- Actual-world Asset Protocol TVL exceeds $10 billion.

- Ethereum and Solana are main RWA tokenization.

- Analysts see RWA and Stablecoins as trillion greenback crypto use instances.

IntoTheBlock information exceeds $10 billion in whole real-world asset (RWA) protocols (TVL).

The milestones mirror a rising curiosity in tokenized belongings, notably in Ethereum and Solana’s blockchains. One analyst considers RWA and Stablecoins as the 2 greatest real-world use instances of Crypto.

How briskly is RWA TVL rising?

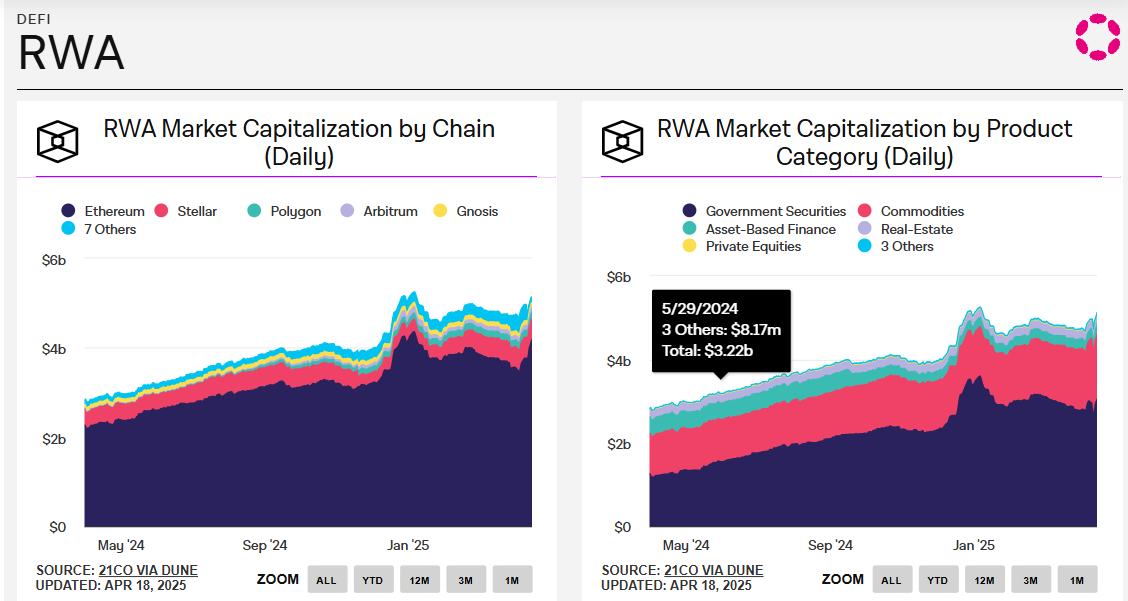

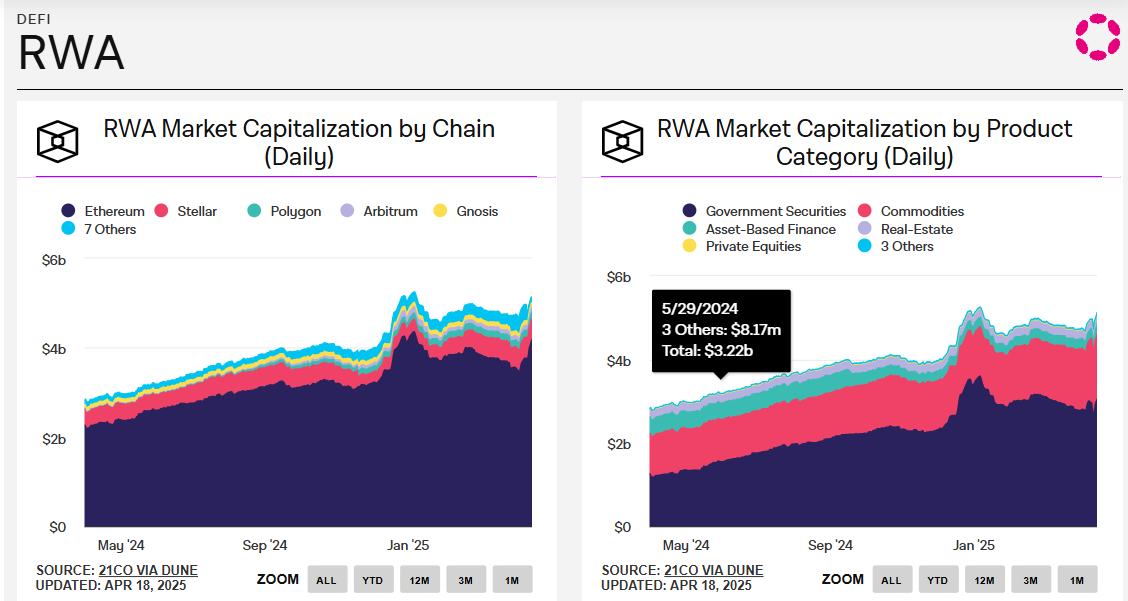

Whole quantities locked to the RWA protocol elevated from below $4 billion in Could 2024 to greater than $11 billion by March 2025. This can be a big surge in capital flowing into tokenization platforms.

This information exhibits sturdy demand for chain demand for conventional belongings resembling actual property, items and personal credit score.

Associated: “Low the barrier”: Deaton with RWA entry. Armstrong calls it “future infrastructure.”

This development drives Ethereum and Solana are key platforms for RWA tokenization. Each networks supply sensible contract capabilities that permit for the issuance, custody and switch of safe, decentralized belongings. Ethereum has huge adoption and deep liquidity. Solana affords sooner speeds and decrease charges.

Analysts see RWA as a $1 trillion use case

Emphasizing this pattern, Crypto Influencer Martyparty shared the TVL chart on X, highlighting that “Actual World Asset TVL continues to develop.” He emphasised that RWA tokenization, together with Stablecoins, represents a trillion greenback alternative for the crypto trade. The continual development of TVL displays wider market confidence in real-world worth tokens.

RWA supplies a bridge between conventional finance and decentralized platforms. Tokenization permits customers to extend effectivity and transparency whereas accessing historically illiquid markets.

RWA’s market capitalization and 24-hour quantity enhance

Based on Coingecko, the RWA token’s whole market capitalization rose above $34.7 billion. This has elevated by 1.5% over the previous 24 hours. High candidates embrace ChainLink, Stellar, Ondo, Buidl and Algorand from BlackRock.

Authorities securities account for the biggest share of the RWA market, persistently explaining 45-50% of the whole. Product and asset-based finance additionally signify vital segments, whereas non-public fairness and actual property retain a small however rising portion of the market.

Associated: $30 Trillion Actual World Asset Market Faucet Market: High 5 RWA Challenge Profiles

Main the way in which ahead in tokenized authorities bonds, notably celebrities, resembling Franklin Templeton and Ondo Finance’s Lead within the issuance of tokenized authorities securities, highlighting the elevated conventional fiscal involvement in accelerating RWA adoption.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.