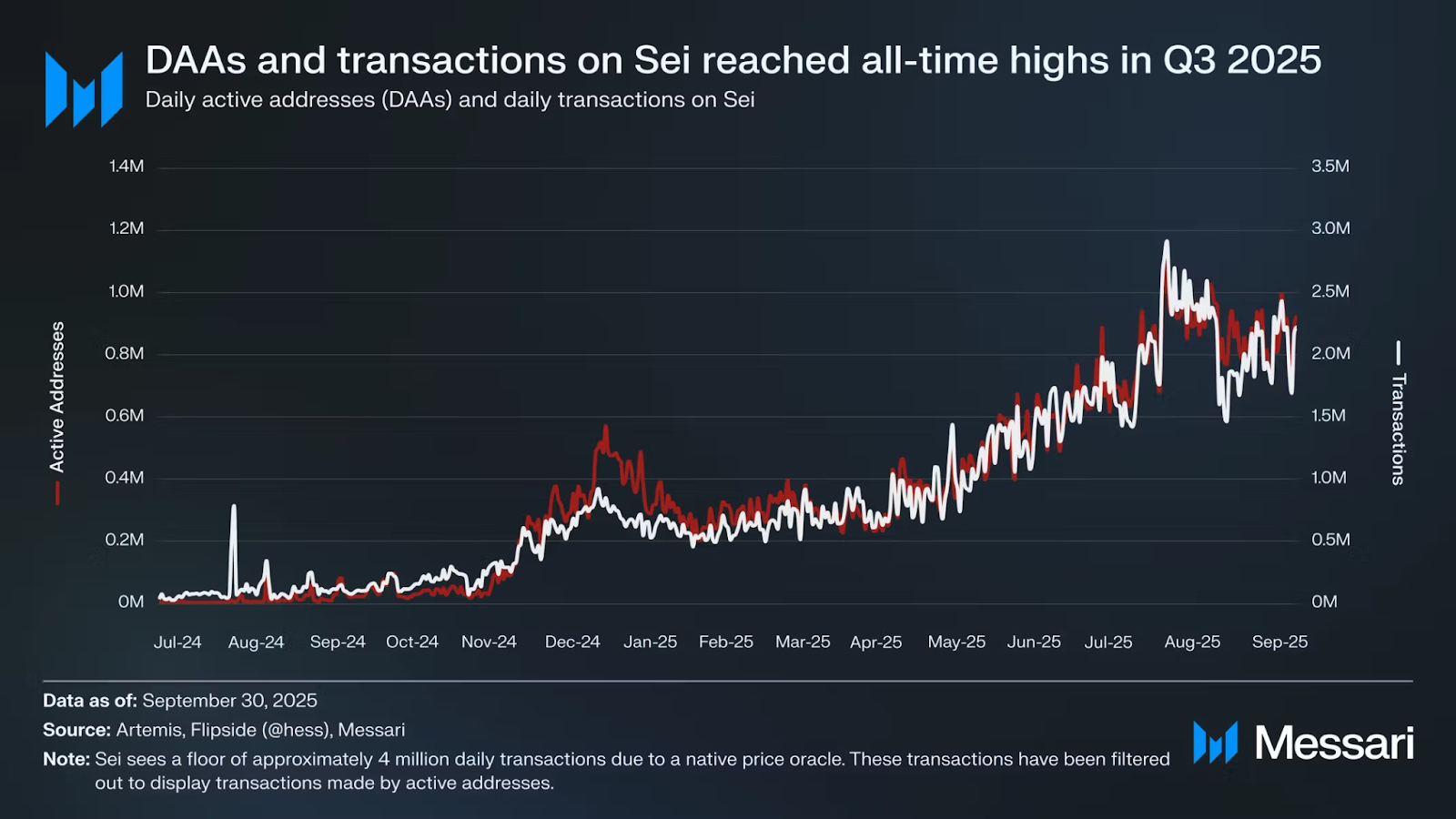

- Sei recorded its fifth consecutive quarter of development, with each day lively addresses rising 93.5% quarter-over-quarter.

- Video games drove utilization, producing 116 million transactions and over 800,000 each day lively customers.

- DEX buying and selling quantity elevated 75% sequentially to $43 million, regardless of a 25% lower in complete locks.

Sei recorded 5 consecutive quarters of community development in Q3 2025. Common each day lively addresses elevated 93.5% sequentially to 824,000, and each day transactions elevated 87.1% to almost 2 million, in line with Messari knowledge.

Video games are the primary demand driver

Video games accounted for almost all of latest actions. Sei processed 116 million gaming-related transactions within the third quarter, a rise of 138% sequentially. The common each day lively addresses related to video games reached 805,000, a rise of 108% sequentially.

Titles similar to World of Dypians, Sugar Senpai, and IDLE Glory generated constant high-frequency transaction flows.

Messari’s report famous SEI’s low-latency design and talent to deal with massive burst calls for with community capability of greater than 200,000 transactions per second at low price.

Moreover, the overall quantity locked decreased by 25.3% quarter-on-quarter to $455.6 million, primarily because of stablecoin outflows and decrease SEI costs.

Nevertheless, common each day spot buying and selling quantity elevated 75% to $43 million, making it one in all sei’s strongest quarters for DEX exercise.

DragonSwap regained its place because the main DEX with each day buying and selling quantity of $13.2 million. Takara Lend additionally stood out, rising TVL by 48.4% to $105.8 million.

Easing token provide strain

Excellent news for SEI token holders, the dynamics on the token facet additionally improved through the quarter. The month-to-month vesting price dropped sharply in August because the Sei Basis’s allocation was absolutely vested and the discharge of ecological reserves decreased.

Annualized inflation fell from 4.8% to 4.4%, however staking yields rose to six.0%, marking the second consecutive quarter of optimistic actual yields for stakers.

Though the deliberate unlock elevated the circulating provide to SEI 6.13 billion, analyst Michael van de Poppe stated that SEI’s bullish rally may proceed if Bitcoin (BTC) rises above $90,000.

Curiously, Q3 additionally noticed various partnerships, together with pockets help with MetaMask and Backpack, analytics with seiScan, and low-latency knowledge feeds with Chainlink. In accordance with the report, a number of establishments have introduced plans to deploy merchandise to Sei.

Associated: Sei companions with Xiaomi to show hundreds of thousands of cell phones into crypto hubs

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.