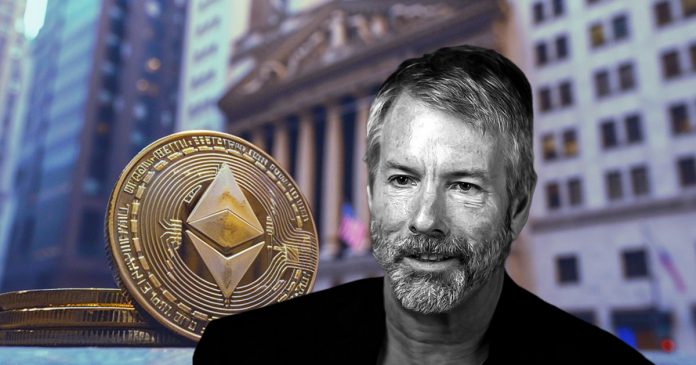

Michael Saylor, govt chairman and co-founder of MicroStrategy, believes the SEC will classify Ethereum as a safety this summer time and reject associated spot ETF functions filed by numerous asset managers, together with BlackRock.

Saylor made this prediction in a social media submit. Could 2 Throughout a presentation on the MicroStrategy World 2024 convention. He additional predicted that different cryptocurrencies “under the stack” similar to BNB, Solana (SOL), XRP, and Cardano (ADA) may also obtain the unregistered safety designation.

Sailor mentioned:

“None of them will ever be wrapped up in a spot ETF and none of them will likely be accepted by Wall Avenue…”

Saylor as a substitute argued that solely Bitcoin (BTC) has full institutional acceptance. He known as BTC the “one common” institutional-grade crypto asset and mentioned, “There’ll by no means be one other.”

The founders of MicroStrategy are well-known for his or her give attention to Bitcoin. Saylor's assertion comes days after MicroStrategy introduced it added $1.65 billion in BTC to its company holdings within the first quarter, alongside the announcement of a Bitcoin-based decentralized id (DID) product. It was carried out.

Necessary selections concerning ETH

The market was initially optimistic in regards to the approval of the Spot Ethereum ETF, however expectations have dropped dramatically in current weeks, with Polymarket pegging the chance of approval at simply 11% on the time of writing. Analysts equally revised their expectations for approval from greater than 80% to lower than 30%.

The important thing date for the SEC's resolution is Could 23, at which level the SEC should resolve on VanEck's proposed ETF. Regulators are anticipated to resolve on different comparable functions on the similar time.

The SEC might also have to state whether or not ETH is a safety. Blockchain developer ConsenSys intends to drive the SEC to state in its lawsuit that ETH just isn’t a safety. US lawmakers are additionally in search of clarification on the difficulty in relation to a different firm, Promethium.

Clear designation of ETH may give corporations a transparent strategy to deal with the asset. Nevertheless, such designations may additionally impression whether or not the SEC approves sure merchandise, similar to spot ETFs, and whether or not corporations deal with ETH with out correct registration.

The submit Saylor predicts the SEC will designate Ethereum as a safety and reject spot ETF functions this summer time appeared first on currencyjournals.

(Tag translation) Bitcoin