- Japan’s 17 trillion yen fiscal shift might reshape world liquidity and impression Bitcoin actions.

- Bitcoin’s weak point will increase as the worth falls beneath key on-chain metrics and loses momentum.

- Japan’s crypto tax cuts and reclassification might increase demand for digital property in the long run.

Japan’s new fiscal push is attracting world consideration as policymakers put together a 17 trillion yen bundle that may mark a decisive shift away from many years of deflation. The plan comes at a time when world markets have change into extremely delicate to adjustments in liquidity and foreign money fluctuations.

Analysts say Japan’s makes an attempt to stabilize family funds whereas growing competitiveness might impression danger property, notably bitcoin, which generally react early to adjustments in liquidity.

Japan’s bullish flip: 17 trillion yen bundle and 20% digital foreign money tax

Based on Reuters, Finance Minister Satsuki Katayama defined the federal government’s intention to strengthen strategic industries comparable to semiconductors and AI. He additionally highlighted measures to assist households address rising costs. Japan goals to stabilize the home economic system with out forcing sudden rate of interest selections.

Because of this, buyers see the bundle as a part of a broader try to cut back long-term deflation dangers. Moreover, the plan additionally calls into query world liquidity, as fluctuations within the yen typically have an effect on world capital flows. A robust yen or elevated volatility might disrupt carry trades and tighten the danger panorama for shares and credit score total.

Along with spending plans, regulators are making ready main adjustments to digital property. Japan’s Monetary Companies Company plans to categorise Bitcoin and related property as monetary devices.

The company additionally plans to cut back the tax fee on cryptocurrency earnings from 55% to twenty%. This transfer will broaden market entry and align the sector with conventional securities. Subsequently, as soon as the market stabilizes, Japan’s fiscal and regulatory course is prone to foster new inflows into digital property.

Associated: Japan to chop crypto tax from 55% to twenty% by 2026: Here is why it is big for Metaplanet

Bitcoin faces technical strain attributable to decline in key ranges

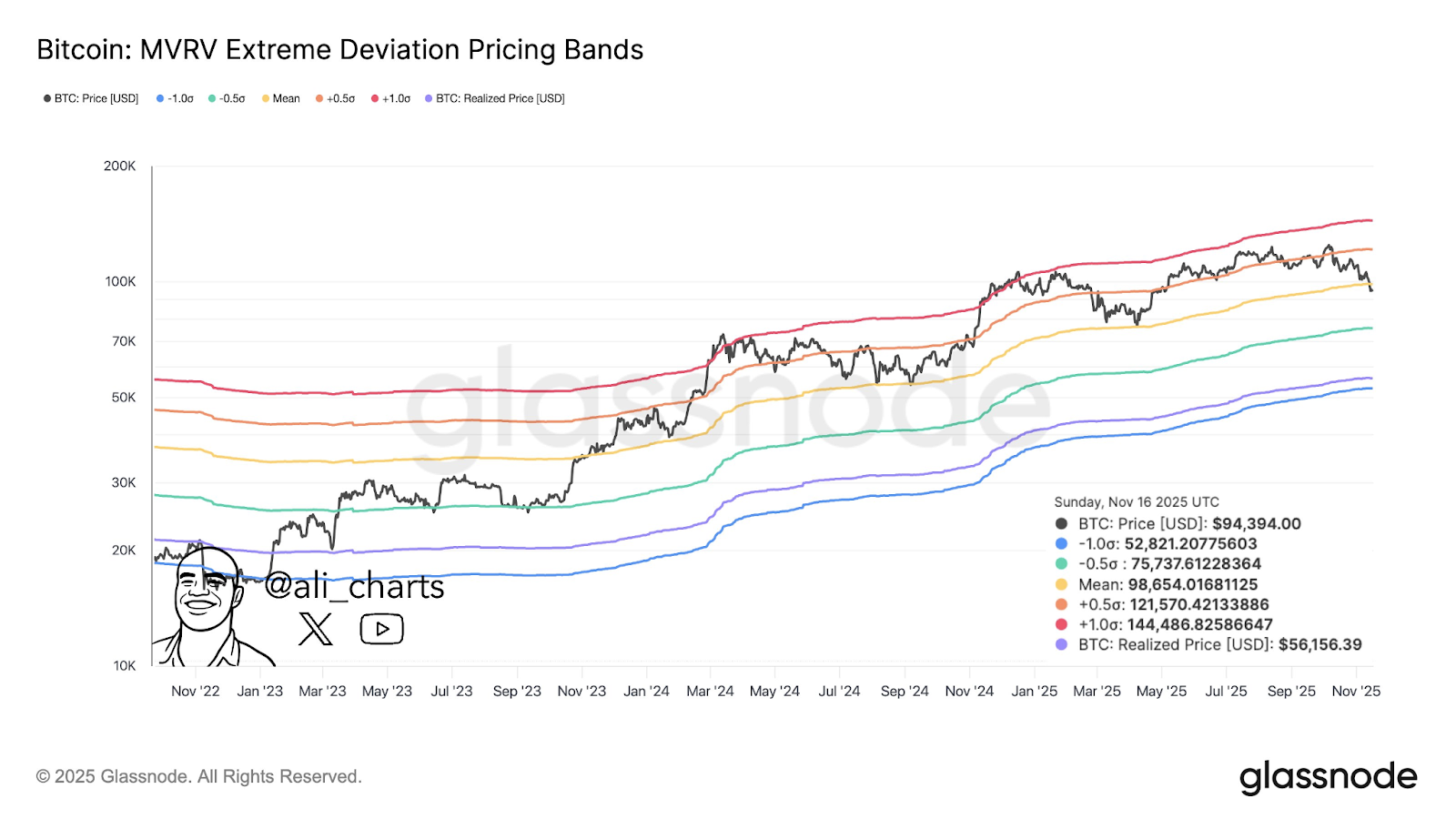

Bitcoin is buying and selling beneath $90,000 after a pointy weekly decline. The inventory has fallen greater than 13% in seven days, based on market information. Analysts word that the worth fell beneath MVRV’s common band of $98,650. This break alerts weakening momentum and will increase the probability of a deeper retracement.

Ali Martinez mentioned the following main assist is at $75,740. That space coincides with the earlier integration zone. Moreover, $56,160 represents the realized worth and key cyclical assist degree. A deeper reset close to $52,820 would replicate the earlier give up zone.

Moreover, the chart exhibits a pattern of lowering volatility, which frequently precedes bigger strikes. Bitcoin must regain $98,650 to cut back the danger of revisiting deeper assist. Till then, analysts imagine this pattern is fragile.

Importantly, Bitcoin is commonly the primary to react to liquidity adjustments associated to Japan’s coverage cycles. Nonetheless, present technical alerts point out that the market is just not prepared for a powerful restoration.

Associated: Why Sanae Takaichi’s historic victory might reset the trajectory of Japan’s crypto coverage

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.