- Chainalies experiences that 54% of Ethereum tokens in 2023 resembled pump-and-dump schemes.

- Based on the report, the fraudsters collected $241 million by means of market manipulation.

- The platform recognized the manipulation by analyzing tokens that had been traded 5 or extra instances on the DEX.

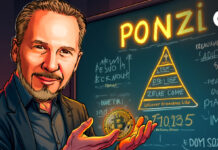

A current report printed by analytics platform Chainalysis revealed that greater than half of the ERC20 tokens launched to Ethereum in 2023 resembled a possible pump-and-dump scheme.

Ki Younger Ju, Founder and CEO of CryptoQuant, drew insights from the report and revealed that fraudsters made off with $241 million by means of a pump-and-dump scheme involving 90,408 tokens. He emphasised what he had collected.

Usually, a pump-and-dump scheme is a fraudulent exercise wherein a malicious actor insists on inflating the worth of an invested cryptocurrency and later “dumps” the tokens at an inflated worth.

The U.S. Securities and Alternate Fee (SEC) says the pump-and-dump scheme is a manipulation. as they wrote,

“In a pump-and-dump scheme, fraudsters usually unfold false or deceptive data to 'inflate' the value of a inventory after which have interaction in a frenzy wherein they 'dump' the inventory by promoting their very own shares on the inflated worth. resulting in panic shopping for. When scammers dump shares and cease hyping them, the inventory worth normally falls and buyers endure losses. ”

As a way of analyzing market manipulation, analysts examined tokens that had been traded a minimum of 5 instances on the DEX, indicating that the tokens had been gaining momentum.

Moreover, the whales eliminated over 70% of the token’s liquidity, leaving lower than $300 within the token’s DEX liquidity pool, indicating a market collapse.

The Chainaosis report additionally revealed that greater than 370,000 tokens had been issued on Ethereum, of which round 168,600 had been accessible for buying and selling on decentralized exchanges (DEXs).

After inspecting the tokens intimately, Chainaracy recognized that 54% of the tokens on the DEX met the standards, suggesting a potential pump-and-dump scheme.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.