- Apparently, SEC attorneys see no contradiction of their positions.

- James Murphy mentioned the SEC is having a tough time “holding the story straight.”

- Within the Binance and Coinbase hearings, the SEC argued that tokens can function safety in addition to different capabilities.

Outstanding crypto lawyer James Murphy (often known as MetaLawMan) not too long ago weighed in on the inconsistency of US regulators in classifying crypto belongings as securities. Particularly, Murphy highlighted latest courtroom hearings through which Securities and Alternate Fee (SEC) attorneys made contradictory claims.

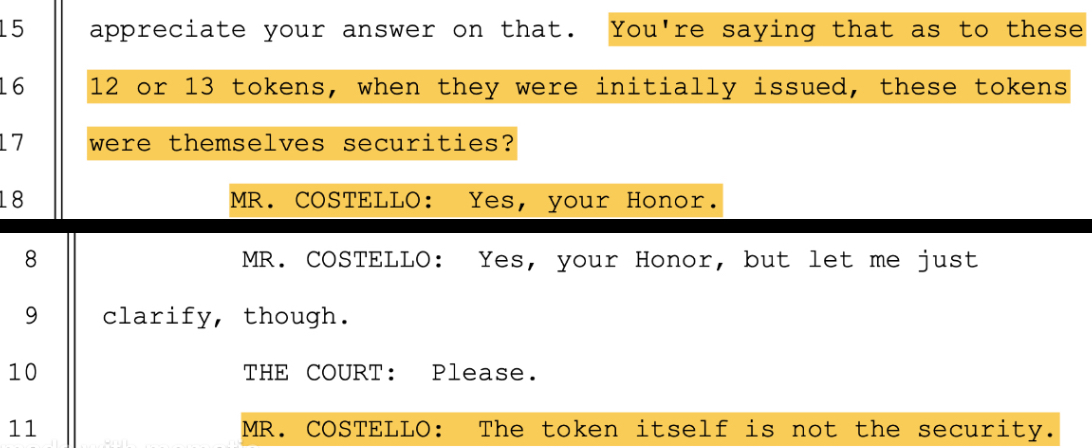

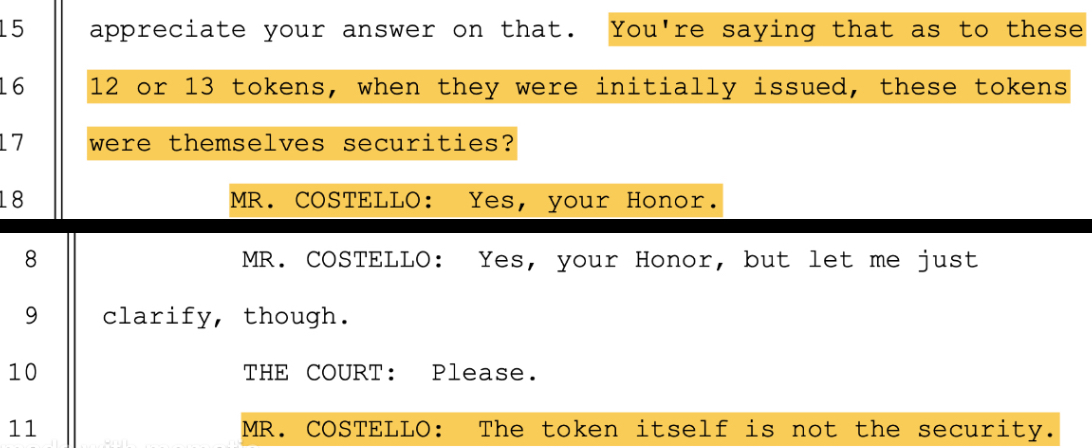

The primary case cited was a January 17 listening to in a lawsuit in opposition to US-based trade Coinbase. In the course of the proceedings, the courtroom requested the SEC for clarification as as to whether the roughly 13 tokens at subject have been themselves securities on the time of their preliminary issuance.

In response, an SEC lawyer mentioned, “Sure, sir,” and asserted that the token was a safety. Nevertheless, in the identical courtroom, SEC attorneys added that “the token itself just isn’t a safety.”

SEC vs. Coinbase Listening to

Moreover, Lawyer Murphy referred to the second listening to of the lawsuit in opposition to Binance, a significant buying and selling platform. Equally, the courtroom requested SEC attorneys whether or not they agree that there’s a distinction between the cash which are the topic of an funding contract and the contract itself.

In response, SEC attorneys spoke within the affirmative, acknowledging that crypto belongings are simply traces of code. Nevertheless, they contradicted themselves once more in the identical listening to, stating that “the token itself represents an funding contract.”

The courtroom disagreed, expressing uncertainty about what it had beforehand heard from the SEC that the tokens represented funding contracts. In defending his place, SEC attorneys argued that the belongings embody funding contracts. Moreover, they don’t agree that there’s a contradiction of their earlier positions.

Primarily, Lawyer Murphy emphasised that in keeping with the SEC, crypto tokens are thought of securities and never securities, and these two statements aren’t thought of contradictory. “The SEC appears to be having a tough time holding their story straight in terms of cryptocurrencies,” he mentioned.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Comments are closed.