Grand Cayman, Cayman Islands, July 9, 2024, Chainwire

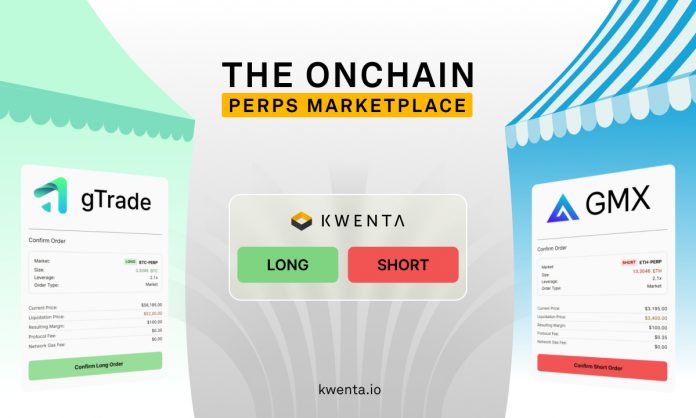

In a step ahead for Arbitrum's derivatives ecosystem, two distinguished DeFi initiatives, GMX and Features Community, have introduced bids to combine their platforms into Kwenta's upcoming perpetual bond market. Kwenta, Optimism's main perpetual bond futures change, expanded its attain with the launch of the Base Community earlier this yr, reflecting bigger plans to attach derivatives liquidity throughout a number of chains. The announcement follows the current approval of a grant from the Arbitrum DAO aimed toward supporting Kwenta's preliminary enlargement onto the Arbitrum Community.

GMX and Features Community Product Choices

GMX and Features Community have submitted proposals to combine their liquidity into Kwenta's platform. These integrations goal to boost the buying and selling expertise for Kwenta customers by offering entry to extra markets and liquidity, whereas leveraging Kwenta's UX-focused roadmap, together with permitting merchants to log in with conventional Web2 credentials and sponsoring gasless buying and selling.

GMX v2, Arbitrum's flagship perpetual futures AMM (Automated Market Maker), constructed on the preliminary success of the v1 product by being the primary to combine Chainlink Knowledge Streams, a low-latency product from a number one oracle supplier focused at high-performance purposes. GMX v2's low charges and broad collection of obtainable markets have rapidly made it common with on-chain merchants.

Recognized for its gTrade platform, Features Community gives a variety of buying and selling pairs, together with cryptocurrencies, foreign exchange and commodities, supported by a decentralized oracle community. Features Community's revolutionary strategy to perpetual futures permits merchants to entry as much as 150x leverage throughout a rising variety of round 200 markets.

Strengthening the arbitration ecosystem

The combination of GMX and Features Community into Kwenta's perpetual market is predicted to speed up the expansion of the on-chain perpetual sector by permitting customers to simply entry superior DeFi merchandise by means of Kwenta's easy-to-use UX layer. Whereas retail-focused purposes have made nice strides by giving customers fast entry to the most effective costs for token swaps and bridging, on-chain leverage has remained a fancy product for extra refined DeFi fans.

This strategic enlargement consolidates Arbitrum's hottest derivatives buying and selling venues onto a single platform, offering a easy and acquainted expertise for merchants new to on-chain merchandise. Kwenta's roadmap guarantees to construct out these quality-of-life options and allow customers to function a number of protocols in a single software.

Future outlook

Kwenta is presently soliciting group suggestions on these proposals in the direction of finalizing its perpetual market. Potential integration with GMX and Features Community aligns with Kwenta's mission to supply an excellent decentralized buying and selling expertise. With these developments, Kwenta goals to change into the main venue for DeFi derivatives buying and selling on Arbitrum.

About Quenta

Kwenta is an on-chain derivatives market on Optimism, Base and Arbitrum. The platform supplies easy-to-use instruments that permit customers to entry deep on-chain liquidity and low charges whereas sustaining full management over their funds. With over $50B in buying and selling quantity by means of its community-governed platform, Kwenta is dedicated to creating instruments that deliver DeFi to everybody.

For extra info, customers can comply with Kwenta's governance dialogue channel on Discord.

contact

MarketingDAOPM

Bert Rock

Quenta

(e-mail tackle protected)

(Tag ToTranslate) Press Launch