Tether-backed video sharing platform Rumble has acquired Bitcoin for the primary time, two months after adopting the highest cryptocurrency as a strategic reserve asset.

On January twentieth, Rumble CEO Chris Pavlovsky introduced that the corporate bought Bitcoin on Friday, January seventeenth.

In accordance with him:

“On Friday, Rumble purchased Bitcoin for the primary time ever. It will not be the final.”

Though the acquisition value has not but been disclosed, Pavlovsky steered that that is only the start of a bigger plan to strengthen Rumble’s Bitcoin place.

The acquisition is in step with Rumble’s broader crypto technique. In November 2024, the corporate revealed plans to speculate $20 million in Bitcoin, citing confidence within the asset’s long-term potential.

On the time, Pavlovsky famous that Bitcoin adoption was nonetheless in its early phases and was gaining momentum because of supportive insurance policies and elevated institutional curiosity.

He additionally highlighted Bitcoin’s resilience to inflation, citing its resistance to dilution from extreme cash printing. He stated it is a helpful asset to the corporate’s funds.

Rumble is a video sharing platform with 67 million month-to-month lively customers and is thought for its relaxed content material moderation method. Final December, stablecoin issuer Tether invested greater than $775 million into the platform.

wider adoption

Rumble’s acquisition of Bitcoin displays a rising pattern amongst prime private and non-private firms to undertake flagship digital belongings as monetary reserves.

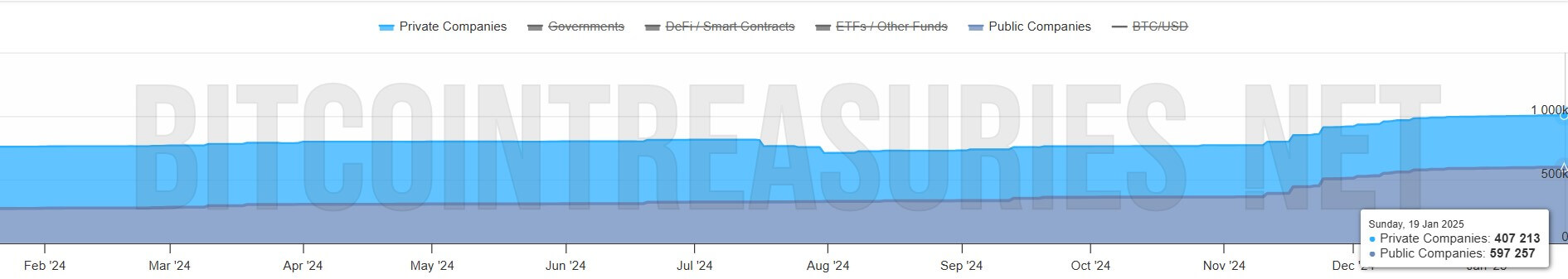

In accordance with Bitcoin Authorities Bond information, over 70 listed firms collectively maintain roughly 600,000 BTC. MicroStrategy leads the group with 450,000 BTC in its vaults.

In the meantime, personal firms similar to SpaceX, Tether, and Block.one accrued 407,212 BTC.

Matthew Hogan, chief funding officer at Bitwise, believes this pattern is just not a one-off. Moderately, he describes it as a “megatrend” that has the potential to reshape the crypto market.

Hogan attributes a few of this variation to the introduction of ASU 2023-08 by the Monetary Accounting Requirements Board (FASB). The brand new guidelines will enable publicly traded firms to report their Bitcoin holdings at market costs, permitting them to mirror earnings as Bitcoin costs rise.

talked about on this article

(Tag translation) Bitcoin