January 2024 noticed important volatility within the Bitcoin perpetual futures market, mirrored in funding charges, open curiosity (OI), and buying and selling quantity. Not like conventional futures, perpetual futures haven’t any expiration date, permitting merchants to carry positions indefinitely. A key facet of those merchandise is the perpetual futures financing price, a mechanism designed to lock futures costs into the spot market. This price will be optimistic or damaging relying on whether or not the market is bullish or bearish.

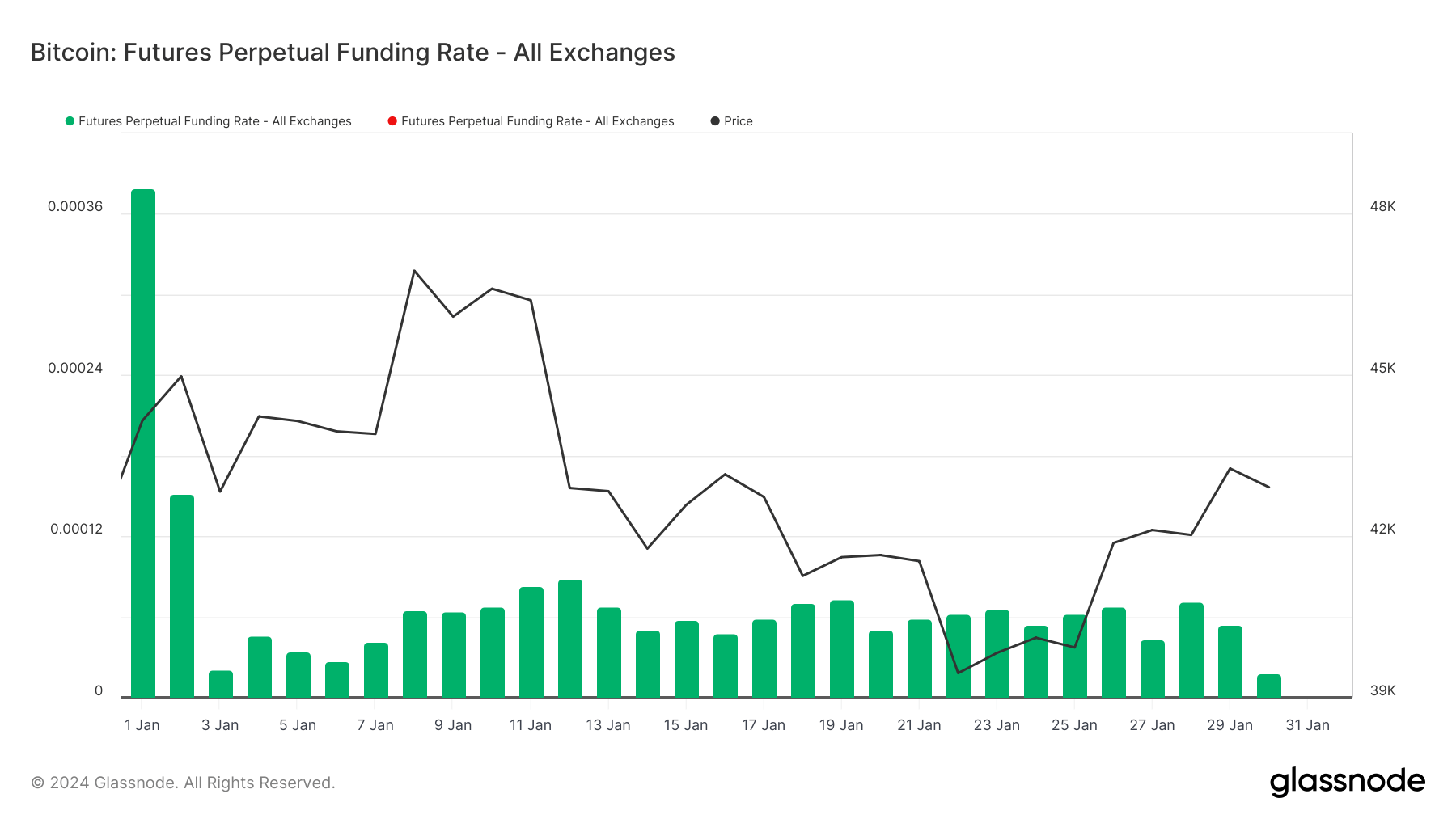

A bullish pattern was seen initially of the month, Bitcoin's The worth rose to $46,940 by January eighth, according to a excessive procurement price of 0.0003790. This state of affairs confirmed that merchants have been keen to pay a premium to carry lengthy positions in hopes of additional worth will increase.

Nevertheless, as January progressed, the market turned risky, with Bitcoin's worth falling to $39,450 by January twenty second and recovering to $43,260 by January twenty ninth. The funding price displays these worth adjustments and is indicative of adjustments in market sentiment. The largest change occurred on the finish of the month when the funding price plummeted to his 0.00001789 though Bitcoin costs remained comparatively secure. This sharp decline alerts a change in dealer sentiment or technique, maybe indicating that the bullish outlook is weakening.

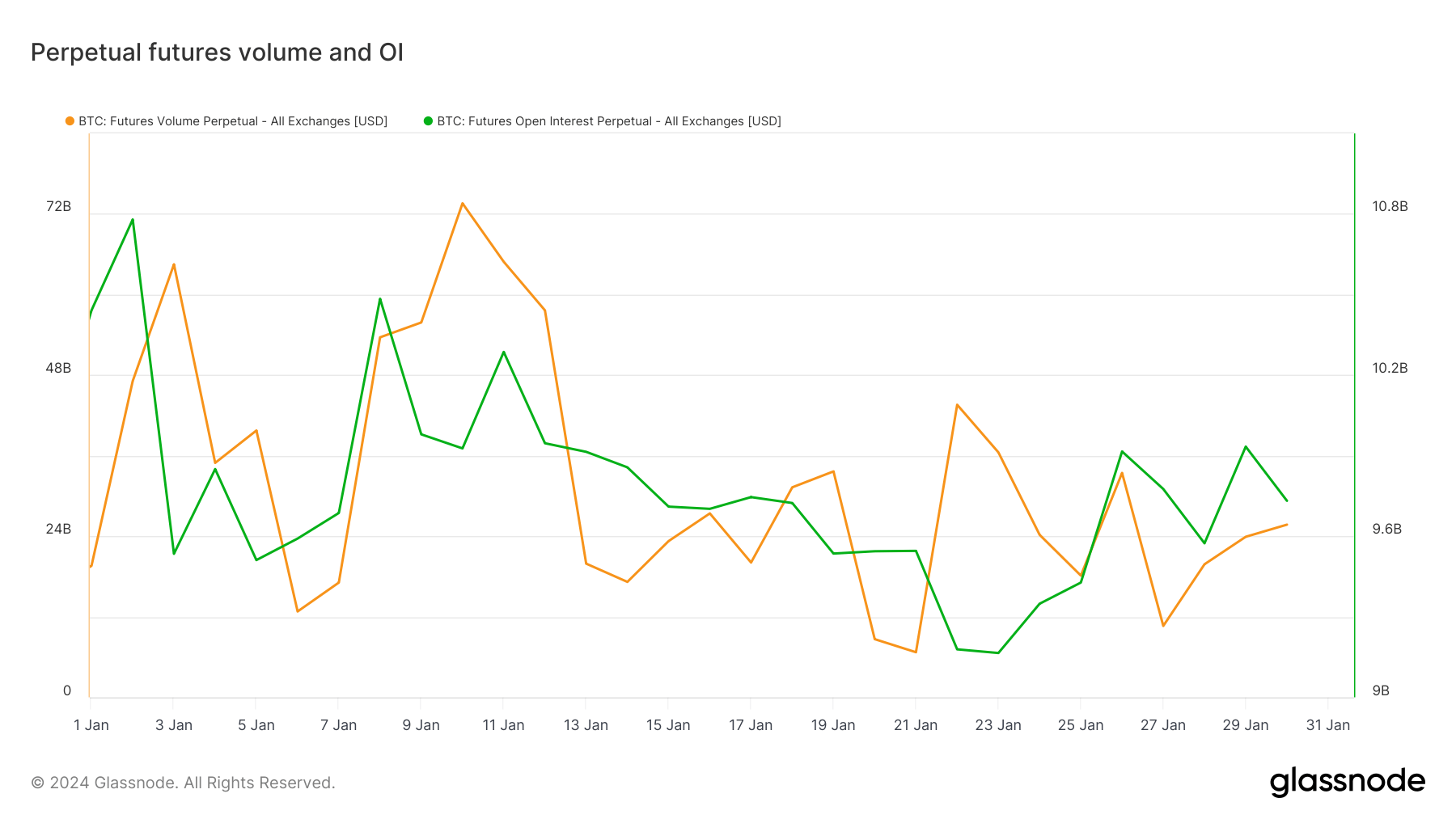

This variation in sentiment can also be evident within the open curiosity and buying and selling quantity of perpetual futures. The year-to-date (year-to-date) highest open curiosity was $10.771 billion on January 2nd, and buying and selling quantity peaked at $73.783 billion on January tenth, indicating sturdy market exercise. . This elevated exercise correlates with early bullish sentiment within the Bitcoin market.

In distinction, the year-to-date low for open curiosity was $9.165 billion recorded on January 23, matching the bottom buying and selling quantity of $6.718 billion. This decline signifies a big pullback in market exercise and will mirror a response to exterior elements comparable to bearish sentiment or market corrections throughout this era.

By January 30, open curiosity had slowly recovered to $9.731 billion, with buying and selling quantity at $25.721 billion. Whereas that is an enchancment from mid-January lows, it nonetheless alerts a extra cautious market.

The introduction of the Spot Bitcoin ETF on January tenth possible influenced this volatility. These ETFs provide buyers a brand new method to achieve publicity to Bitcoin and will entice buyers away from perpetual futures.of Shift to ETFs could also be on account of their notion low danger They usually have better regulatory acceptance than futures, particularly perpetual contracts.

The numerous decline in funding charges on the finish of January, mixed with adjustments in open curiosity and buying and selling volumes, signifies a change in market sentiment. Initially bullish, market sentiment shifted to a extra cautious or bearish outlook by the top of the month. The introduction of spot Bitcoin ETFs could have influenced this modification, because it offers a brand new avenue for Bitcoin publicity and will have diverted some curiosity from perpetual futures.

These developments sign a shift in danger urge for food amongst merchants and maybe a diversification of funding methods.

The submit Why the Bitcoin perpetual futures market was risky in January appeared first on currencyjournals.

Comments are closed.