- Pump.Enjoyable faces resistance at $0.00745 regardless of the acquisition that offsets 7.9% of provide.

- On-chain knowledge reveals that the outflow is $3.27 billion, with income near a short-term excessive.

- Key assist is $0.00628-0.00585, with upside targets being $0.0078-0.0081.

Pump.Enjoyable Worth trades at present at $0.00676 and glides practically 2% as consumers wrestle to develop their restoration above the important thing Fibonacci and EMA resistance zones. The latest $54 million buyback has rekindled group belief, whereas the sustained outflow suggests short-term hesitation amongst merchants.

Pump.Enjoyable Worth Take a look at Central Fibonacci Resistance

Pump worth dynamics (Supply: TradingView)

Pump.Enjoyable stays locked between Fibonacci retracement ranges of 0.5 ($0.00695) and 0.618 ($0.00745) and reveals resistance tolerance after final week’s rebound. The 20-day EMA at $0.00677 continues to realize momentum within the upward momentum, whereas the 50-day EMA at $0.00648 serves as rapid dynamic assist.

The 200-day EMA is low at $0.00585, forming a strong base for deeper correction. The RSI studying hovered close to 51.4, indicating impartial momentum after cooling from ranges approaching the start of the week. If the customer is unable to retrieve the $0.00745 zone, the chance of one other retest could be $0.0060, converging the 50 EMA and 0.382 retracement.

A $54 million buyback helps fundamental belief

The official October 4 replace of Pump.Enjoyable revealed a $54,273,082 repurchase in pump tokens between September 4th and October 2nd. The acquisition offsets roughly 7.9% of the round provide, highlighting some of the aggressive token repurchase packages of the outlined property.

This technique strengthens investor confidence by lowering provide strain, however timing amid a decline in on-chain inflows raises questions in regards to the sustainability of present gatherings. Buybacks present structural assist, however the wider market stability of pumps is determined by constant ecosystem exercise and ongoing income progress.

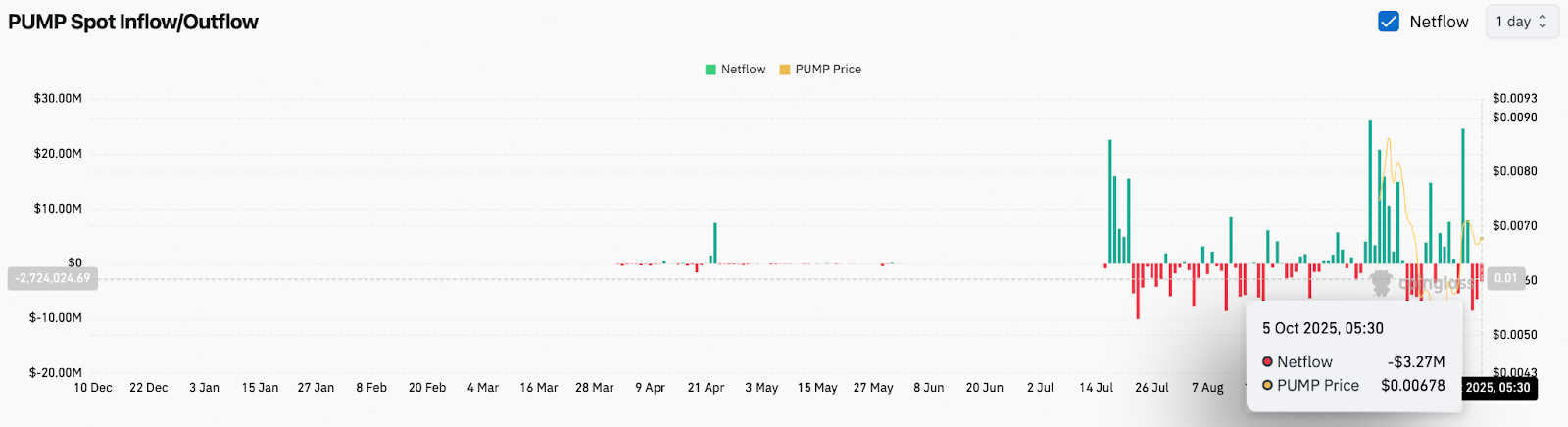

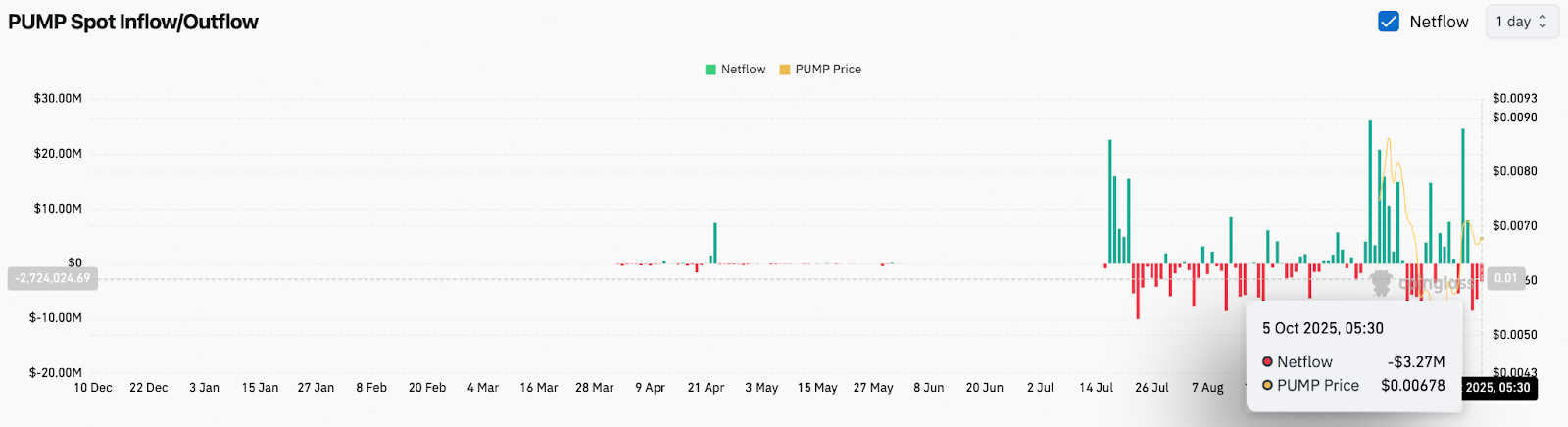

On-chain knowledge reveals up to date leaks

Pump Web Stream (Supply: Coinglass)

Coinglass knowledge confirmed a web outflow of $3.27 million on October 5, indicating a noticeable shift from the influx stripes seen earlier this month. Regardless of the bullish buyback headline, it seems that short-term merchants are profiting by approaching the $0.007-0.0074 vary.

The persistence of the purple Netflow bar from late September to October means that speculative capital is spinning after the earlier spikes of the pump. Persistent outflows may additional restrict worth progress, particularly if buyback actions slower than $2 million a day.

Pump.Enjoyable worth technical outlook

Pump.enjoyable Quick-term Worth Forecast identifies the vital assist and resistance ranges to watch.

- Upward goal: $0.00745 (FIB 0.618) and $0.00810 (FIB 0.786) stay vital hurdles earlier than retesting $0.0089.

- Disadvantages assist: $0.00628 and $0.00585 kind a right away demand zone.

The EMA alignment reveals a short-term integration because it requires near-dominance of over $0.00745 to reaffirm its management. Dropping $0.00648 may put your token to a different weak spot in the direction of $0.0058.

Outlook: Will pump.enjoyable go up?

Pump.Enjoyable’s short-term outlook is determined by whether or not an aggressive buyback program can outweigh the pressures from ongoing spills. The muse stays sturdy, with cumulative purchases bought from the beginning for practically $126 million, however the expertise reveals integration after a pointy rebound.

If the pump exceeds $0.0065 and the influx resumes, the cross to $0.0078-$0.0081 will stay open. Failure to keep up that flooring may trigger sentiment to return from impartial to reveal tone, with merchants taking a look at $0.0058 as their subsequent key protection line.

For now, pumps stay asset certain to the steadiness between highly effective toconomies and short-term liquidity decline.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.