Presently, Shiba Inu (SHIBUSDT) is buying and selling in a decidedly risk-off market, and this backdrop is shaping the near-term outlook for the Shiba Inu cryptocurrency in a significant manner.

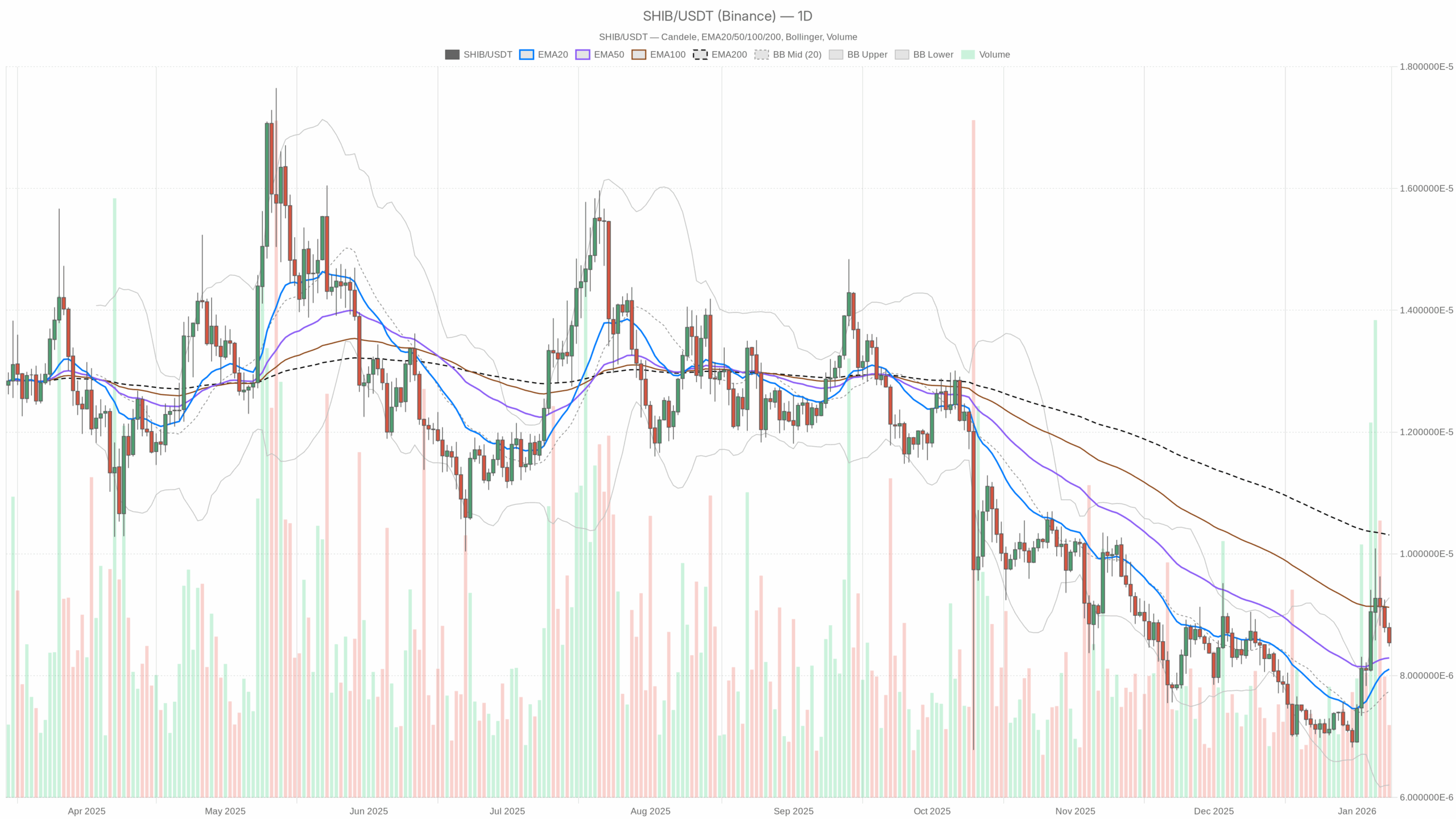

Day by day chart (D1): Shiba Inu Crypto caught within the center

The each day timeframe is what units the macro bias for SHIBUSDT. Right here the system flags the regime as impartialand a number of other out there indicators again it up.

RSI (D1)

RSI 14 (each day): 56.73

The each day RSI is positioned simply above the midline. That is typical of a market that has seen some upward stress lately however has not but entered a real development part. Neither overbought nor oversold, making it appropriate for consolidation or early balancing levels relatively than blowing by means of the roof or deep reductions. Within the case of the Shiba Inu cryptocurrency, this implies the client has not utterly misplaced management, but it surely additionally doesn’t imply they’re dictating the tape.

MACD (D1)

MACD line/sign/histogram: just about flat within the information

MACD readings are flat, with no sturdy traits confirmed each day. This matches the impartial regime tag. So, on this timeframe, Shiba Inu Coin is neither in a clear bullish enlargement nor in a sustained bearish slide. The market is ready for a catalyst, both contemporary inflows into meme cash or broader de-risking measures to tug SHIB down.

EMA (D1)

EMA 20 / 50 / 200 (each day): No values out there for feed

We can not converse concerning the actual development construction throughout these EMAs as we wouldn’t have dependable numerical ranges right here. On condition that the RSI is in a impartial regime close to 57, essentially the most lifelike assumption is that the value is not going to transfer aggressively away from the short-term and intermediate-term transferring averages. In apply, that always means SHIB is chopping round worth areas that each bulls and bears can declare.

Bollinger Bands and ATR (D1)

Bollinger bands (mid worth/excessive worth/low worth) and ATR14: Not entered

With out bands and volatility ranges, we can not speak about actual squeeze or enlargement conditions. Nonetheless, we will infer from the macro surroundings (shrinking market quantity, worry, and BTC’s sudden rise in dominance) that the realized volatility of meme cash just like the Shiba Inu cryptocurrency tends to happen in sharp clusters. There are durations of quiet churn adopted by durations of sudden spikes pushed by information or liquidity. We’re at present in a broader risk-off temper, which usually compresses speculative volatility earlier than the subsequent huge transfer.

Pivot stage (D1)

Day by day Pivot (PP/R1/S1): Not out there from feed

Even with out exact ranges, the idea remains to be necessary. In a impartial regime, costs are inclined to fluctuate round each day pivots and the highs and lows of the earlier session. For SHIBUSDT, which means day merchants will focus extra on intraday ranges than clear breakouts till volatility and quantity return.

Shiba Inu Cryptocurrency Day by day Factors: Larger time frames don’t scream traits in both path. The RSI favors the bulls barely, however the lack of sturdy MACD momentum and the impartial regime point out that this can be a stability zone. SHIB is weak to macro flows. There’s room for upside if dangers come again. When worry persists, the trail of least resistance turns into decrease.

Hourly chart (H1): Early indicators of stress on Shiba Inu coin

On the hourly chart, we begin to see the results of the risk-off temper and rising short-term stress.

RSI (H1)

RSI 14 (H1): 33.76

The hourly RSI is being pushed down in direction of the oversold zone. It is a signal of short-term promoting stress. Intraday merchants are bidding and consumers are retreating, however not but in a capitulation flash. Within the case of the Shiba Inu cryptocurrency, that is precisely the form of motion we see as capital rotates and BTC’s dominance skyrockets, because the extra speculative names lean first.

MACD, EMA, Bollinger Bands, ATR, Pivot (H1)

The MACD for the primary half of the 12 months is flat within the information, and there aren’t any EMA, Bollinger Bands, ATR, or pivot numbers out there. Photographed with impartial The regime label for the primary half of the 12 months depicts the market declining, relatively than trending like a reasonably waterfall. Whereas the shorts are snug to press, they do not offer you full management. As soon as sentiment stabilizes, a short-covering rebound may emerge shortly.

Takeout by hour: The hourly RSI is tilted. bearish In distinction to on a regular basis neutrality. That is the primary timeframe battle. Macro hasn’t damaged down, however intraday flows are clearly on the promote facet.

15 minute chart (M15): execution layer, biased in direction of bearish path

Within the execution timeframe, the system has already flagged the regime as follows: bearish Examine short-term pressures.

RSI(M15)

RSI 14 (M15): 37.59

Brief-term RSI is weak however not oversold. This tends to correspond to a extreme setback relatively than a panic. Regionally, the Shiba Inu digital foreign money is at an obstacle. The rally is promoting, and the intraday path is about for a gradual decline until a pointy liquidity occasion corresponding to brief overlaying or information breaks it.

Different indicators (M15)

For the reason that MACD is flat and there’s no EMA, band, ATR or M15 pivot out there, it primarily will depend on construction and RSI. The system is trying down, the momentum is weak, however there’s nonetheless room for each a step down and a snapback. It is a dealer’s tape, not an investor’s setup.

15 minute takeout: The minimal timeframe is bearish A weak authorities. This confirms that until intraday momentum situations reverse, short-term executions want a weakening pullback relatively than chasing an upside.

Market Background: Why This Second Is Necessary for Shiba Inu Cryptocurrency

A number of macro components are necessary right here to grasp SHIB and body expectations.

- Bitcoin benefit ~56.8%: Capital is concentrated in BTC and there’s often an absence of meme coin movement. Traditionally, Shiba Inu worth will increase are tough to maintain as BTC dominance will increase additional.

- 24-hour whole market cap -2.8%, quantity -15.9%: It is a typical risk-off, and it is not about One Coin. Declining gross sales, whether or not up or down, means the breakout is extra prone to be an illiquid spike than a well-supported development.

- Concern and greed at 28 years outdated (worry): Buyers are on the defensive. On this environment, tales like “Shiba Inu may attain $0.0001” or “Will Shiba Inu Coin attain 1 cent” appeal to extra skepticism than capital until supported by new catalysts.

- Regulatory and safety overhang: Headlines about tax crackdowns and bodily assaults on crypto holders are inflicting alarm. This sometimes pushes flows into majors and stables relatively than speculative meme property.

Merely put, the present surroundings the place Shiba Inu costs proceed to rise shouldn’t be favorable. That does not preclude a pointy brief squeeze, but it surely does make it more durable to maintain with out a vital return to risk-on.

Shiba Inu Coin: Bullish situation

Regardless of the heavier environment throughout the day, a constructive path for the Shiba Inu cryptocurrency remains to be into consideration, however it’s conditional on a number of components.

The bullish path appears like this:

- Your each day momentum will stabilize and enhance additional.:D1’s RSI is holding above 50 and beginning to transfer in direction of the 60-65 space, indicating that consumers are regularly absorbing the decline relatively than merely rebounding.

- The momentum throughout the day is reversed.: Within the first half and M15, the RSI ought to regain the 45-55 zone and maintain there, indicating that promoting stress is not dominating all of the pullbacks.

- market situations enhance: The market capitalization will cease the bleeding and stabilize, whereas BTC’s dominance will pause or retreat a bit. That will point out that altcoin danger is as soon as once more turning into extra acceptable.

In that surroundings, SHIBUSDT could first make a imply reversion transfer in direction of the latest worth space the place the 20EMA and 50EMA on D1 are roughly positioned. If the altcoin’s breadth improves, it may lengthen additional and head increased. That is the place tales like Shiba Inu’s worth rise and potential breakout develop into actual relatively than mere hypothesis.

What invalidates the bullish situation:

- The each day RSI has decisively misplaced its midline, dropping beneath 45 for a number of classes.

- The H1 RSI is both caught within the low 30s or has fallen to the 20s with out a sturdy rebound, however this can be a signal of development promoting relatively than a push.

- It is a basic surroundings the place the Shiba Inu cryptocurrency tends to underperform considerably as a result of steady rise in BTC dominance and the decline in market capitalization.

If this case continues, the concept Shiba Inu worth will increase will proceed to be imminent turns into weak. At that time, any spike is extra prone to be a brief squeeze than the beginning of a broader uptrend.

Shiba Inu Coin: Bearish situation

Brief-term information leans on this path because of weak intraday momentum and general low danger urge for food.

The bearish path appears like this:

- The momentum of the 1-hour and 15-minute charts continues to be sturdy.: H1’s RSI was hovering within the low 30s, M15 was within the 30-40 vary, and it shortly rebounded and offered.

- Day by day regime adjustments from impartial to bearish: Even with out express EMA information, we will see this from the a number of purple each day candles, the failed rally, and the RSI falling from the excessive 50s in direction of the 40s.

- Macro risk-off deepens: Market capitalization continues to say no and quantity stays depressed, however BTC’s dominance stays or will increase. It is a basic surroundings the place merchants systematically de-risk altcoins.

In that case, the Shiba Inu cryptocurrency will fall, respect for the assist stage will weaken, and the market will as soon as once more begin asking, “Is Shiba Inu coin lifeless?” To be clear, the dying story is usually exaggerated for risky memetic property, however beneath that situation, SHIB would develop into a supply of liquidity and never a vacation spot.

What invalidates the bearish situation:

- The RSI for the primary half has risen once more above 45-50 and stays there, indicating that the bullish consumers are lastly beginning to intervene.

- The each day RSI both sticks to the mid-50s or shortly regains it after some pullback.

- With altcoins not solely following BTC’s lead but in addition gaining bids, the market capitalization and breadth of cryptocurrencies has visibly improved.

As soon as these adjustments happen, lively shorts in SHIBUSDT can be weak to a squeeze, particularly given the velocity of sentiment reversals for meme cash and comparable property.

Positioning of Shiba Inu Cryptocurrency: How to consider dangers

Throughout timeframes, the core tensions that outline our present positioning are:

- Day by day (macro) bias: Impartial – Larger time frames usually are not damaged. SHIB is neither in a confirmed downtrend nor in an uptrend.

- 1 hour and quarter-hour: bearish development – Intraday flows are defensive, with sellers controlling short-term path.

This leaves merchants with the basic setup contradiction and forces them to make a mode selection.

- Momentum merchants could contemplate promoting rebounds on decrease time frames so long as momentum in H1 and M15 is weak and market background is a priority.

- Imply reversion merchants can be on the lookout for indicators of depletion on the intraday chart, particularly if the H1 RSI falls into oversold territory whereas the intraday RSI stays strong close to the mid-$50s.

Volatility and uncertainty must be revered right here. With decreased buying and selling quantity and worry current, Shiba Inu worth actions will be gappy and delicate to information. Each sharp rises and falls can happen, particularly round broader market headlines or sudden actions in Bitcoin.

This isn’t a assure in both path. The present information says: macro stability, micro stress. If the market temper improves, the Shiba Inu cryptocurrency has room to rise additional. Nonetheless, if the worry persists and BTC continues to soak up liquidity, SHIBUSDT stays prone to fall additional earlier than speak of a sustained restoration turns into lifelike.

If you wish to monitor the market utilizing skilled charting instruments and real-time information, you possibly can open an account at: make investments Utilizing associate hyperlinks:

Open an Investing.com account

This part incorporates sponsored affiliate hyperlinks. We could earn commissions at no extra value to you.

This evaluation is data market commentary and isn’t funding, tax, or authorized recommendation. Cryptoassets are extremely risky and might result in full loss. At all times conduct your individual analysis and contemplate your danger tolerance earlier than making any buying and selling choices.