- Hedge fund legend Ray Dario warns that the US is dealing with a “debt-induced financial coronary heart assault” as a result of its debt

- He factors out a $2-year deficit, suppressing international demand for the US Treasury as a serious threat issue.

- Dario sees exhausting belongings with restricted provide like gold and Bitcoin as “engaging options.”

Billionaire investor and hedge fund legend Ray Dario has issued a harsh warning in regards to the US financial system, predicting a “debt-induced financial coronary heart assault” pushed by unsustainable authorities spending.

In an in depth put up rebutting a Monetary Occasions article, he introduced the case on why the US debt disaster is reaching a crucial stage and why belongings corresponding to Gold and Bitcoin have change into important options for traders.

$2 trillion deficit and provide and demand disaster

Dario’s central argument is that the US is “the second half of a serious debt cycle,” and its monetary state of affairs is not acceptable.

What are the numbers behind the debt disaster?

He factors out that the federal authorities is predicted to spend $7 trillion the next yr, however will solely increase $5 trillion in taxes. This leaves a $2 trillion deficit behind, and requires funding by issuing extra debt, pushing citizen debt upwards of over $37 trillion and the debt-to-GDP ratio to almost 120%.

Associated: Debt, Deficit, Greenback: Why Bitcoin and Cryptocurrence amid the US fiscal downside

Why is there a “provide and demand downside” in US debt?

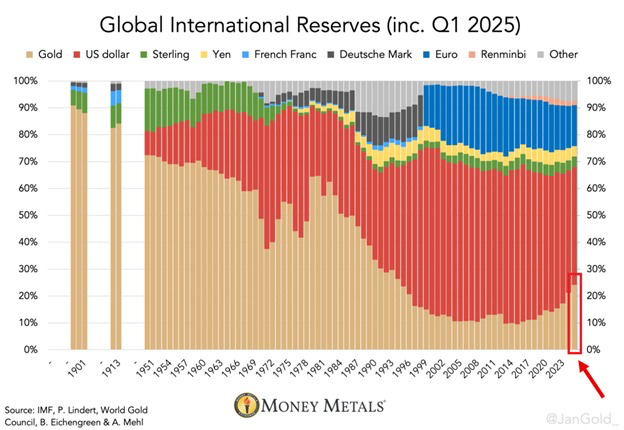

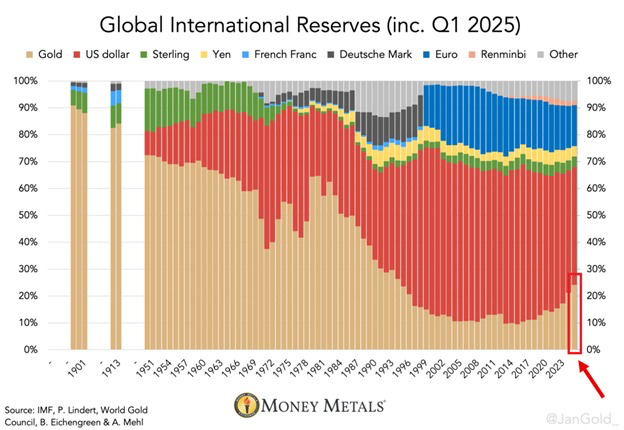

The US is issuing report quantities of debt, whereas the biggest international consumers promote it. Main US Treasury holders, like China and Japan, have considerably diminished their holdings. This declining demand, mixed with an explosive provide, is a recipe for what Dario calls an “financial coronary heart assault.”

Why is Dario bullish on cash and code?

With authorities debt and the worth of Fiat forex in danger, Dario factors to 2 distinct options for traders trying to keep their wealth.

Why does Dario see worth in gold and bitcoin?

Dario argues that arduous belongings with restricted provide, corresponding to gold and Bitcoin, have gotten more and more engaging as the federal government is compelled to print extra money to cowl its debt.

he,”…If the provision of greenback cash rises or demand for it drops, it may make crypto a beautiful various forex.”

This view is mirrored by corporations like JpMorgan. JPMorgan factors out that Bitcoin is undervalued in comparison with gold.

Associated: jpmorgan says bitcoin is undervalued and units 126k truthful worth vs. gold

Does Stablecoins assist to resolve the issue?

Dario factors out an attention-grabbing exception. He believes that well-regulated, secure stability usually supported by the US Treasury Division may really improve the demand for US debt from the crypto ecosystem, a view supported by the latest genius legislation below the Trump administration.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.