vital level

- Regulators have been cracking down on the U.S. crypto business, with lawsuits towards Binance and Coinbase lately introduced.

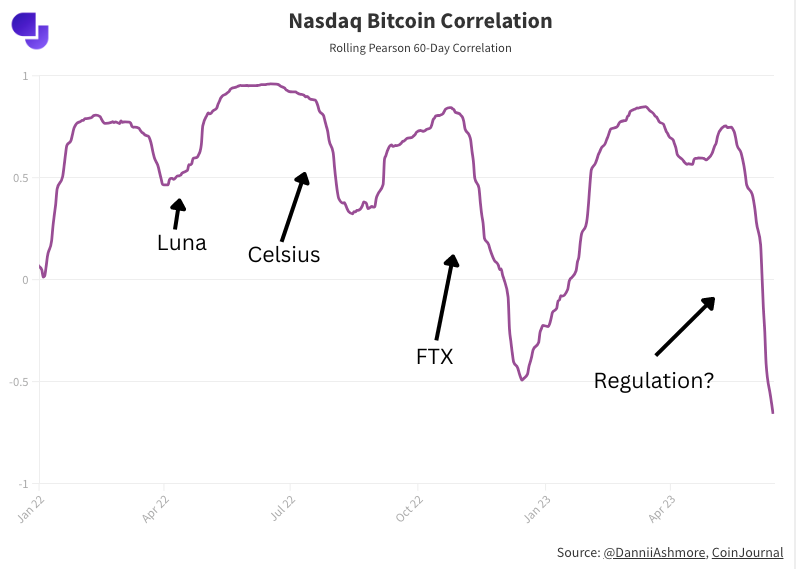

- Bitcoin-equity correlation is at a five-year low, the latter is skyrocketing, however considerations over the way forward for the US business are holding again Bitcoin’s value.

- The change has recorded 33 consecutive days of web outflows, however withdrawals haven’t been notably noteworthy

- Largest withdrawal quantity is Binance, with 7.3% of stability heading for exit

- Allegations towards Binance transcend securities violations confronted by most centralized corporations

The warfare between Binance and the SEC continues. So is Coinbase. Equally, the cryptocurrency business as an entire is instantly dealing with a regulatory risk that makes the U.S. cryptocurrency business really feel like an existential risk.

Unsurprisingly, the market responded with a promote. Bitcoin fell under $25,000 final week for the primary time in three months, however has since rebounded and is now buying and selling at $26,500.

However extra notably, this occurred throughout a inventory market rally. As I’ve elaborated final week, the correlation between shares and Bitcoin is now at its lowest stage in 5 years. That is much like the drop in correlation seen in November when FTX crashed amid a inventory market surge following lower-than-expected inflation.

As such, bitcoin’s value drop could appear minor at first look, nevertheless it’s been performing comparatively poorly as the remainder of the market has been so scorching.

As such, bitcoin’s value drop could appear minor at first look, nevertheless it’s been performing comparatively poorly as the remainder of the market has been so scorching.

change bitcoin

However aside from value, how are markets reacting? Are individuals once more involved about storing belongings on these centralized exchanges?

Trying on the whole quantity of bitcoins saved on these exchanges, there have been 33 consecutive days of web outflows. This would be the longest since November 2022 in the course of the FTX scandal.

Nonetheless, the withdrawals should not the identical measurement. Again in November, the final time we noticed constant web withdrawal flows, FTX was uncovered as bankrupt (and fraudulent) after dropping $8 billion in shopper belongings. Concern was so excessive that the complete market panicked, fearing different exchanges would observe swimsuit.Bitcoin ran to the exit doora lot of which is distributed on to chilly storage (or bought for money).

Whereas present developments are worrying for cryptocurrencies in their very own method, there doesn’t seem like any concern that buyer funds might be in danger. This isn’t a repeat of his FTX, and the market response has additionally calmed down considerably.

In reality, taking a look at whole Bitcoin balances throughout exchanges, we will see that the latest drop has not stood out within the sharp downward development we now have seen since early 2020.

Is Binance Totally different?

However what about Binance? The costs directed on the world’s largest cryptocurrency change are definitely extra despicable than a mere securities breach. Binance and CEO Zhao Changpeng Encourages Clients to Commerce, Manipulate Buying and selling Volumes, Fail to Observe Correct Cash Laundering Procedures, and Encourage US Clients and VIPs to Keep away from Location-Based mostly Restrictions and commingling with shopper funds.

It is the latter accusation that is making headlines, evoking painful recollections of FTX. I’ve criticized Binance for working in an extremely opaque method (Binance has all the time refused to reveal their debt), the place buyer funds had been misappropriated, like within the FTX scandal. Thus far there isn’t a proof of that. Once more, this actually has little in widespread along with his FTX scenario.

On Saturday, a US court docket even accredited an settlement between Binance and the SEC to dismiss a short lived injunction freezing all belongings of Binance.US.

“We’re happy to announce that the court docket has denied the SEC’s request to freeze TROs and belongings on our platform which is clearly unjustified each factually and legally,” Binance.US mentioned on Twitter.

This appears to have softened the apocalyptic situation, even when it was attainable from the start. Nonetheless, once we particularly have a look at the circulation of funds on Binance, we see extra outflows than different main exchanges. Two weeks after the lawsuit was introduced on June 5, 7.3% of Bitcoin balances had been withdrawn. This equates to 52,000 bitcoins, or about 0.3% of the full circulating provide.

For context, 13.3% of Bitcoin balances had been withdrawn in an analogous two-week interval when Binance got here below hearth for its lack of transparency relating to its reserves after the FTX collapse. As you may see within the graph above, the quantity is clearly massive, nearly double the circulation. That is what we have seen thus far throughout this SEC lawsuit.

What does all this imply? Not that many, actually. Binance has been working within the shadows for a very long time. right here It was an extended awaited day when the SEC lawsuit was introduced. Nonetheless, considerations in regards to the security of shoppers’ funds shouldn’t rise instantly, which is mirrored within the comparatively low outflow of funds from the platform.

Nonetheless, the allegations towards Binance go far past merely promoting unregistered securities, which is the primary situation throughout the business (and Coinbase is being sued). Because of this cash is flowing out of Binance at a sooner tempo than different exchanges, even when its measurement will not be a trigger for concern.

Total, the response is no surprise. In reality, there was no information of those lawsuits both.

(tag translation) evaluation

Comments are closed.