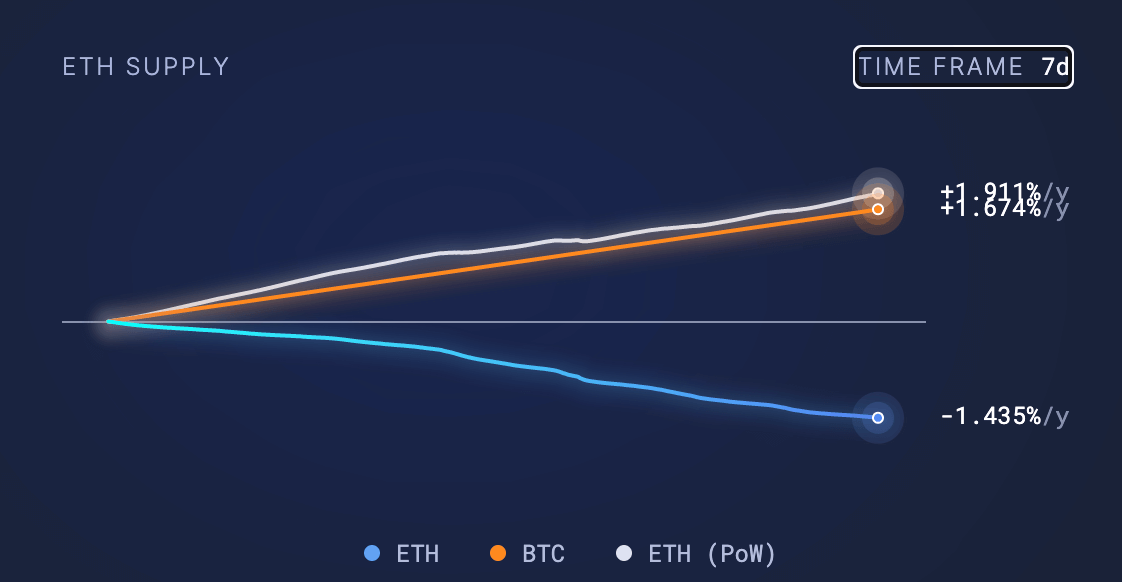

In distinction, Bitcoin's provide elevated by 1.716% over the identical interval. This highlights the variations within the financial insurance policies of the 2 largest cryptocurrencies, as Bitcoin maintains a predictable issuance schedule. On the similar time, the stability between staking rewards and transaction charge burnout now determines modifications in Ethereum's provide.

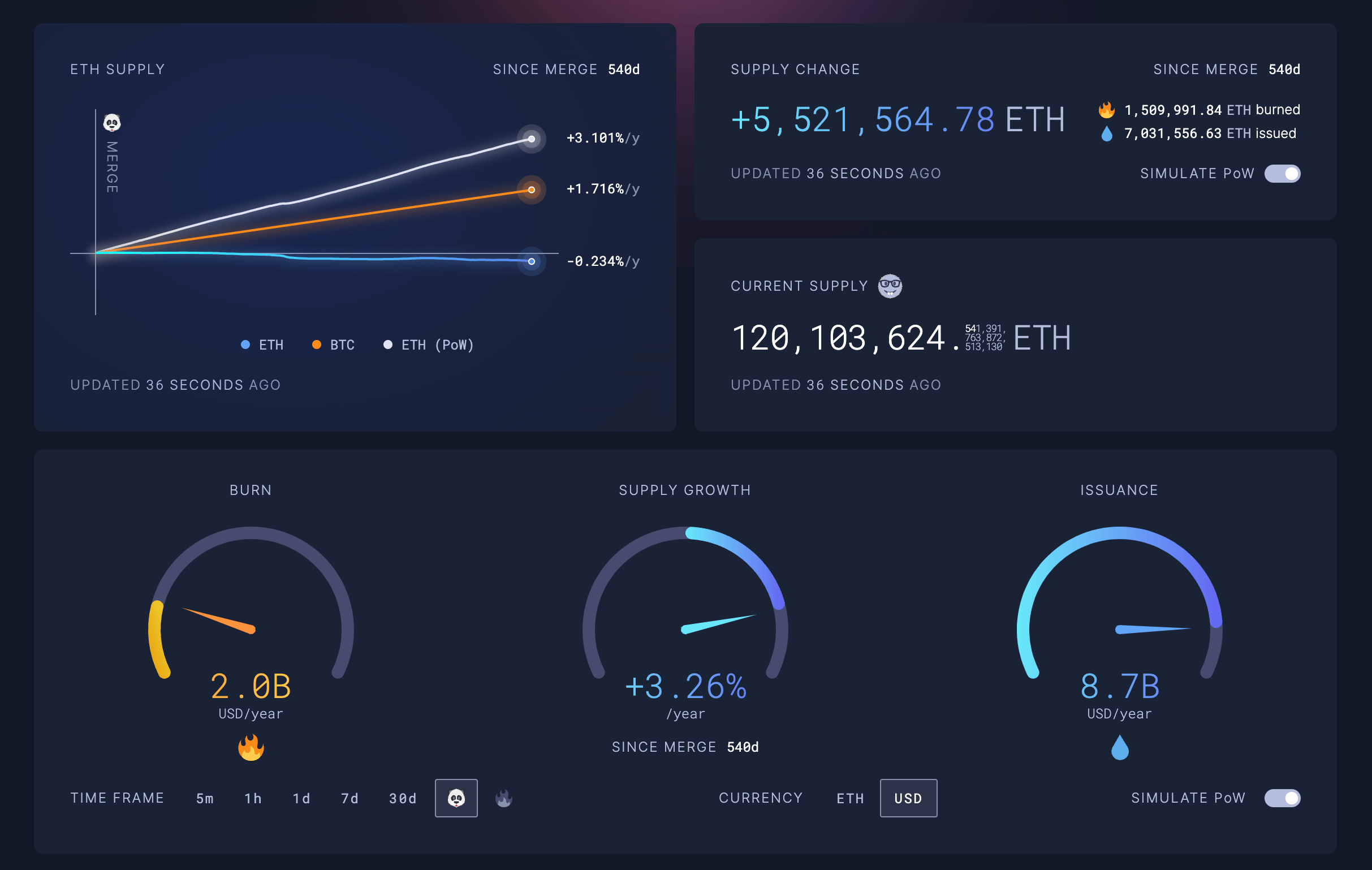

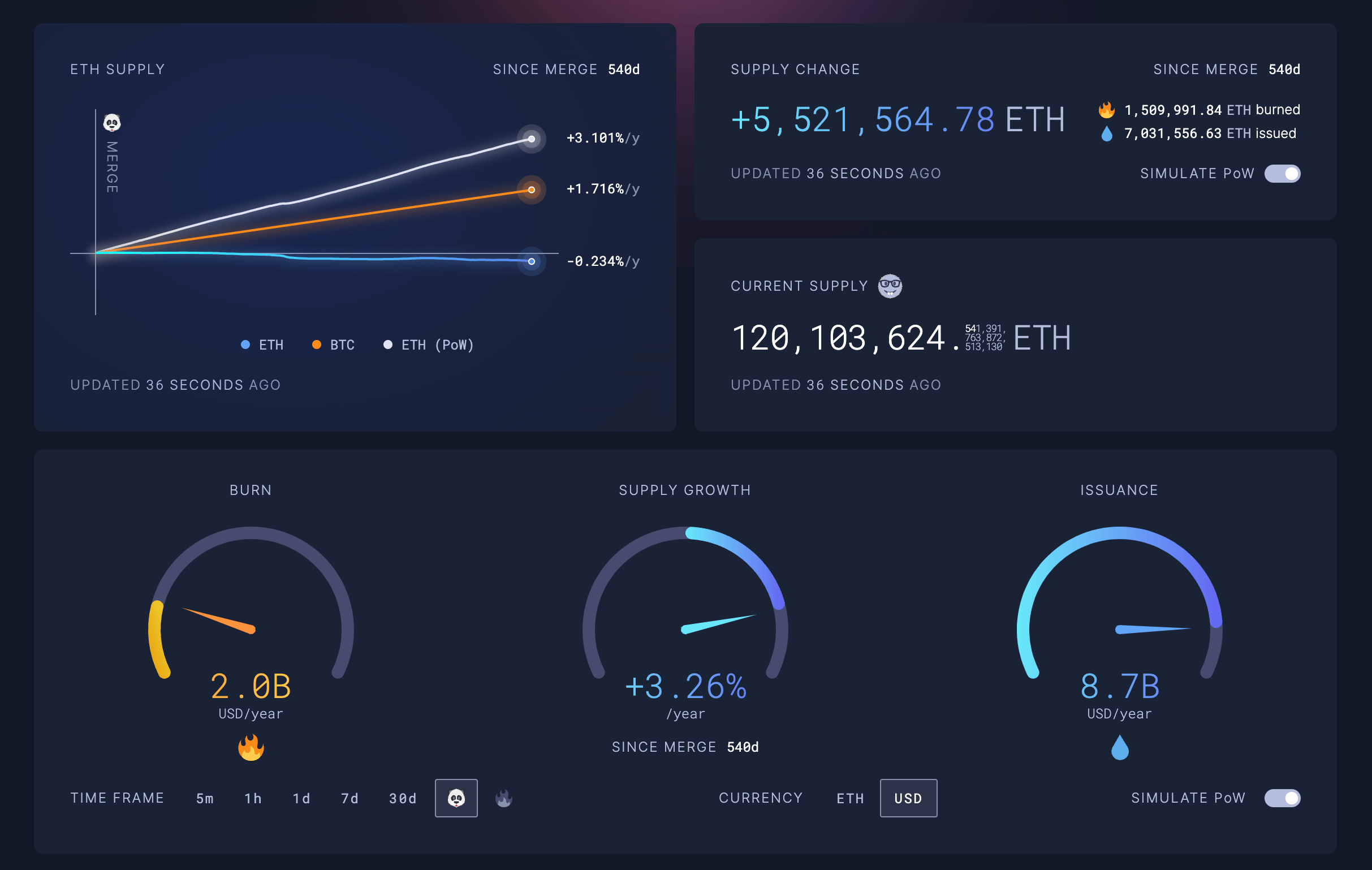

Proof-of-Work (PoW) simulations on the Ultrasound.cash dashboard present that Ethereum’s provide would have elevated by greater than 5.5 million ETH over the identical interval if the community had not transitioned to PoS. Proven. Beneath the PoW mannequin, simulations present that on the similar burn fee of 1.5 million ETH, 7,031,556 ETH can be issued, resulting in a internet improve of 5,521,564 ETH for the reason that merger. The worth of the ETH issued on this simulation can be $21,865,393,440, leading to a theoretical inflation fee of three.26%.

This clear distinction highlights the deflationary impression of Ethereum’s new consensus design in comparison with earlier mining-based programs. The transfer to PoS has led to a validator staking ETH securing the community on behalf of his PoW miner, which has considerably lowered new ETH issuance. This alteration, coupled with the continued burn mechanism launched in EIP-1559, is placing downward strain on Ethereum provide development.

In line with real-time knowledge, the full circulating provide of Ethereum is at the moment 120,103,624 ETH. Alternatively, PoW simulations estimate that if the miner had nonetheless powered the community with the previous mannequin, the provision would have reached 125,625,188 ETH.

The decline in provide since The Merge is in keeping with the Ethereum neighborhood's imaginative and prescient of deviating from Bitcoin's fastened inflation schedule and making ETH a deflationary asset in the long term. Proponents imagine that the mix of staking rewards and charge burning will proceed to offset new issuance, probably leading to durations of provide volatility which might be internet damaging.

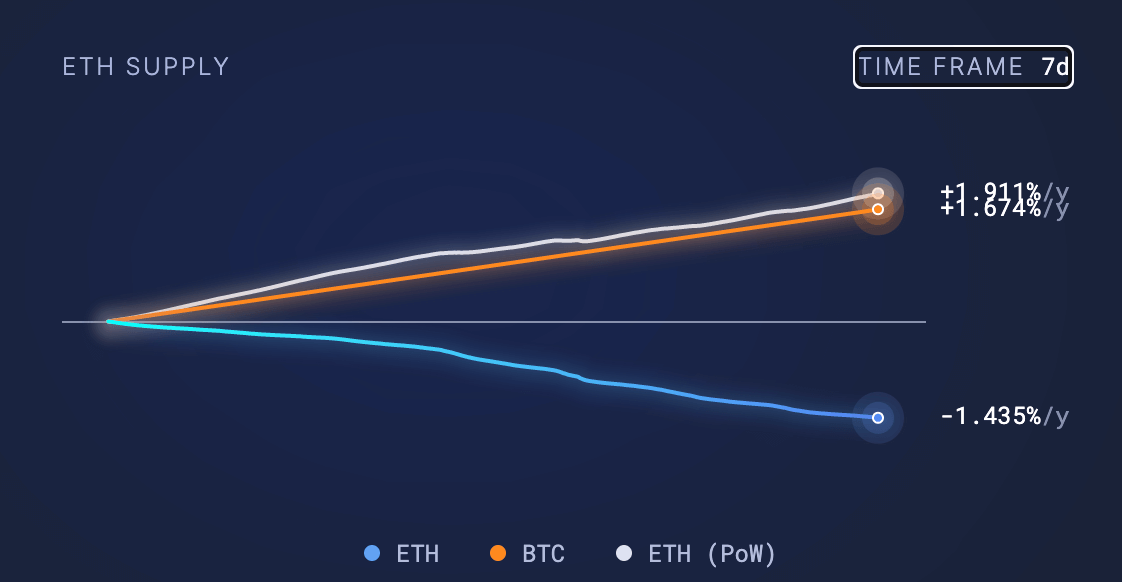

Over the previous 7 days, the rise in ETH community charges has helped speed up the deflationary habits, growing to -1.435%. Furthermore, even underneath PoW, that inflation fee would have dropped to his 1.911% because of the spike in community exercise and correlation with the burn mechanism.

Nevertheless, critics argue that the transfer to PoS has centralized management of the community within the fingers of main staking entities and exchanges. In distinction to Bitcoin's decentralized mining community, some have warned that the focus of staked ETH might undermine Ethereum's decentralization and safety ensures.

As Ethereum continues to evolve underneath the brand new PoS regime and Bitcoin retains its established PoW mannequin, observers shall be watching carefully to see how their respective provide dynamics and safety tradeoffs play out. It is going to be. As the quantity of Bitcoin issued approaches half because of the upcoming halving, the inflation fee is predicted to fall to 0.8%, inside 1% of Ethereum. Nevertheless, the provision of Bitcoin is fastened and the inflation fee will finally fall to zero. Ethereum's inflation fee is said to community exercise and the quantity consumed via community transactions.

Nonetheless, ETH's deflationary pattern over the previous 540 days presents an early glimpse into the potential way forward for the 2 largest cryptocurrencies forward of the primary Bitcoin halving for the reason that merge. The long-term sustainability and impression of each networks stays to be seen, however Bitcoin is at the moment thriving with a market capitalization of $1.3 trillion, adopted by Ethereum at $478 billion.

talked about on this article

(Tag translation) Bitcoin