- Eth ETFs have lowered YTDs by 50% or extra, and inflows are restricted.

- The 2-2x ETH ETFs are the perfect efficiency funds of 2025.

- NASDAQ ISE submitted its ETHA choices record in July 2024.

The US Securities and Trade Fee (SEC) has formally permitted choices buying and selling in a number of spot Ethereum ETFs, indicating a big improvement for institutional buyers in search of hedging methods within the crypto market.

The inexperienced mild, introduced Wednesday by way of a number of filings, applies to BlackRock’s Ishares Ethereum Belief (ETHA), Bitwise Ethereum ETF, Grayscale’s Ethereum Belief, and Ethereum Mini Belief.

The transfer is to stability considerations about volatility with demand for stylish funding instruments within the quickly evolving digital asset sector.

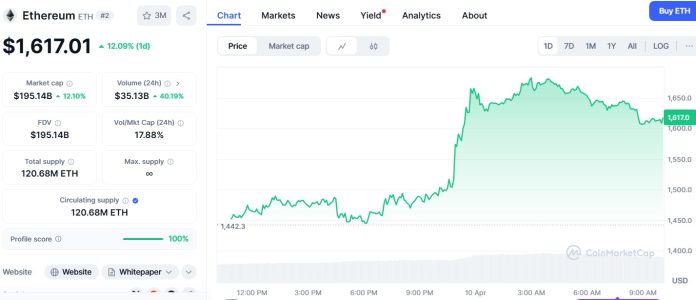

Ethereum costs have since surged greater than 12%, partly supported by broader macroeconomic developments, together with a short lived US tariff freeze.

Approval of ETF choices opens new methods

This approval permits buyers to commerce choices agreements linked to ETH ETFs, permitting for extra nuanced methods similar to cowl calls, buffers and risk-controlled hedging.

An possibility is a by-product that permits the acquisition or sale of the underlying ETF at a given value inside a set interval.

The choice was initially delayed following a submission to record choices at BlackRock ETHA on July 22, 2024.

The SEC has a deadline of April ninth, and its last approval coincides with the precedent set in October 2023, when choices trades for 11 Spot Bitcoin ETFs throughout NYSE American, Nasdaq and Cboe had been permitted.

The SEC approval discover mentioned the choice presents buyers a low-cost manner of exposing them to ether value actions.

He additionally mentioned the choice would supply versatile autos for these holding ETH ETFs or associated positions to effectively handle their publicity.

ETH ETF information loss YTD of fifty% or extra

The approval of the choice has sparked new curiosity in Ethereum, however the efficiency of ETH ETF stays silenced.

Farside buyers say these ETFs have fallen by greater than 50% for the reason that begin of the yr, with inflow recorded in simply 4 days since February twentieth.

Regardless of this low efficiency, leveraged merchandise have emerged as sturdy acquirers.

In keeping with Bloomberg ETFs, two -2x Ethereum ETFs (designed for brief ETF efficiency utilizing double leverage) are at present the highest efficiency alternative product in 2025.

This reveals that buyers not solely depend on bullish sentiment, but additionally actively place etheric volatility.

ETH jumps 14% with twin market triggers

The Ethereum market responded shortly to Wednesday’s regulatory adjustments. In keeping with CoinmarketCap, ETH has grown by greater than 12% in 24 hours, buying and selling at $1,617 on the time of writing.

This upward transfer comes from a short lived suspension of US tariffs introduced by the previous president, a coverage analysts imagine has eased short-term macroeconomic tensions.

The meeting reveals that each regulatory and geopolitical selections are more and more shaping the value of crypto belongings.

Whereas approval of the ETH ETF possibility supplied a structural increase, the market additionally responded to exterior non-cryptic information that reduces uncertainty within the world buying and selling setting.

Extra ETH funding than anticipated in 2025

The approval of the choice additionally units the stage for a wider deployment of Ethereum-related ETF merchandise.

ETF Retailer president Nate Geraci mentioned by way of X (previously Twitter) that the market ought to count on the launch of varied new ETFs within the close to future, together with cowl calls and buffer methods.

Bloomberg ETF skilled James Seyfert mirrored the sentiment that SEC approval was “100% anticipated” given the set of precedents with Bitcoin ETF choices.

Nonetheless, watchdog teams like Higher Markets have expressed concern, and have beforehand urged the SEC to delay such approvals because of the excessive volatility and speculative nature of their belongings.

As a result of rising institutional curiosity, the SEC’s cautious but constant method reveals a broader motion in the direction of the mainstream of crypto asset lessons by way of regulated funding autos.

Put up SEC clears the ETH ETF possibility and Ethereum spikes 12% after the tariff break first appeared in Coinjournal.