- Gold has risen by $3,782.98, a 44% YTD, bringing traders nearer to $3,800 in the hunt for secure belongings.

- Deutsche Financial institution says Bitcoin displays the adoption of gold.

- Gold Lags M2-Adjusted Highs, Bitcoin is setting a brand new report for development in cash provide.

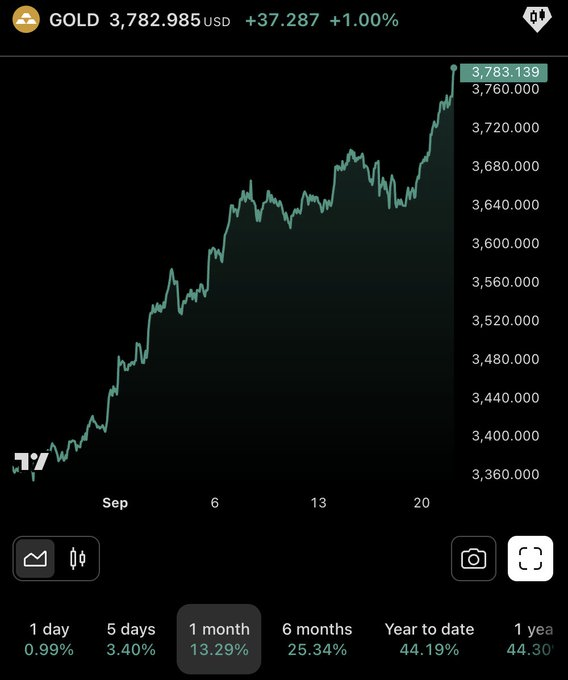

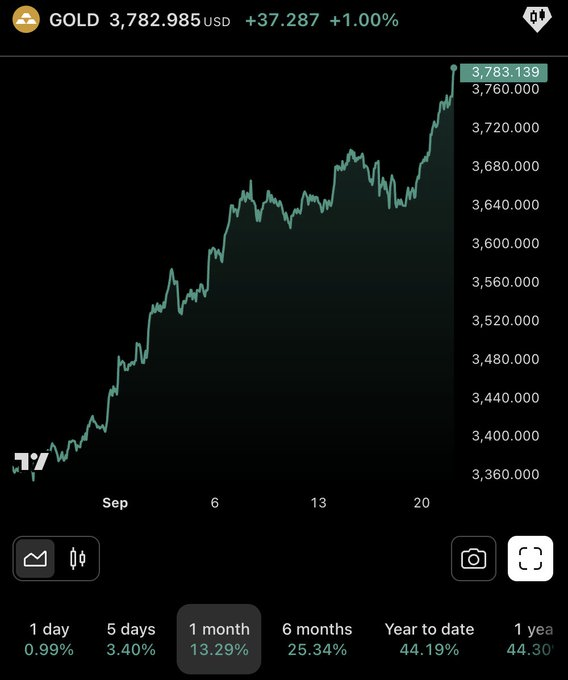

Gold surged to $3,782.98 per ounce on September 23, up 1% per day and over 13% this month. For the reason that begin of the yr, metals have earned 44%, and are among the many finest efficiency belongings of 2025. The breakout, which surpassed resistance by $3,720, confirmed sturdy consumers momentum as merchants focused the following milestone at $3,800.

The efficiency metrics within the timeframe emphasize the power of the rally. Gold has risen at 3.4% and 25.34% over the previous six months, with a full yearly improve of almost coinciding with 44.3%.

Macro driving a gathering

Surges mirror traders’ demand for security amid inflationary pressures, forex debilitating and geopolitical dangers. These situations proceed to push the ability circulate into the steel. Marketwatchers now see $3,800 as a degree that may entice much more influxes.

Associated: Bitcoin vs. Gold: BTC loses floor as central banks drive gold

Discussions concerning the practicality of gold have additionally emerged in public locations. Changpeng Zhao (CZ) identified that verifying bodily gold is tedious and evaluating it to the portability of digital belongings is tedious. Analyst Lark Davis added that gold momentum might function a precursor to Bitcoin’s subsequent main transfer.

Bitcoin and Gold: Parallel Adoption Story

Deutsche Financial institution Report

Deutsche Financial institution Analysis Institute paper, “Bitcoin vs. Gold: The way forward for central financial institution preparation by 2030Bitcoin claims to be monitoring Gold’s early adoption curve. The report stated that elevated regulatory and institutional use has steadily lowered the volatility of Bitcoin, as gold has stabilized as a reserve asset all through the twentieth century.

The financial institution contrasted the stronger efficiency of Bitcoin in opposition to development in gold provide and gold lag on a M2-adjusted foundation. Gold has but to surpass its inflation-adjusted peak since 1980 and 2011, however Bitcoin has at all times set a brand new report in comparison with US M2 development.

Associated: Digital Gold vs. Actual Gold: Bitcoin Risky Rally Closes at $3.5K+ Gold

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.