- In 2024, retail Bitcoin inflows fell greater than 5 occasions as ETFs shifted investor exercise.

- Small holders decreased international trade deposits in favor of ETFs and long-term self-custody.

- As a result of accumulation of establishments and corporations, the worth improve of Bitcoin is now over $100,000.

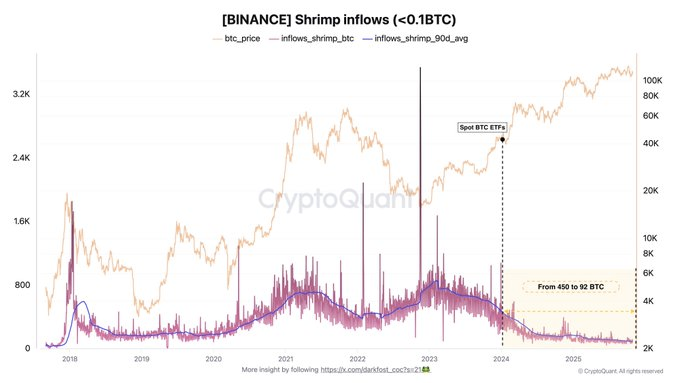

Retail participation in Bitcoin has declined over the previous two years, with new information displaying a major decline in flows from small holders, also known as “shrimps,” to giant exchanges like Binance. These traders, outlined as wallets holding lower than 0.1 BTC, have been much less energetic because the rollout of the US spot Bitcoin exchange-traded fund (ETF) in early 2024.

Based on current information from CryptoQuant, inflows from this section have fallen to a mean of 92 BTC per day, in comparison with 552 BTC firstly of 2023. This metric, based mostly on a 90-day shifting common, exhibits that deposits amongst small holders have declined by greater than 5 occasions. This marks one of many largest declines in retail exercise because the start of Bitcoin.

Associated: Bitcoin retail sentiment collapses. Is that this a contrarian backside for BTC?

Affect of spot ETF launch

The introduction of the Spot Bitcoin ETF coincided with a transparent structural change in buying and selling habits. Earlier than the ETF went stay, each day inflows from small addresses averaged round 450 BTC. Deposits on Binance and different main exchanges have declined since its launch in January 2024, indicating that many retail traders have shifted to oblique publicity via institutional funding merchandise.

Market information exhibits that the decline in inflows is per broader adjustments in participation patterns. From 2018 to 2023, shrimp inflows elevated quickly annually associated to market volatility. Nevertheless, from 2024 onwards, these fluctuations decreased as extra traders selected long-term storage choices or shifted away from direct buying and selling actions.

Adjustments in market composition

Analysts have recognized three major components explaining this contraction. As an alternative of holding or buying and selling Bitcoin immediately, nearly all of retail traders select publicity to ETFs. Others who stay out there more and more select to maneuver their belongings away from exchanges. Moreover, many individuals who beforehand held lower than 0.1 BTC have since amassed bigger quantities and surpassed the shrimp class.

Regardless of the decline in retail inflows, the worth of Bitcoin continued to rise, reaching over $100,000 in 2025. This hole signifies that worth momentum is at the moment pushed primarily by institutional investor accumulation and company monetary enlargement, somewhat than small offers.

Associated: Bitcoin worth stabilizes at $108,000, Ethereum at $3,600, and Solana at $185 in the present day after Hong Kong ETF approval

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.