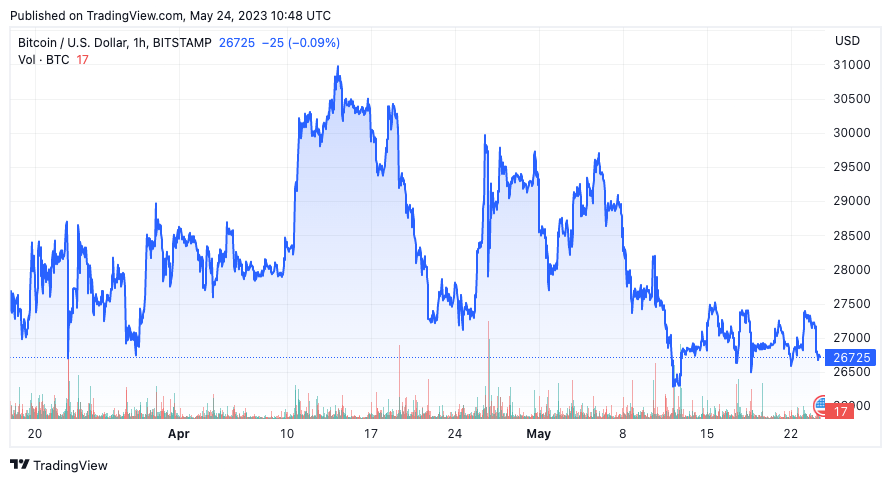

The Bitcoin market was quiet for many of Might, with costs hovering in a comparatively secure vary between $26,000 and $28,000.

Beneath this seemingly calm floor, nonetheless, a number of on-chain indicators level to potential shifts in market sentiment and investor conduct.

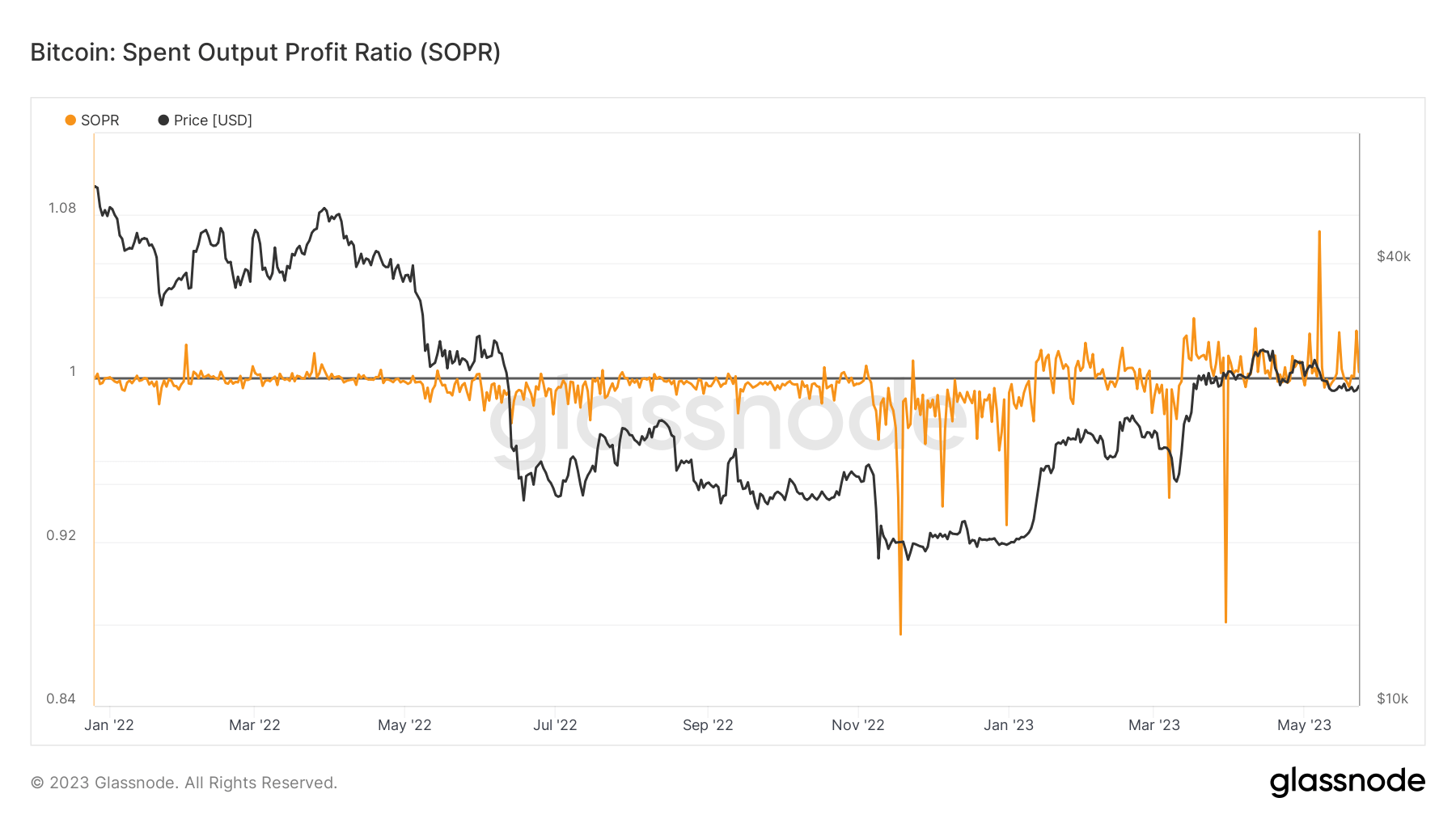

Revenue on Manufacturing Spent (SOPR) is a invaluable measure of profitability and losses suffered by the market. A SOPR worth larger than 1 signifies that the cash moved on the chain throughout that interval are being bought profitably on common. Conversely, if the SOPR worth is lower than 1, it means the coin is promoting at a loss on common.

The SOPR is trending downward and is progressively approaching the vital worth of 1. Whereas this may occasionally look like trigger for concern, bear in mind that falling SOPR values might additionally point out a market part the place traders are holding property in anticipation of favorable market circumstances. You will need to Or the worth could also be greater sooner or later.

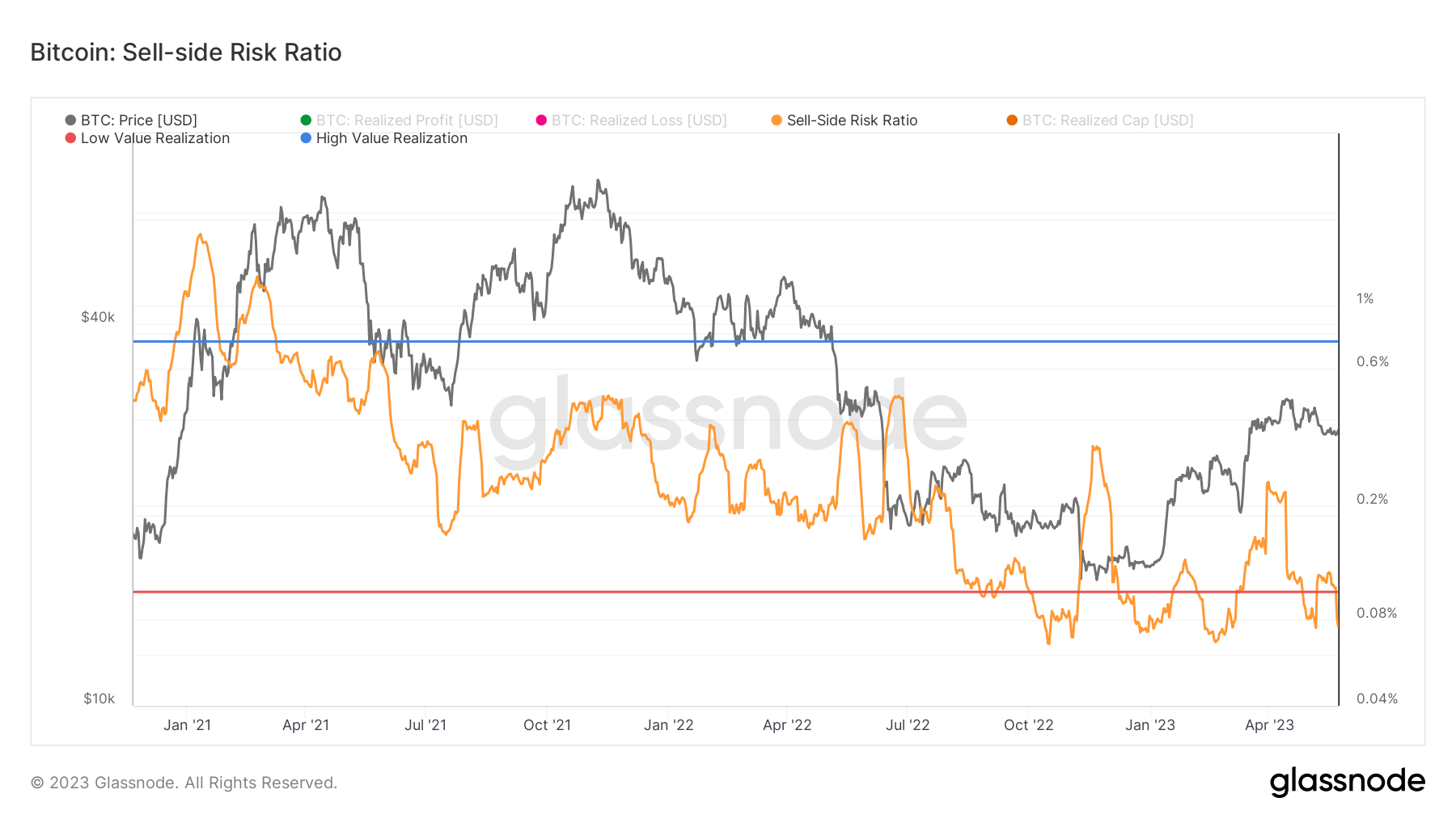

The sell-side danger ratio gives invaluable perception into the general sell-side strain out there by evaluating the entire USD spent by traders on-chain to the realized market capitalization. A low ratio signifies comparatively minimal whole sell-side danger out there. This implies a interval of low worth realization and diminished market volatility, which is commonly related to market consolidation and sideways developments.

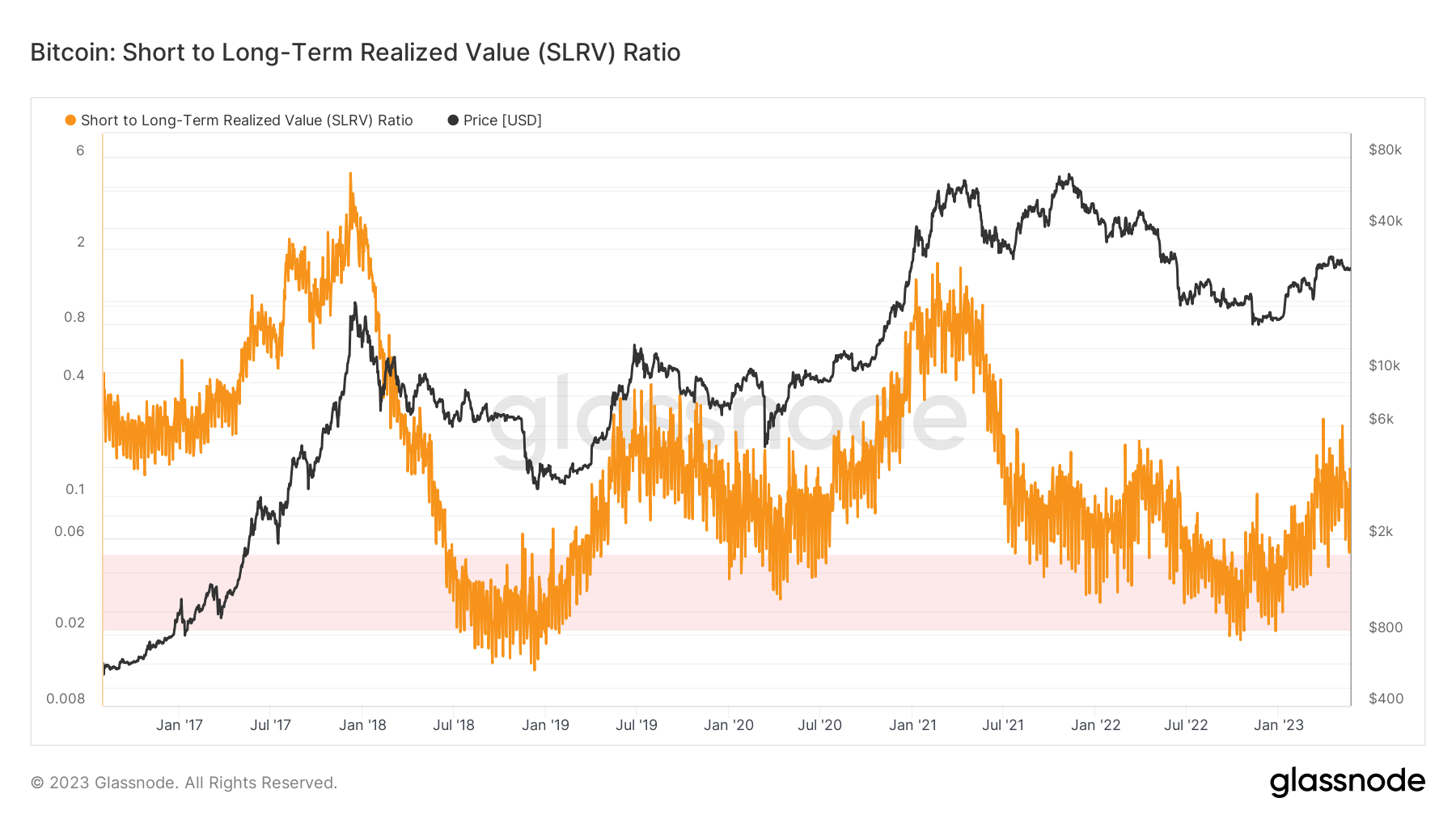

The Brief-to-Lengthy Realized Worth Ratio measures short-term buying and selling exercise and long-term holdings. A low SLRV ratio suggests restricted short-term exercise and curiosity in Bitcoin or a rising base of long-term holders. This might point out an accumulation part and a comparatively low sell-side danger setting.

a crypto slate As we speak’s evaluation reveals that whales holding over 10,000 BTC have gathered for a lot of April and are on the verge of additional accumulation.

Since early Might, the SLRV ratio has proven a downward pattern. That is per earlier findings and additional helps broader market developments of low sell-side danger and creating fertile soil for accumulation.

Whereas the present scenario within the Bitcoin market presents a seemingly peaceable look, a deeper evaluation of on-chain indicators reveals refined nuances which will form future value actions. Decrease SOPRs, decrease sell-side danger ratios, and decrease SLRV ratios level to a market setting characterised by low volatility, consolidation, and potential accumulation phases.

Regardless of the latest lull, a put up first appeared on currencyjournals that on-chain indicators present potential for Bitcoin’s upcoming volatility.